Pexa – Accumulate

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one. PXA was recently listed on the ASX with a market cap of $3bn.

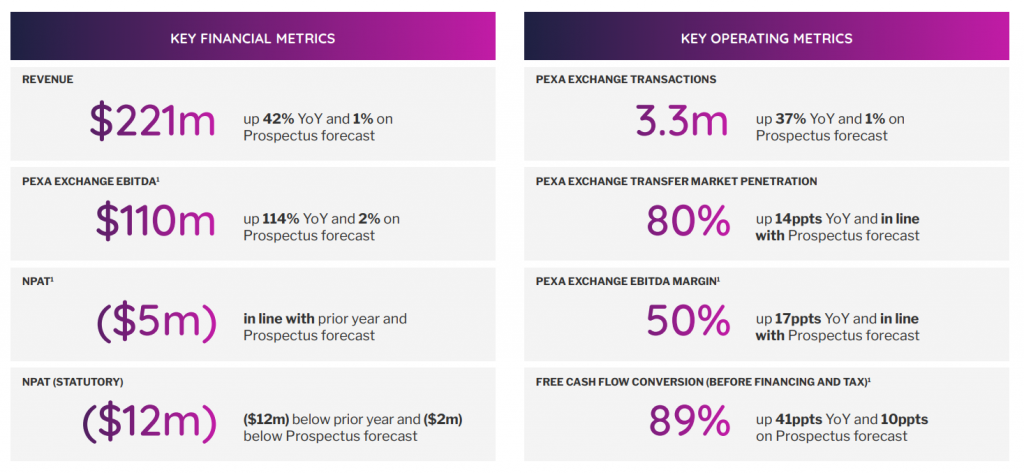

FY21 underlying earnings doubled to $110 million and analysts are forecasting a further 20% increase in FY22.

CBA & Link are major shareholders.