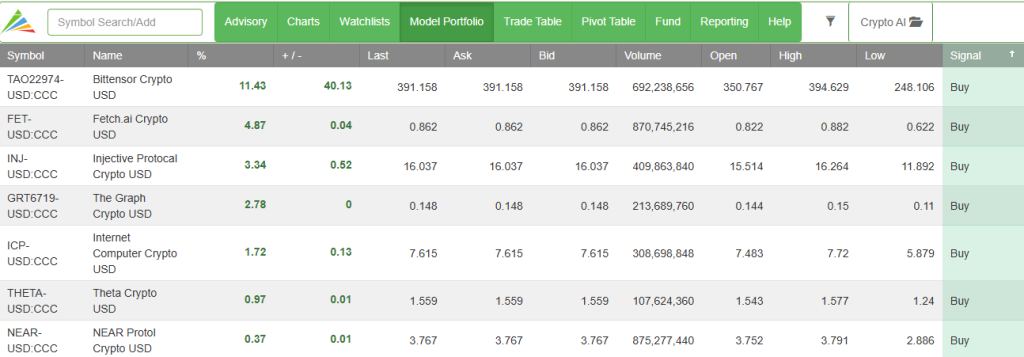

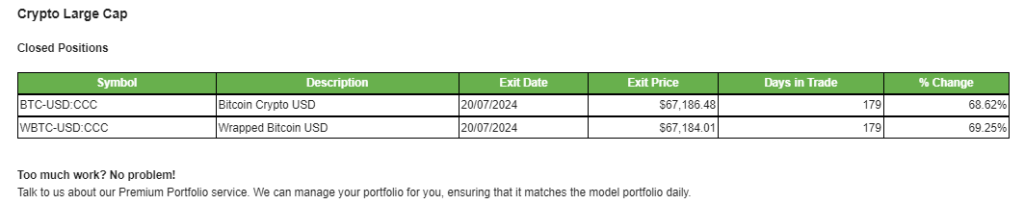

Crypto Trade Table

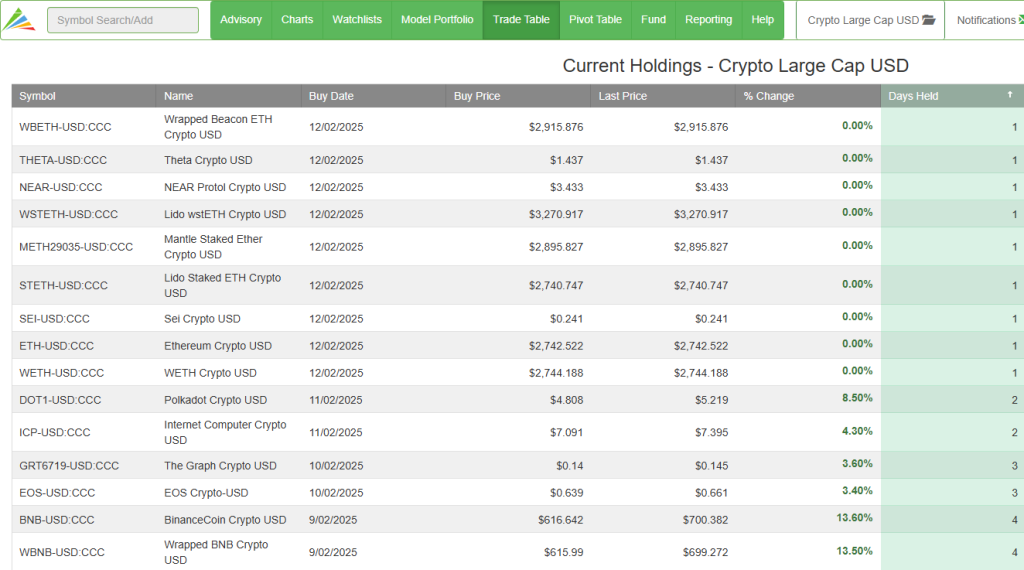

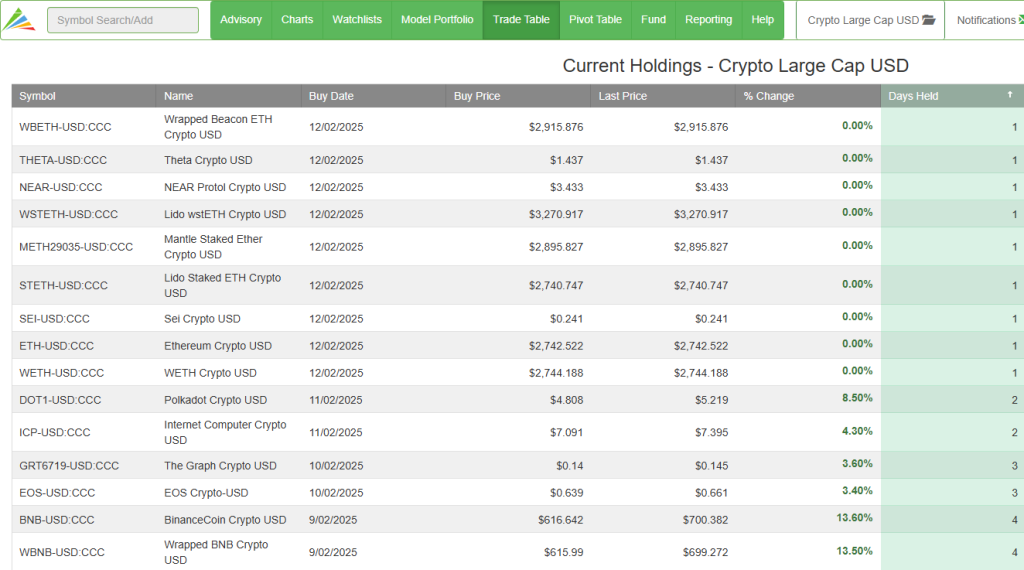

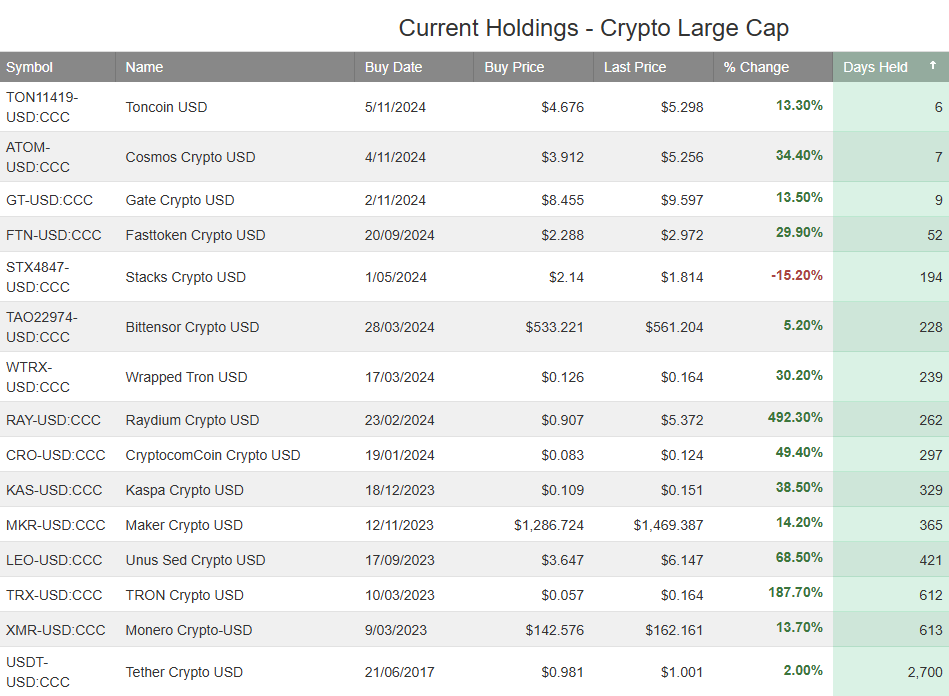

Our large-cap trading model has added nine new positions.

Our large-cap trading model has added nine new positions.

New holdings have been added to our AI crypto model portfolio.

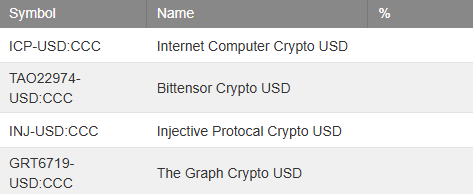

The following 4 should be added to your portfolio based on the new AI Algo Engine database.

Donald Trump signed an executive order on Thursday (ET) to establish the Presidential Working Group on Digital Asset Markets, tasked with developing a federal regulatory framework governing digital assets, including stablecoins.

“President Trump will help make the United States the centre of digital financial technology innovation by halting aggressive enforcement actions and regulatory overreach that have stifled crypto innovation under previous administrations,” the official White House site states.

According to the executive order, the working group will also have the task of evaluating the potential creation and maintenance of a national digital asset stockpile, in addition to proposing criteria for establishing such a stockpile.

