Resmed – Support Zone

ResMed is under Algo Engine buy conditions and we see buying support building within the $30 – $33 price range.

ResMed is under Algo Engine buy conditions and we see buying support building within the $30 – $33 price range.

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

COH has rallied from $175 to a high of $257. The subsequent pullback has seen buying interest rebuild at the higher low of $207. This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.

Woolworths Group announced a disappointing trading update which revealed COVID had weighed heavily on earnings during the first half. The retailer anticipates $215mil in COVID-related expenses and before tax profit to fall from $1.3bn to $1.2bn.

We see value in the stock within the highlighted price range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Pro Medicus is up 100% since the buy signal back in July 2020.

While the stock trades on a very high multiple 120x FY22 earnings, the 40%+ revenue, and profit growth is supported by long-term contract wins. Watch for another Algo Engine buy signal on the current price retracement.

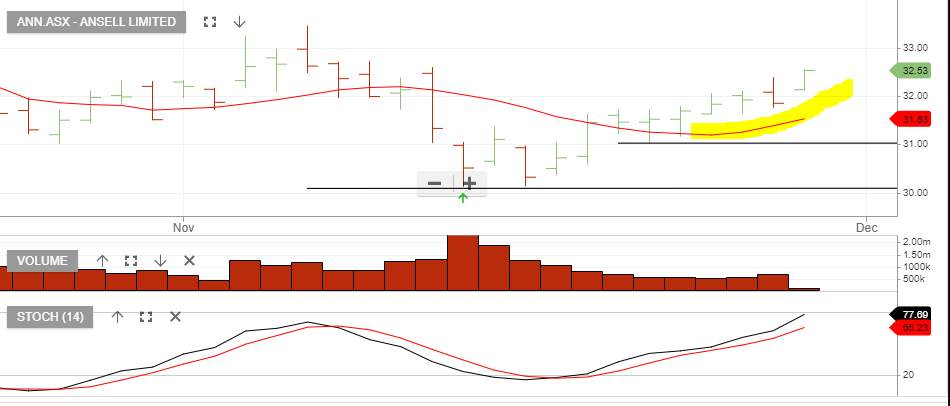

The Ansell trade from Monday night’s webinar is starting to build momentum. We entered the trade as a counter-trend position as the price action crossed above the 10-day average.

29/11/21 update: ANN remains above the 10-day average.

10/1 update: ANN has rallied 10% from the Nov lows. The price action remains positive, (as a counter-trend trade), and traders should stick with the position as long as the price holds above the 10-day average.

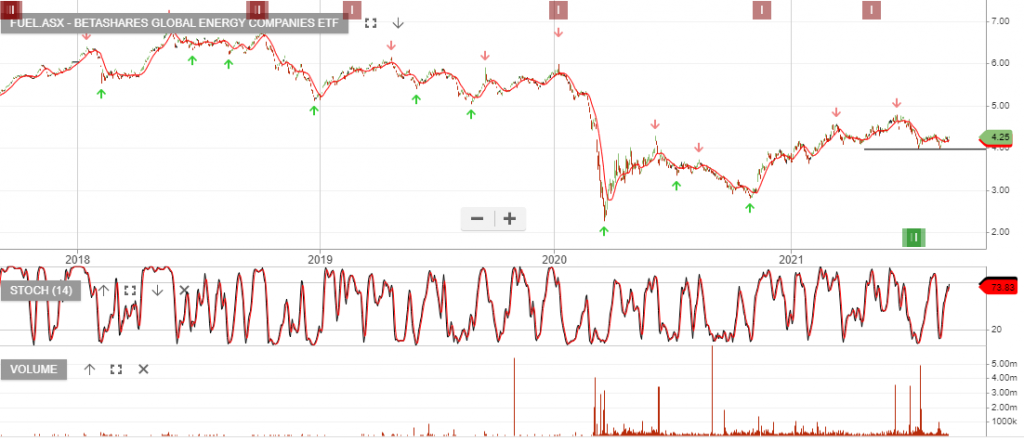

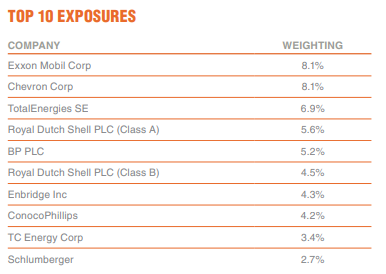

BetaShares Global Energy Companies is under Algo Engine buy conditions.

Fuel aims to track the performance of an index that comprises the largest energy companies (ex-Australia), hedged into Australian dollars.

23/12 Update:

10/1 update: FUEL ETF is now trading $4.90, up 10% from the original entry.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

10/1 update: WPL remains our preferred energy exposure along with the FUEL ETF. WPL has now rallied 10% and the momentum remains positive.

Rio Tinto is under Algo Engine buy conditions.

13/12 Update:

10/1 update: RIO remains our preferred iron ore exposure, we continue to hold the position whilst it remains under Algo Engine buy conditions. Traders may choose to focus on the momentum of the current rally and consider closing the short-term trade should we see a break below the 10-day average.

Or start a free thirty day trial for our full service, which includes our ASX Research.