JHX Rallies 14.6%

James Hardie Industries was added to our model portfolio on 12 October and is now up 14.6%.

James Hardie Industries was added to our model portfolio on 12 October and is now up 14.6%.

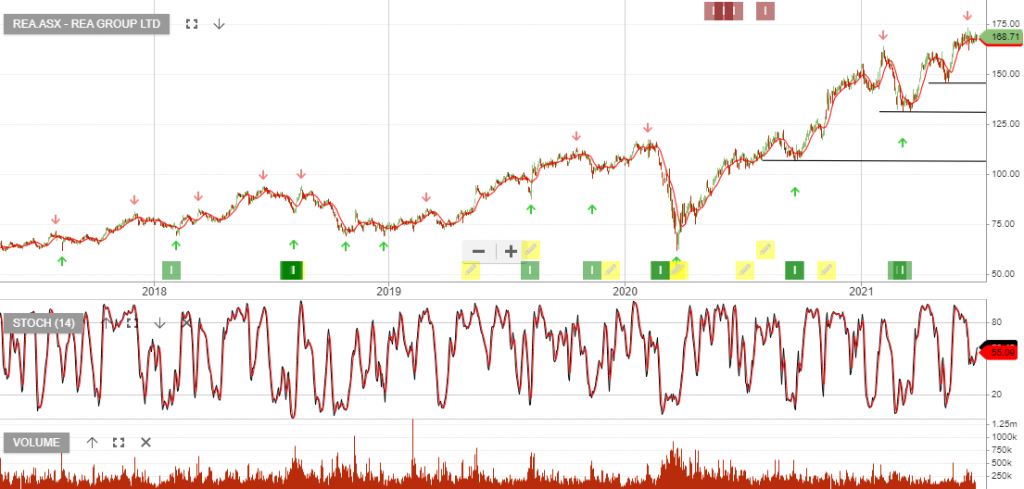

REA Group is among the best-performing stocks in our ASX 100 model portfolio, with the share price up 67% since being added in September last year.

REA Group has acquired 100 percent of the shares in Mortgage Choice for $1.95 a share, valuing the company at $244 million. REA is now focused on accelerating its financial services strategy to become a leading player in the home loan market.

REA is a high quality business with terrific growth potential, however, the 65x PE multiple is a little rich and we recommend waiting for the next Algo Engine buy signal.

5/11 update: REA Group delivered 22% revenue growth for Q1 FY22.

Link Administration Holdings reported FY21 profit of $112m. FY22 guidance is now low single-digit revenue growth and flat EBIT.

The downside in the share price is underpinned to a certain degree through the announced buyback of $150m.

The forward dividend yield is 2.7%.

5/11 update: Carlyle Group has returned for a renewed buyout offer of $5.38 per share which values the target at around $2.8 billion.

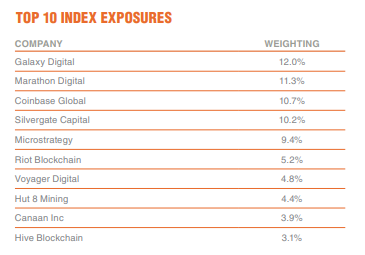

New ETF listing BetaShares Crypto Innovators

EXPOSURE TO THE GROWTH POTENTIAL OF THE CRYPTO ECONOMY

The crypto economy has been growing strongly, aided by the performance of Bitcoin, Ethereum

and other digital assets over the past ten years, with this growth anticipated to continue. The

companies within CRYP are seeking to build on that success.

EXPOSURE TO THE BROAD CRYPTO-EQUITY ECOSYSTEM

CRYP is designed to capture the full breadth of the crypto ecosystem by investing in pure-play

crypto companies (such as cryptocurrency exchanges, crypto mining companies and mining

equipment firms), companies whose balance sheets are held at least 75% in crypto assets, and

diversified companies with crypto-focused business lines. CRYP invests in up to 50 crypto leaders,

