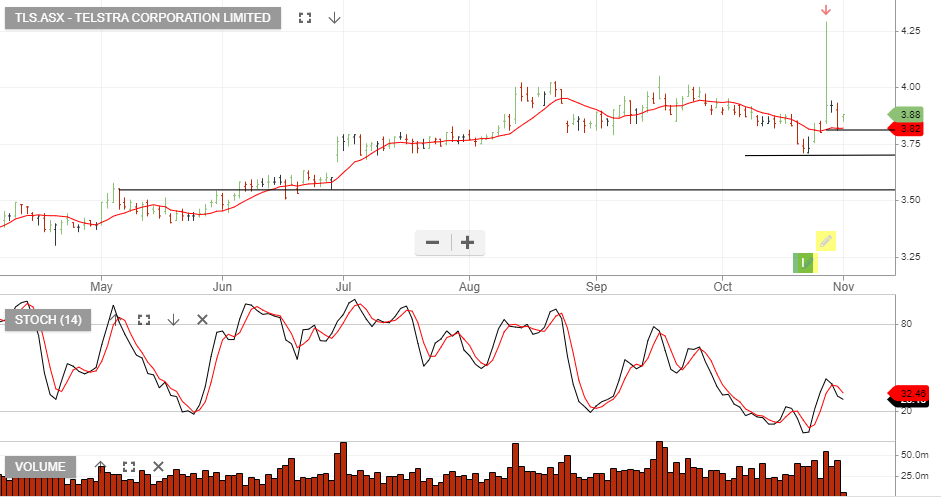

Telstra – Buy Signal

Telstra Corporation is under Algo Engine buy conditions and has now been added to our ASX model portfolio.

1/11 update: Trader update, buy and place the stop loss at $3.80

Telstra Corporation is under Algo Engine buy conditions and has now been added to our ASX model portfolio.

1/11 update: Trader update, buy and place the stop loss at $3.80

Brambles is under Algo Engine buy conditions and has now been added into our ASX model portfolio.

Note: Traders may wish to remain patient and wait for a close above the 10-day average.

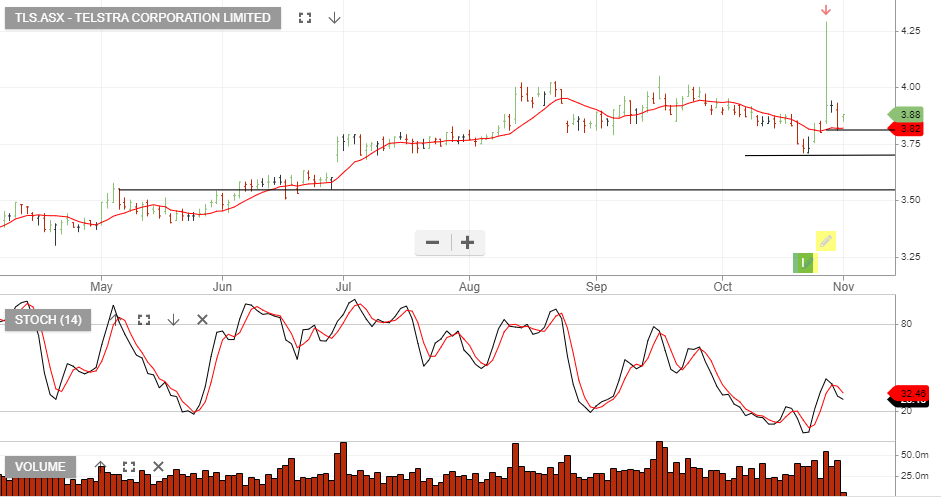

Wesfarmers is under Algo Engine buy conditions and is a current holding in our model portfolio.

Wesfarmers now holds 19.3% of Australian Pharmaceutical Industries. The acquisition has less than two weeks left in confirmatory due diligence. The battle between Sigma and Wesfarmers for the API business and final offers will be worth watching.

Accumulate.

1/11 update: Retain long exposure and traders may decide to shift the stop loss to Friday’s low.

