Pexa

Pexa Group remains a top holding in our ASX Property Fund. We rate the stock a buy with a stop loss of $13.

Pexa Group remains a top holding in our ASX Property Fund. We rate the stock a buy with a stop loss of $13.

Consensus expectations for S&P 500 companies’ earnings per share for 2024, 2025, and 2026 are $US243, $US279, and $US317.

Based on current PE ratios, the index is trading in line. If the EPS increased to $279 next year, the index would be at 6000 points. The question is, can earnings grow at the forecast rate, or will slowing global GDP begin to drag, and earnings come in at a lower than forecast level in 2025?

For share-term traders, you should be on the long side of the index (once again), with a stop loss at 5493.

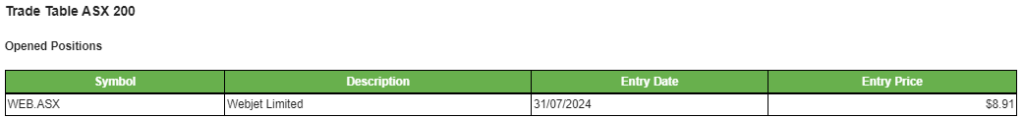

Webjet is a new holding in our ASX200 Trade Table.

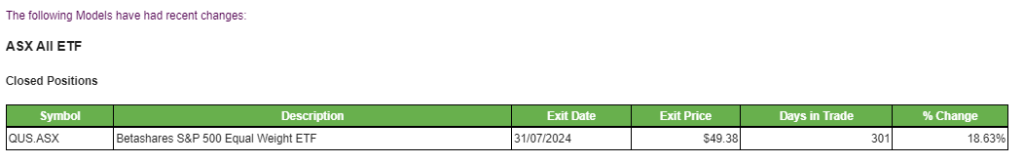

After a 301-day holding period, the ETF was sold for a gain of 18.63%

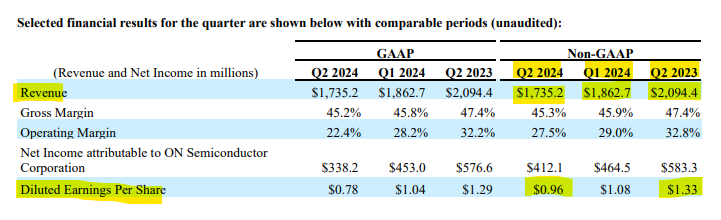

ON Semiconductor Corporation – Common 2Q quarter revenue was $1.73bn, with GAAP diluted earnings per share and non-GAAP diluted earnings per share of $0.78 and $0.96, respectively.

The company returned $650 million of free cash flow over twelve months to shareholders through stock repurchases.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Ramsay Health Care is rated a buy with a stop loss below $46.13.

Viva Energy Group is a new position in our ASX200 Trade Table.

Rio Tinto is a new position in our ASX 200 Trade Table.

VanEck Vectors China New Economy is oversold and offers investors an attractive entry point.

Or start a free thirty day trial for our full service, which includes our ASX Research.