The move is a welcome development for the cryptocurrency market, which has been eagerly watching to see if Trump follows through on his pre-election promises.

Global Cryptocurrency Market Cap—The global cryptocurrency market cap is $3.6 Trillion, double its size only one year ago. Bitcoin’s market cap is $2 Trillion.

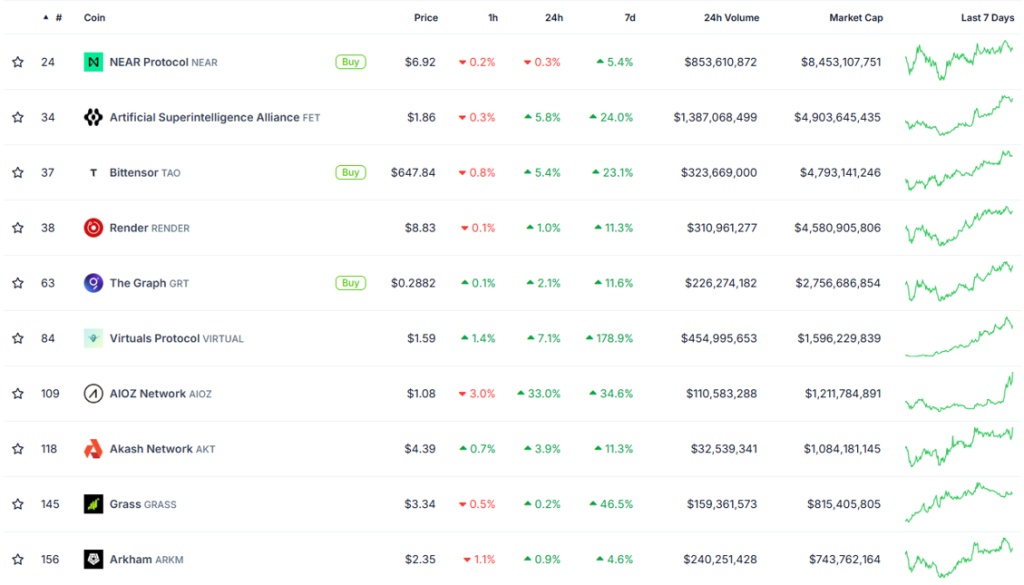

1. NEAR Protocol (NEAR)

These projects represent a convergence of AI and blockchain technologies, addressing a variety of use cases, from decentralized computing to AI-powered analytics and automation. Let me know if you’d like a deeper dive into any specific coin!

Best Overall Technology

If we consider AI-specific technology, BitTensor (TAO) stands out for its unique approach to incentivized AI model collaboration, which is foundational for decentralized AI ecosystems.

For general-purpose AI and blockchain integration, Fetch.ai (FET) leads with its versatility and real-world use cases.

For infrastructure and scalability, Akash Network (AKT) and NEAR Protocol (NEAR) are highly robust, depending on whether you prioritize computing or dApp development.

Key Insights from the Table

BitTensor (TAO): $4.79 billion.

24-Hour Trading Volume: A high trading volume indicates strong investor activity.

Fetch.ai (FET): $1.387 billion (highest trading volume among the coins in the list).

NEAR Protocol (NEAR): $853 million (second-highest).

Virtuals Protocol (VIRTUAL): $454 million.

7-Day Price Change: Significant price gains over 7 days indicate growing investor demand.

Virtuals Protocol (VIRTUAL): 178.9% (largest 7-day gain).

AIOZ Network (AIOZ): 34.6%.

Grass (GRASS): 46.5%.

Market Cap: Higher market caps suggest established projects with significant investor backing.

NEAR Protocol (NEAR): $8.4 billion (largest market cap in the list).

Fetch.ai (FET): $4.9 billion.

