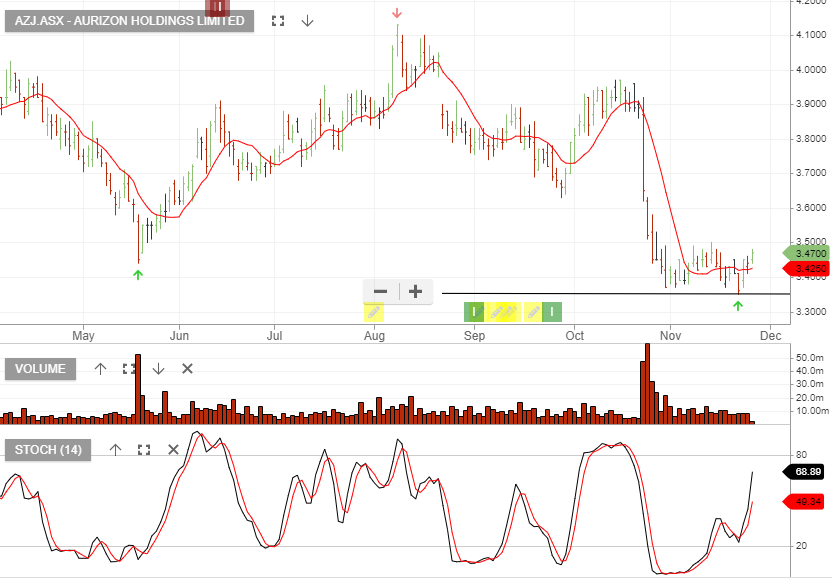

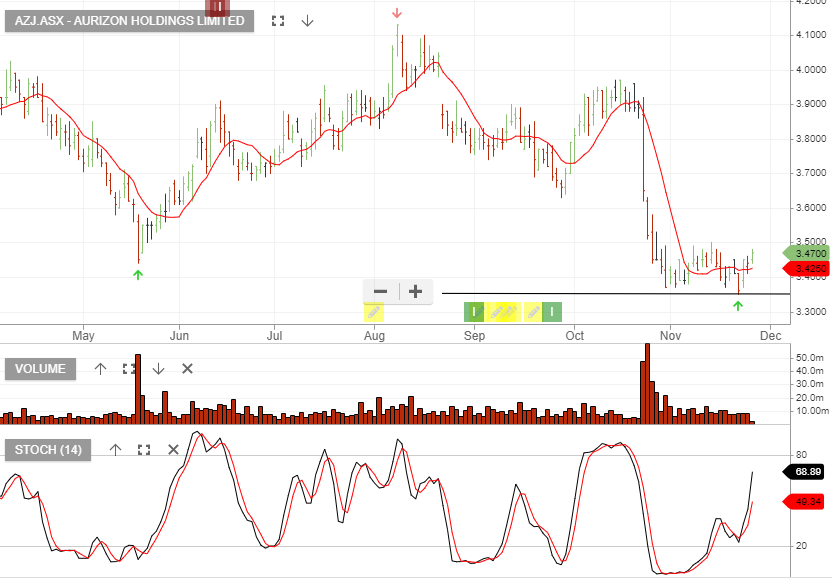

Aurizon – Value Play

Aurizon Holdings offers value and we expect buying support to build above the $3.35 support level.

Aurizon Holdings offers value and we expect buying support to build above the $3.35 support level.

Mineral Resources is under Algo Engine buy conditions and is in our ASX 100 model portfolio.

25/11 update: (ASX:MIN} has crossed the 10-day average and is now 10% above the entry-level.

The US Federal Reserve Fed funds rate is currently between zero and 0.25 per cent. QE is being reduced from $US120 billion to $US105 billion a month and then a further reduction to $US90 billion from Jan onwards.

Current market expectations are for the Fed to raise its cash rate from the record low 0.1 per cent level in 2023.

The price of iron ore rose 2.9 per cent to $US102.75. A relaxation of curbs on Chinese property developers, rising margins for steel producers, and signs that Chinese authorities will add fiscal and monetary support look positive for the commodity.

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

Woodside is expected to issue almost 1 billion new shares to pay for the acquisition of BHP’s petroleum business under the $41bn merger deal. BHP shareholders will receive shares in WPL and we may see some overhang of selling for the market to absorb, however, we view the deal as a vote of confidence in the new merged entity, given BHP’s decision to merge their energy assets rather than pursue a cash deal.