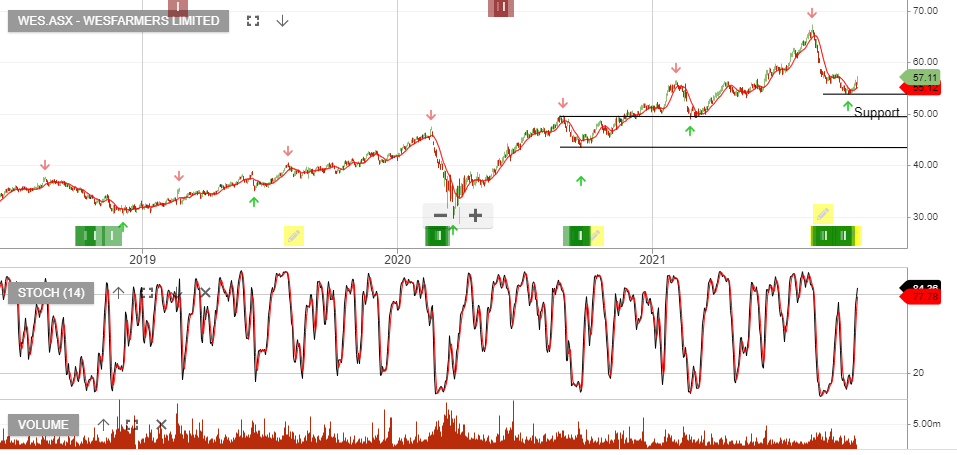

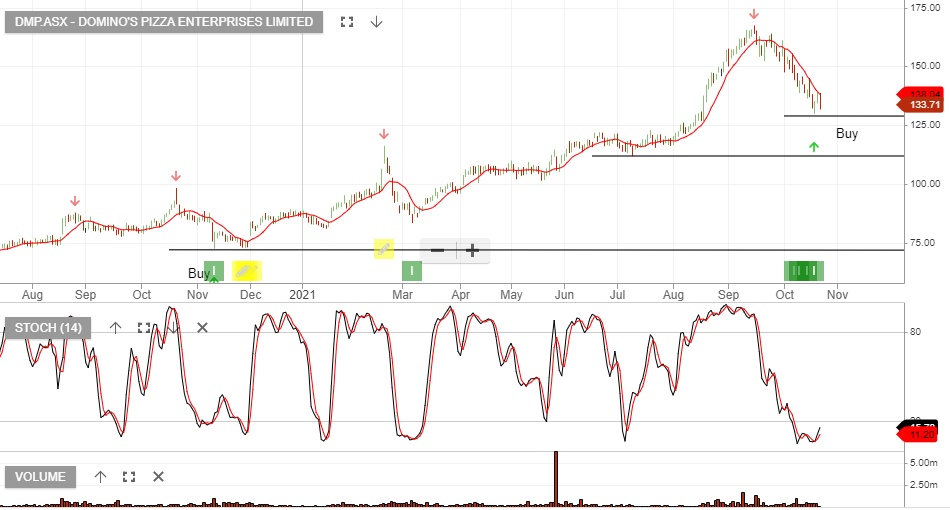

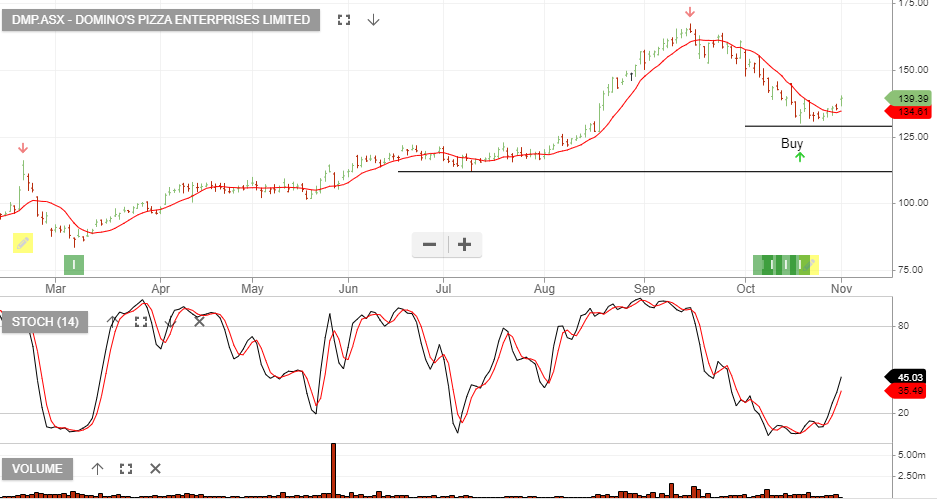

Domino’s Pizza Enterprises is under Algo Engine buy conditions and is among the best-performing stocks in our ASX 100 model portfolio. The stock is up 74% since being added in November last year.

The recent pullback and higher low formation has generated another entry reminder. Accumulate DMP within the $115 to $135 price range.