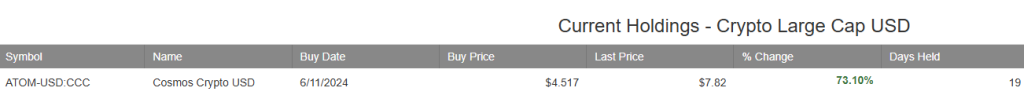

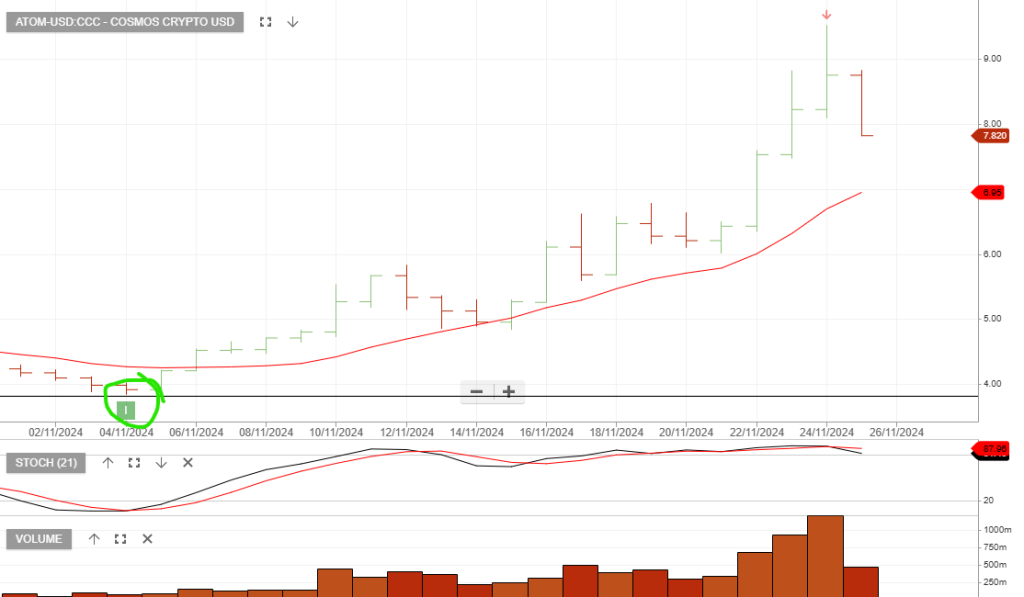

Our Large Cap Trade Table added Cosmos 19 days ago, and the trade is up 73%. Make sure you’re tracking the movements and watching for the email sell instructions.

