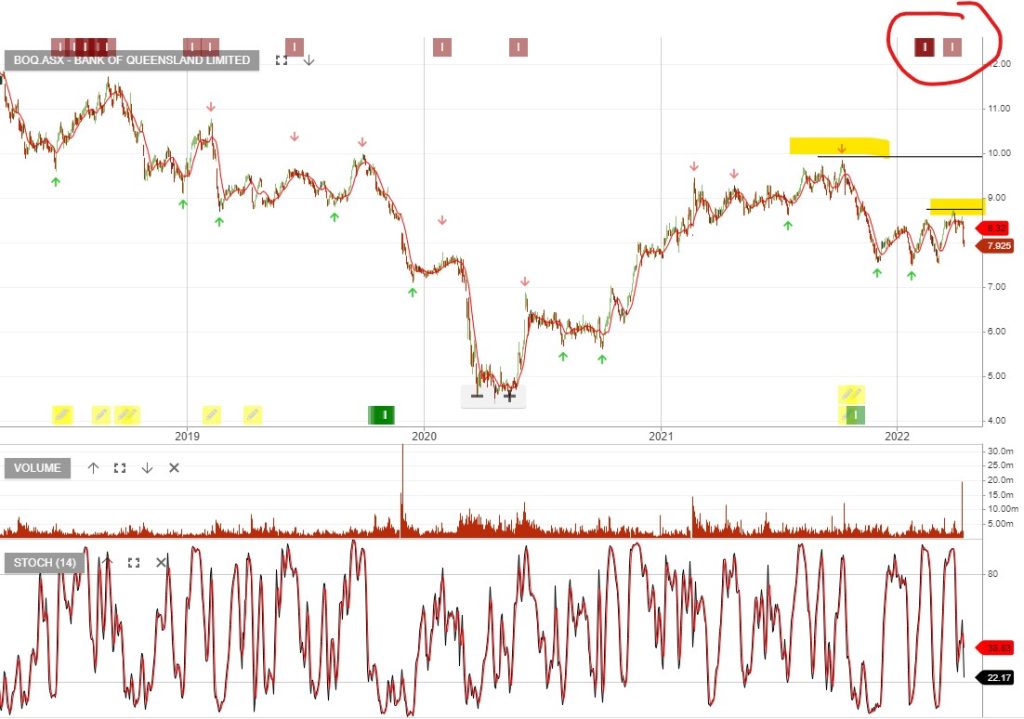

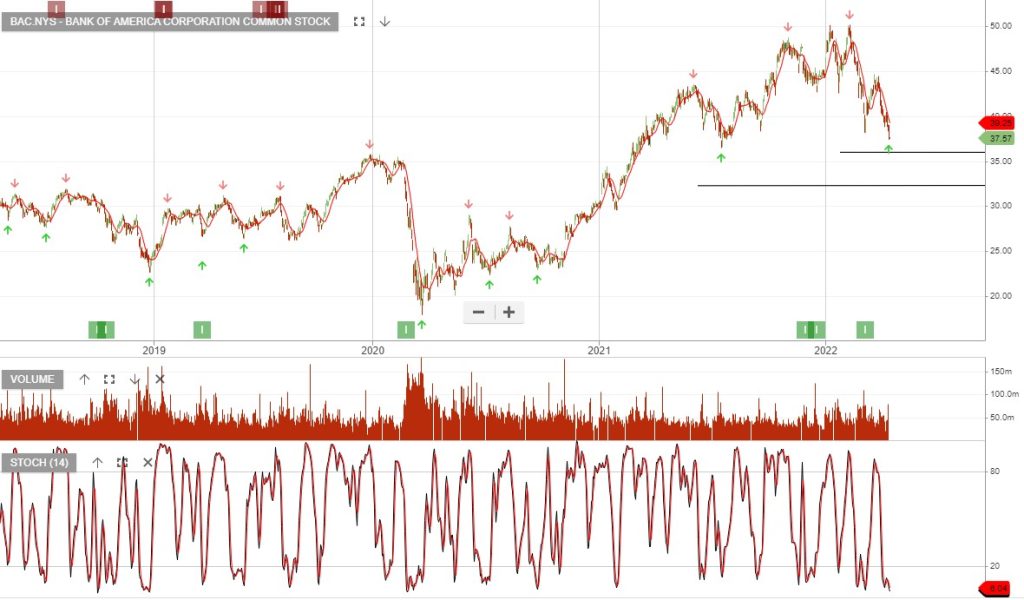

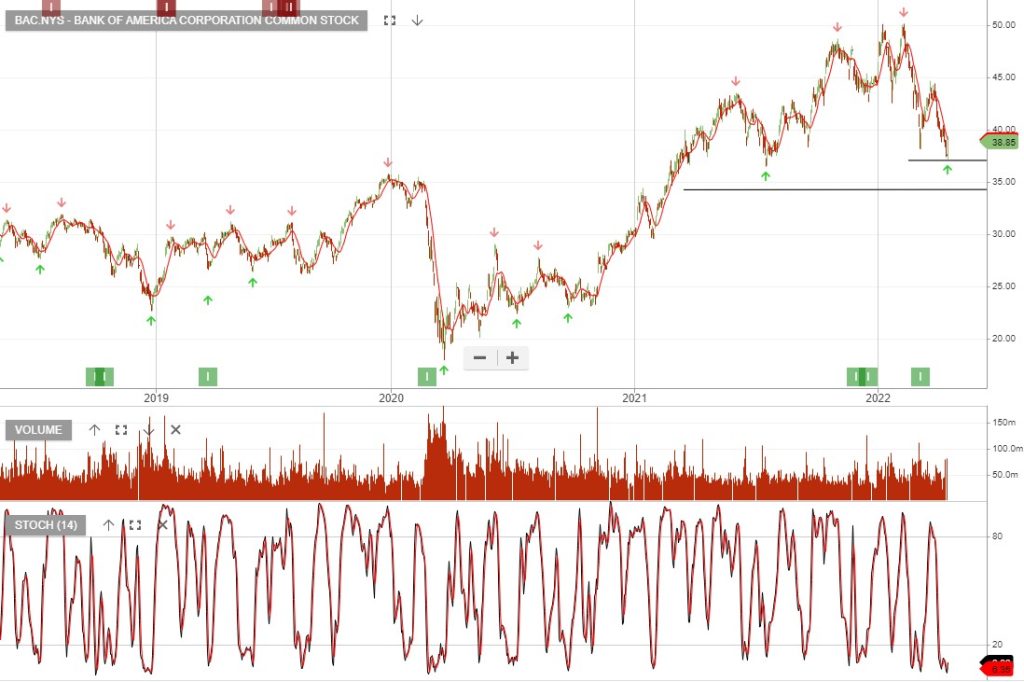

Bank of America – Algo Buy

Bank of America provided a bullish outlook after reporting a smaller-than expected 13% fall in first-quarter profit, as growth in consumer lending overshadowed a decline in global dealmaking.

The World Bank is reducing its global growth forecast for 2022 by nearly a full percentage point, to 3.2% from 4.1%, due to the impacts from Russia’s invasion of Ukraine, World Bank President David Malpass said.