1/11 update: DMP continues to see buying interest build above the $135 support level.

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

Continue to track the CWN share price and wait for a cross above the 10-day average.

12/8 update: CWN is now trading above the 10 day average.

18/10 update: Crown recovery continues, buy with a stop loss below $8.75

1/11 update: The recent move back down to $10 is likely to find renewed buying interest. We remain long CWN shares.

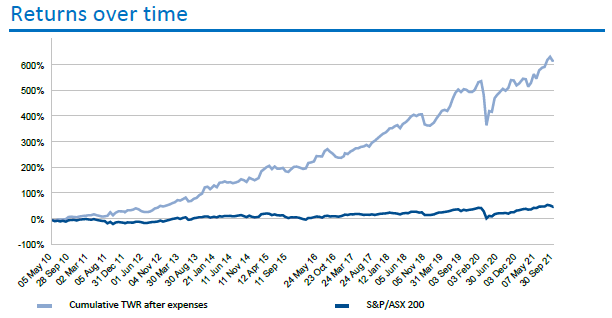

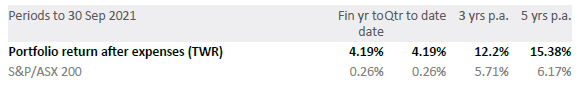

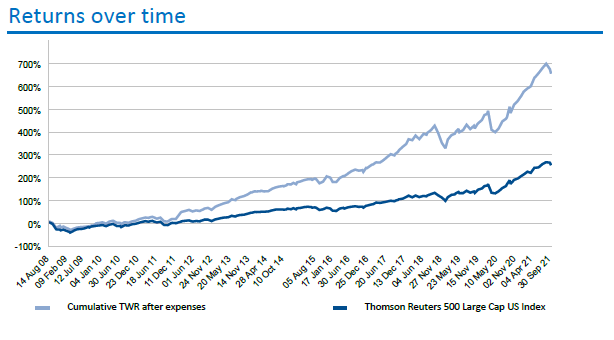

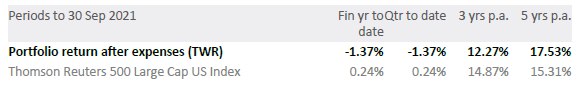

The updated 5-year performance data for all Algo Engine buy and sell signals for the period ending 30 September.

Model Name: ASX S&P100 is 15.38% p/a.

Model Name: ASX ALL ETF is 14.85%.

Model Name: US S&P100 is 17.53% p/a.

June 2021 Data:

