Paypal

PayPal Holdings, Inc. – Common stop loss lifts to $68.55

PayPal Holdings, Inc. – Common stop loss lifts to $68.55

BetaShares Geared Us Equity Fund Currency Hedged is rated a buy with the stop loss at $38.47

In case you missed it, you can watch last night’s webinar here.

BetaShares Glb Agriculture Comp Currency Hdgd is rated a buy. Stop loss $6.22

Alcoa positive momentum is building.

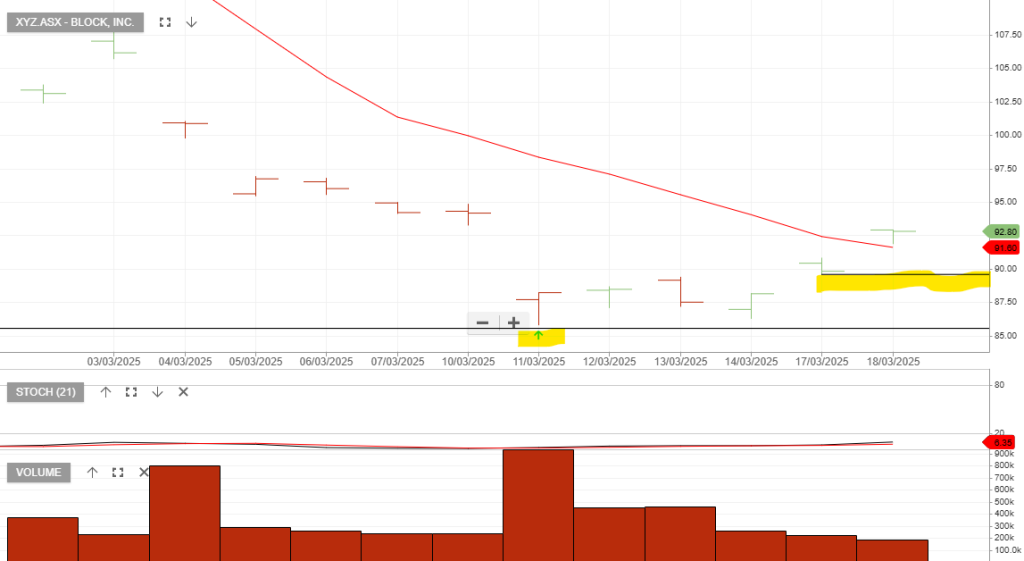

Block, trade is now in play, apply a stop loss at $89.59

Earnings spotlight: Tuesday, March 18 – Tencent Music Entertainment Group

Earnings spotlight: Thursday, March 20 – Accenture, Nike, Micron Technology and FedEx.

Ramsay Health Care has been upgraded to Outperform by Macquarie Bank.

Mineral Resources stop loss lifts to $21.51

Or start a free thirty day trial for our full service, which includes our ASX Research.