Ansell

Ansell is under Algo Engine buy conditions.

Ansell is under Algo Engine buy conditions.

Global X Cybersecurity is under Algo Engine buy conditions.

Betashares Future Of Payments is under Algo Engine buy conditions.

Inghams Group is under Algo Engine buy conditions.

BetaShares Cloud Computing is under Algo Engine buy conditions.

Global X Artificial Intelligence is a new ETF listed on the ASX.

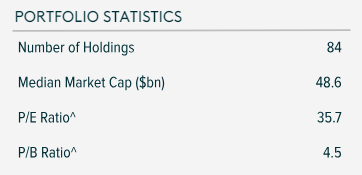

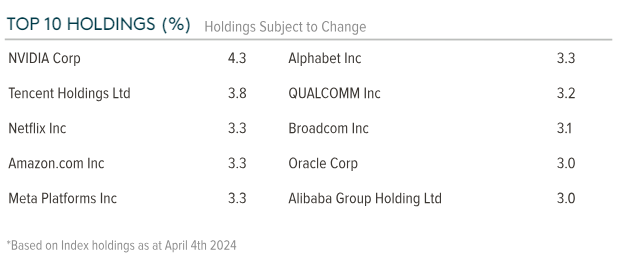

The index is designed to track the performance of companies listed or incorporated in developed markets

that are positioned to benefit from the development and utilization of Artificial Intelligence (AI) in their

products and services, as well as companies that produce hardware used in AI applied for the analysis of

Big Data. Indxx has identified the following categories as providing exposure to the underlying theme:

Category 1

Artificial Intelligence Developers – develop AI and use AI in their own products

Artificial Intelligence-as-a-Service (“AIaaS”) – provide artificial intelligence capabilities to their

customers as a service.

Category 2

Artificial Intelligence Hardware – produce semiconductors, memory storage and other hardware that is

utilized for artificial intelligence applications. Quantum Computing – develop quantum computing technology.

The top 60 companies from Category 1 and the top 25 companies from Category 2 will form the final

index.

CrowdStrike Holdings, Inc. – Class A Common delivered strong Q1 FY25 results with 33.5% ARR growth and 41.8% free cash flow growth.

CrowdStrike raised its full-year revenue guidance and is expected to continue delivering 30%+ growth in the near-term

VanEck Small Companies Masters invests in a diversified portfolio of ASX listed securities with the aim of providing investment returns (before Management fees) that closely track the performance of the MVIS Australia Small-Cap Dividend Payers Index.

The MVIS Australia Small-Cap Dividend Payers Index is a pure play index designed to capture the

performance of dividend paying Australian small cap equities, with real diversification across both

securities and sectors.

The Index includes the most liquid small cap ASX listed companies that did not omit their latest dividend payment and that generate at least 50% of their revenues in Australia. Individual Index components are determined using a stringent rules based methodology focusing on liquidity, with a minimum of 25 securities, each with a maximum weighting of 8%.

6/6 update: Northern Star Resources is above the 10-day average, and the stop loss can be lifted to $14.10

Northern Star Resources is a buy with a stop loss below the $14 support level.

BetaShares Crude Oil Index ETF-Currency Hedged is likely to find buying support at $5.50.

Or start a free thirty day trial for our full service, which includes our ASX Research.