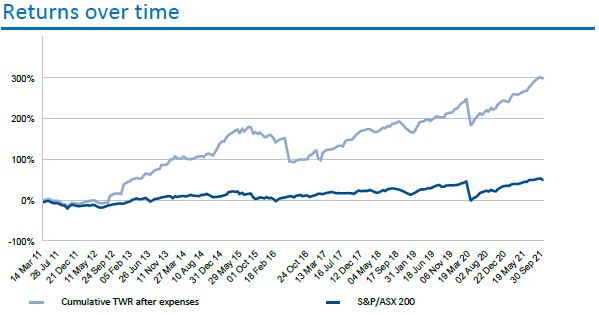

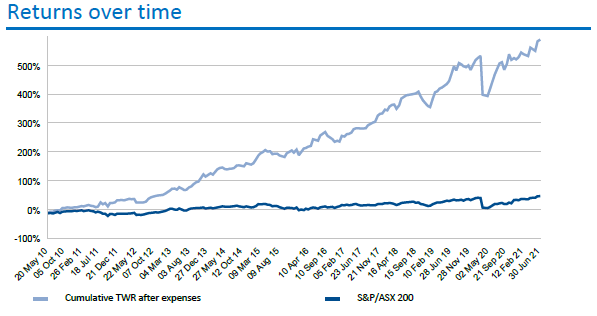

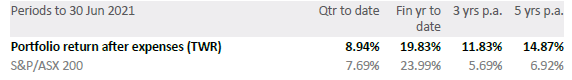

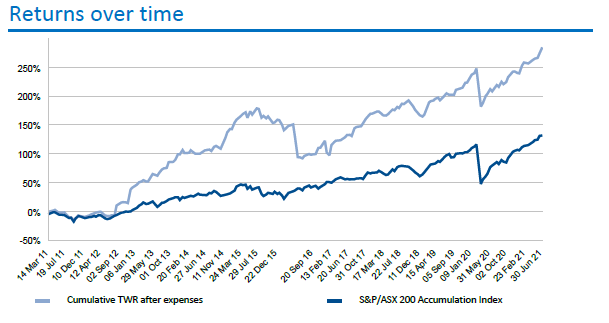

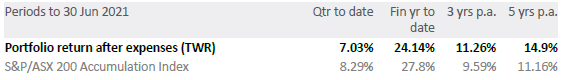

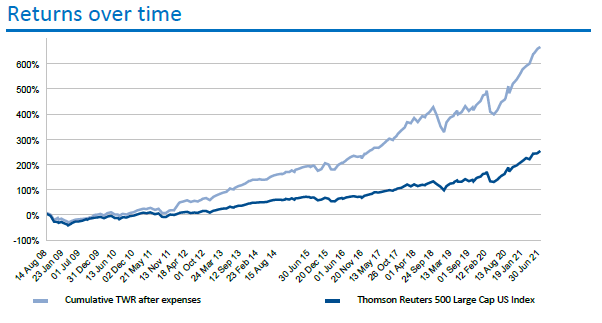

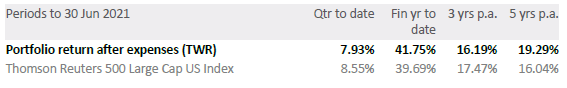

The updated 5-year performance data for all Algo Engine buy and sell signals for the period ending 30 June 2021

Model Name: ASX S&P100 is 14.87% p/a.

Model Name: ASX ALL ETF is 14.9%.

Model Name: US S&P100 is 19.29% p/a.

Disclaimer: This data illustrates the simulated 5 year historical time weighted rate of return of applying our algorithm based investment model over the ASX100 & US S&P100 listed securities. Past performance is no guarantee of future returns.

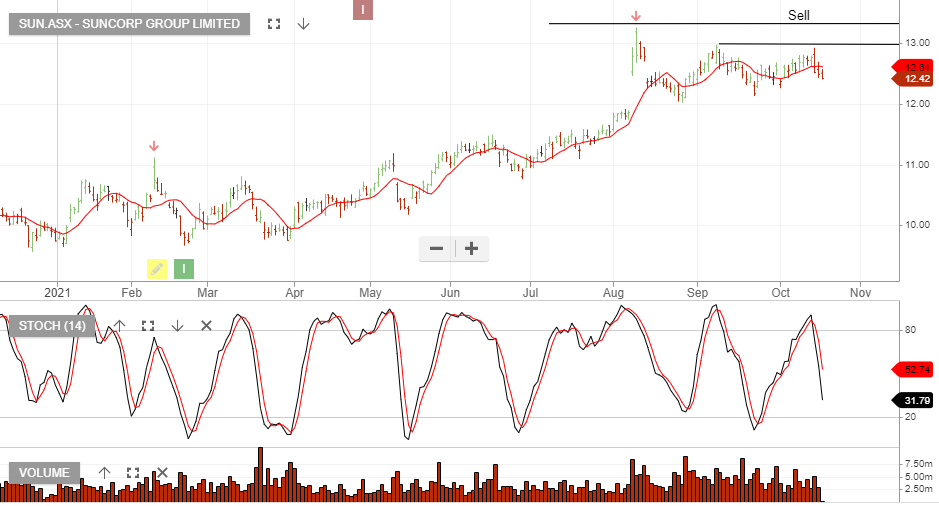

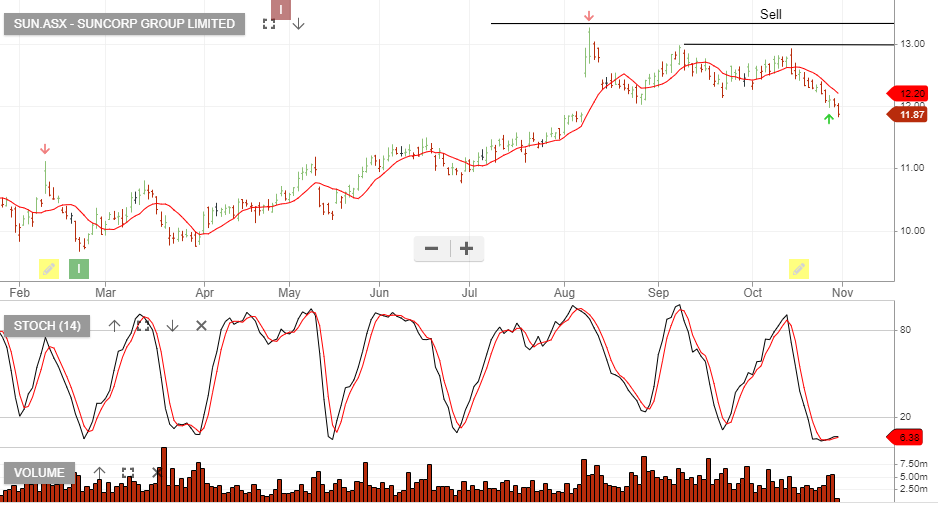

Suncorp Group is under Algo Engine sell conditions and we expect selling pressure to build below the $13.00 resistance level.