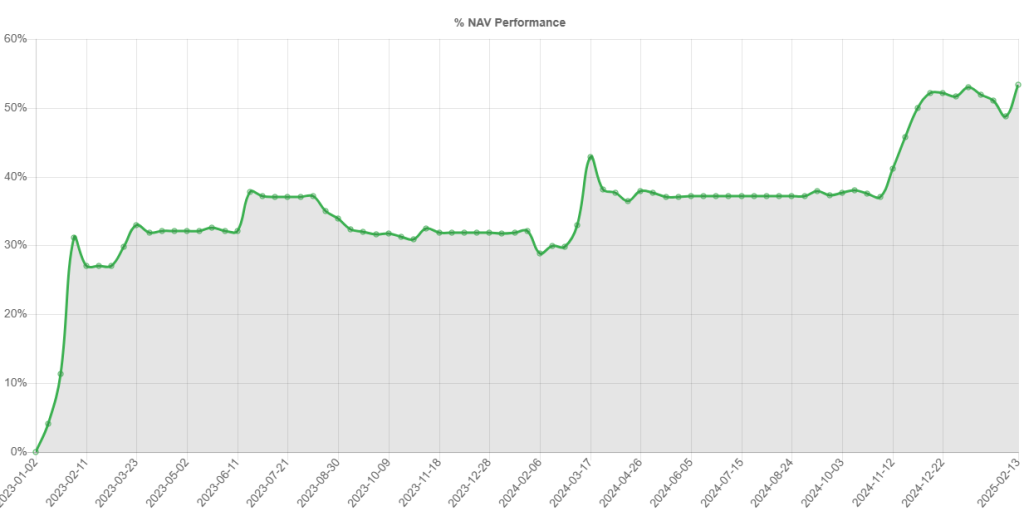

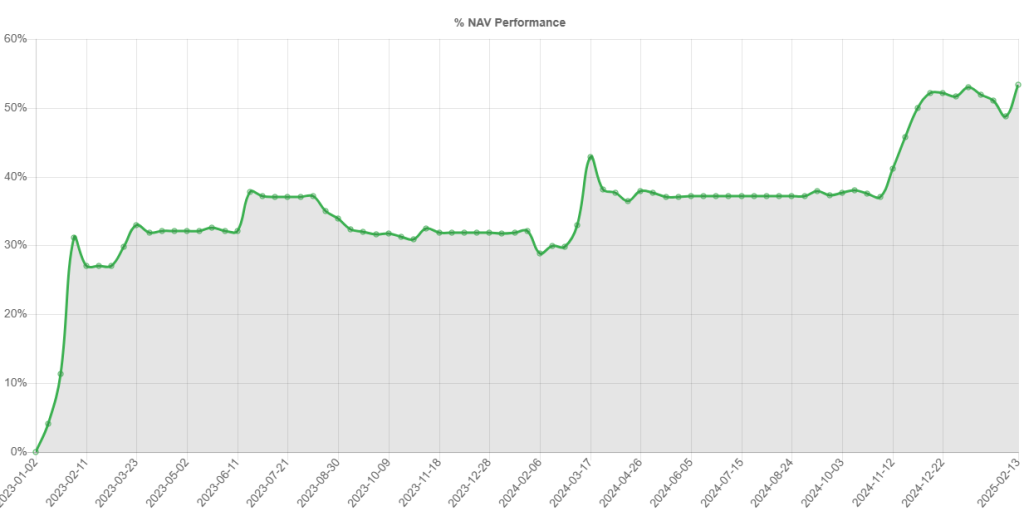

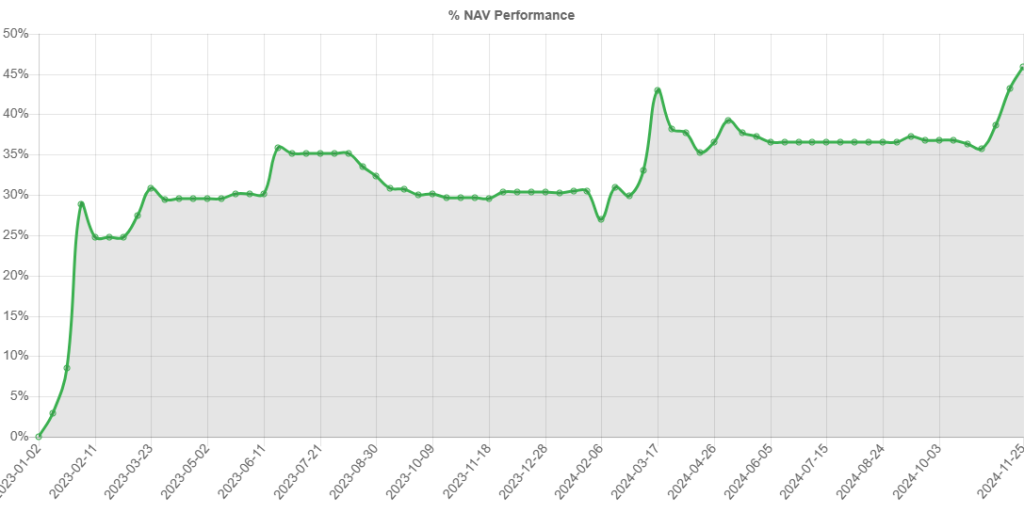

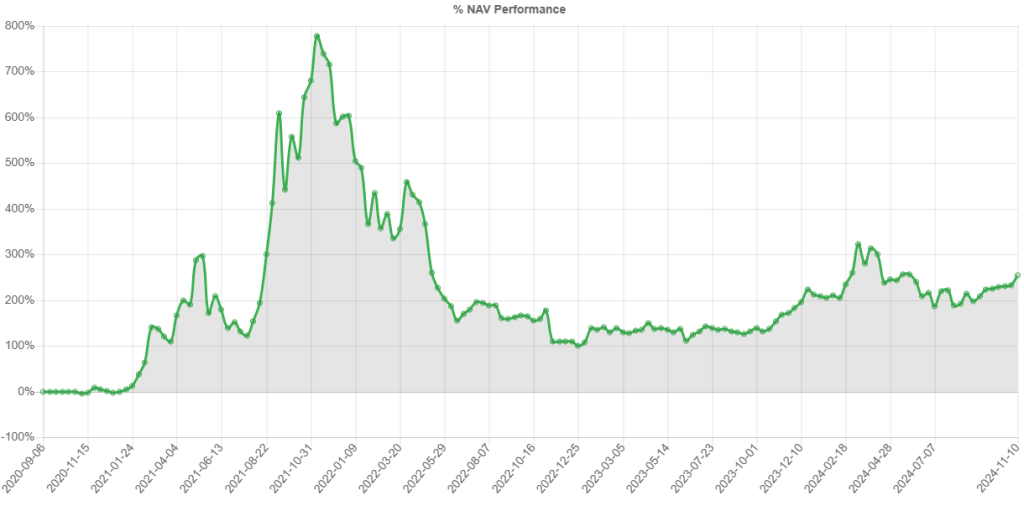

Our Crypto Large Cap model portfolio is up over 80% in the last 12 months.

Bitcoin is rated a buy with a stop loss of 56,590.

The first and most cost-effective bitcoin ETF on the ASX enables simple and convenient access without the complexity of individual ownership.

Or start a free thirty day trial for our full service, which includes our ASX Research.