including Coinbase, Riot Blockchain and Microstrategy

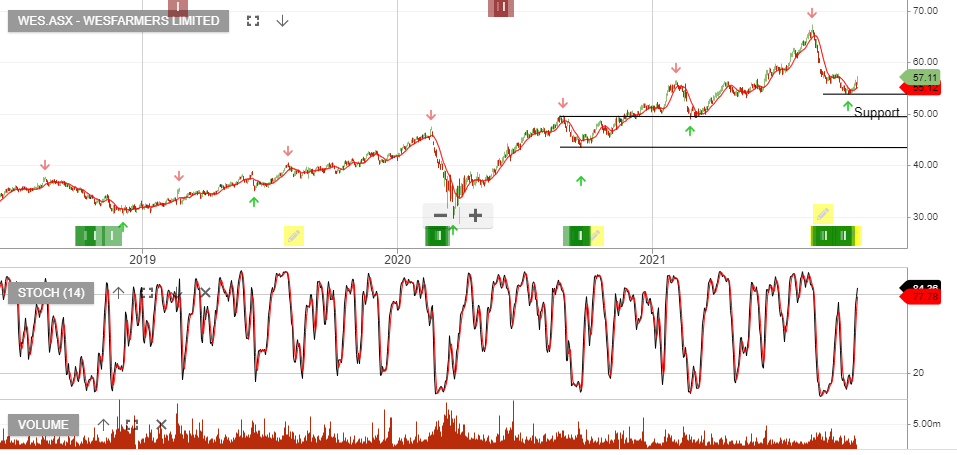

Wesfarmers is under Algo Engine buy conditions and is a current holding in our model portfolio.

Wesfarmers now holds 19.3% of Australian Pharmaceutical Industries. The acquisition has less than two weeks left in confirmatory due diligence. The battle between Sigma and Wesfarmers for the API business and final offers will be worth watching.

Accumulate.

1/11 update: Retain long exposure and traders may decide to shift the stop loss to Friday’s low.

4/11 update

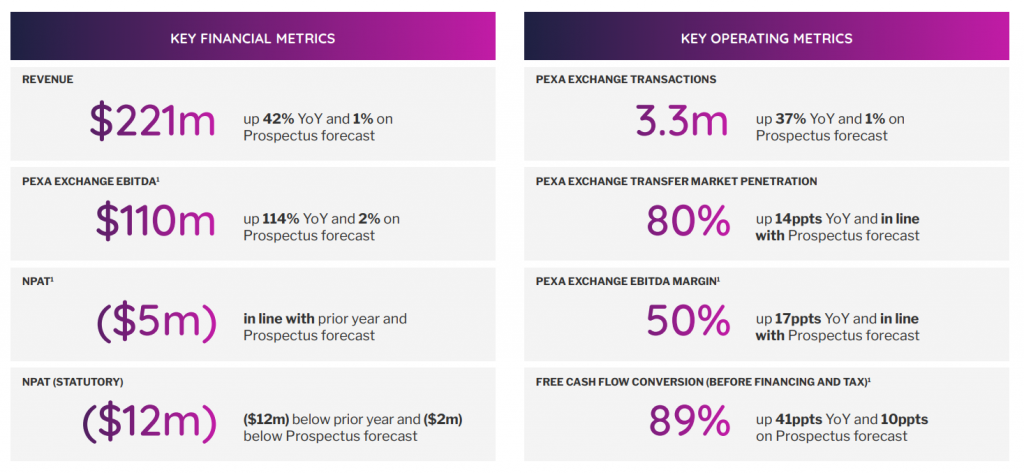

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one. PXA was recently listed on the ASX with a market cap of $3bn.

FY21 underlying earnings doubled to $110 million and analysts are forecasting a further 20% increase in FY22.

CBA & Link are major shareholders.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

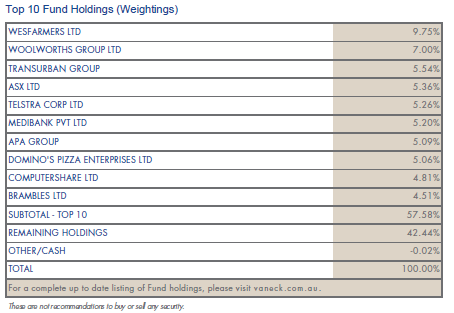

VanEck Vectors Morningstar Aust Moat is under Algo Engine buy conditions and has now been added to our ASX All ETF model portfolio.

Bega Cheese is under Algo Engine buy conditions.

The FY21 result beat forecasts on a number of key metrics, with FY21 sales +38%, underlying EBITDA increased +38%, and NPAT up 24%.

FY22 BGA is targeting further earnings growth and to realise the synergies from the LD&D acquisition.

BGA buying support to increase above the $5.00 support level.

1/11 update: Bega has rallied from the $5.26 entry-level and the current higher low at $5.32 is likely to see strong buying support.

Or start a free thirty day trial for our full service, which includes our ASX Research.