Short SUN with stops above $13.00

29/10 update:

Neuren Pharmaceuticals is under Algo Engine buy conditions.

Neuren Pharmaceuticals reported the successful completion of its Share Purchase Plan (SPP) at $2.05 per share, which closed on Friday 1 October 2021. The SPP was offered to give all shareholders in Australia and New Zealand the opportunity to subscribe for additional shares at the same price as was offered to institutional and sophisticated investors in the recent placement.

Total gross proceeds of $23.3 million from the placement and SPP will accelerate the development and increase the value of NNZ-2591 for four neurodevelopmental disorders, by enabling a Phase 2 clinical trial in Prader-Willi syndrome and the foundational work for Phase 3 development across Prader-Willi, Phelan-McDermid, Angelman and Pitt Hopkins syndromes. NNZ-2591 has Orphan Drug designation from the US Food and Drug Administration for all four disorders and from the European Medicines Agency for three.

Neuren CEO Jon Pilcher commented: “We are pleased with and grateful for the support of shareholders in both the placement and the SPP. Neuren is now in a strong financial position as we approach the Rett syndrome Phase 3 results for trofinetide and advance the development of NNZ-2591 for multiple neurodevelopmental disorders in parallel.”

Treasury Wine Estates is under Algo Engine buy conditions.

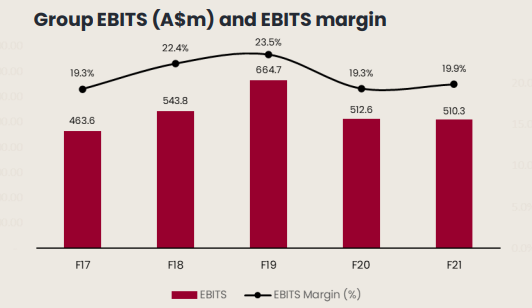

TWE continues to adjust to a post pandemic/post Chinese tariff environment. FY21 EBIT of $510 exceeded market expectations. After a number of years of disappointment for TWE in this region, we see America’s division accelerating growth into FY22.

FY22 EBIT growth is forecast to be in the mid to high single-digit range.

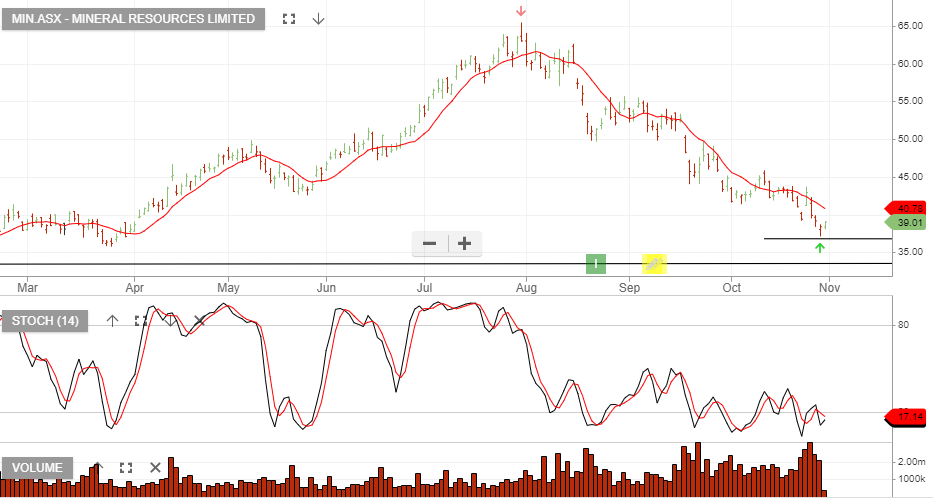

Mineral Resources is under Algo Engine buy conditions and is in our ASX 100 model portfolio.

Or start a free thirty day trial for our full service, which includes our ASX Research.