China New Economy ETF

VanEck Vectors China New Economy is likely to find buying support.

VanEck Vectors China New Economy is likely to find buying support.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Inghams Group is rated a buy with a stop loss at $3.43.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Pexa Group will likely find buying support in the $12 – $13 range.

Global X S&P Biotech has a higher low formation with support at $45.

Mineral Resources is under Algo Engione buy conditions.

The sell-off in lithium following recent news about tariffs on Chinese electric vehicles has created a weakness in MIN’s share price. Iron ore and lithium markets are likely near support, and we’re watching for momentum to push the share price above the 10-moving average as our trade entry point.

Note: Mineral Resources has announced the early closure of the Yilgarn Hub in WA.

VanEck Vectors China New Economy is likely to find buying support.

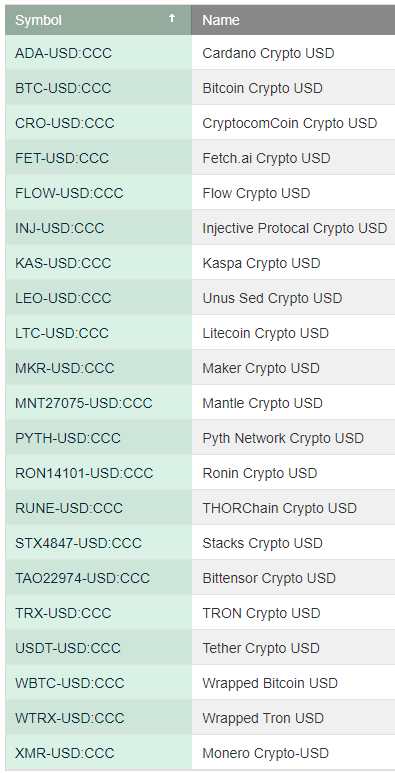

If you’re considering building a crypto investor portfolio, we’ve compiled our top 20 investments. Make an even allocation to each position and hold the portfolio until you see the Algo Engine switch to sell conditions.

If you need assistance, please call 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.