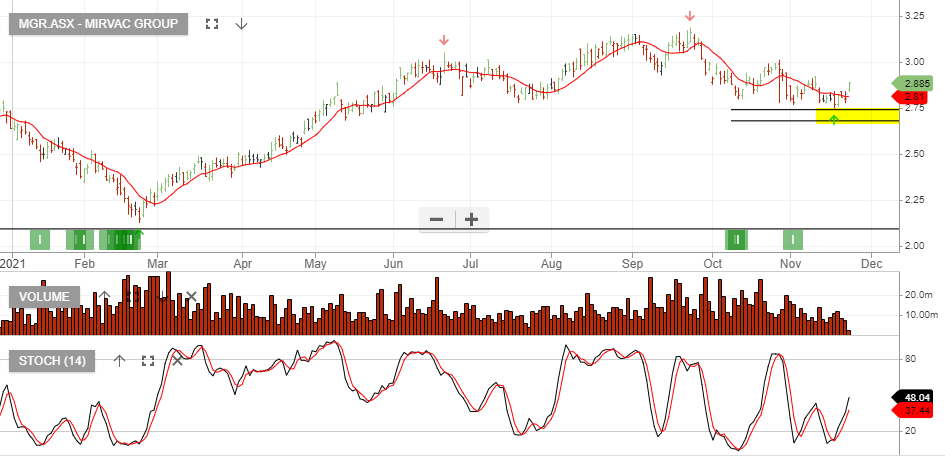

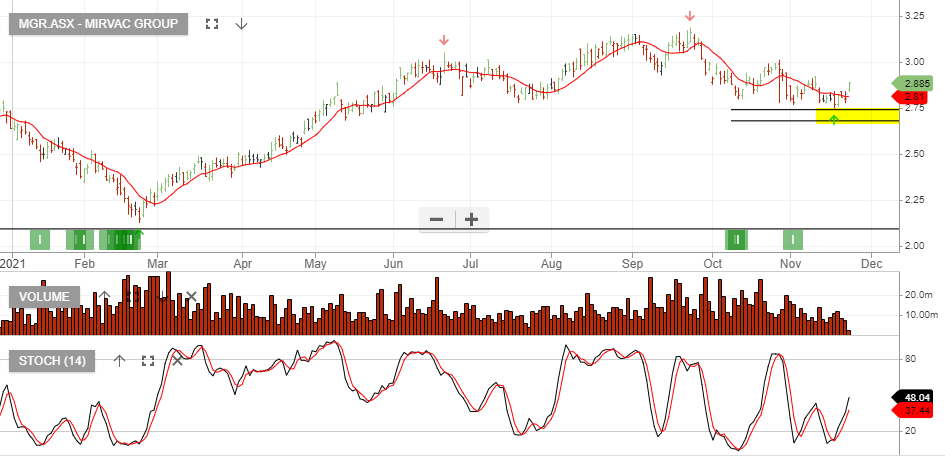

Mirvac is under Algo Engine buy conditions.

Buy MGR at market.

Sell on stop at $2.75 (break below recent pivot low).

Hold the trade open, as long as the price action remains above the 10-day average.

Mirvac is under Algo Engine buy conditions.

Buy MGR at market.

Sell on stop at $2.75 (break below recent pivot low).

Hold the trade open, as long as the price action remains above the 10-day average.

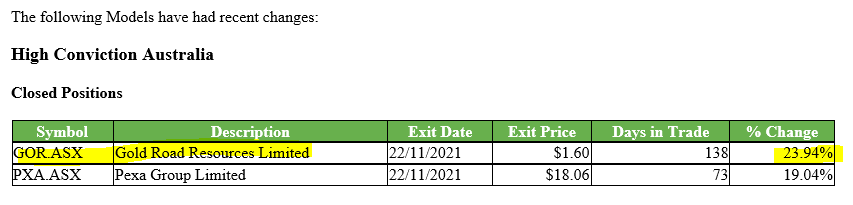

Gold Road Resources is now under Algo Engine buy conditions.

23/11 update: GOR has been sold from our ASX High Conviction portfolio, generating a 23% gain.

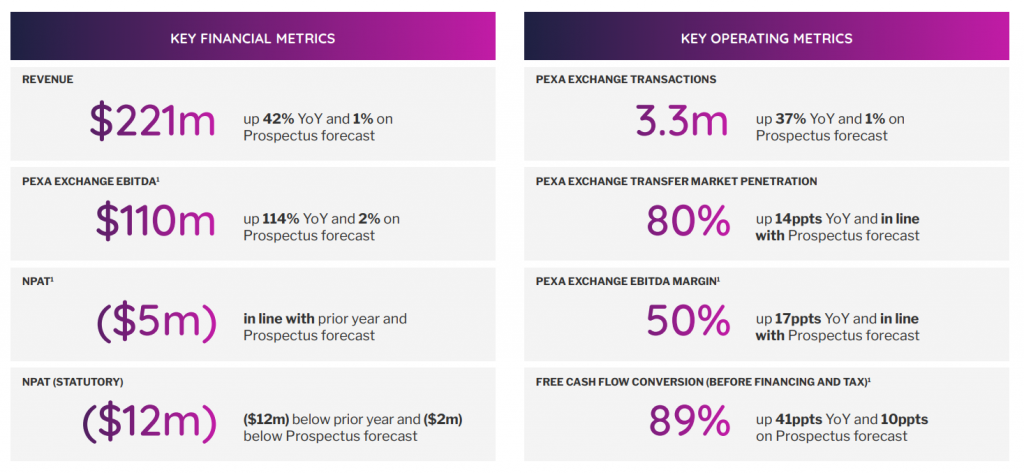

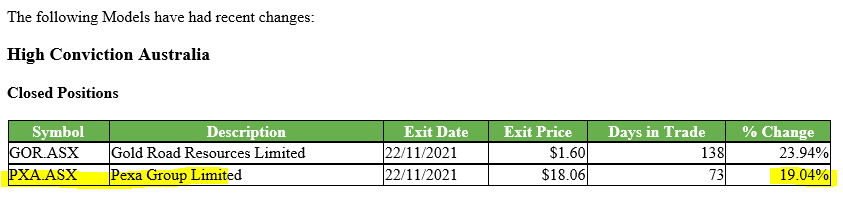

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one. PXA was recently listed on the ASX with a market cap of $3bn.

FY21 underlying earnings doubled to $110 million and analysts are forecasting a further 20% increase in FY22.

CBA & Link are major shareholders.

23/11 update: Our Pexa trade has been closed, generating a 19% return.

Or start a free thirty day trial for our full service, which includes our ASX Research.