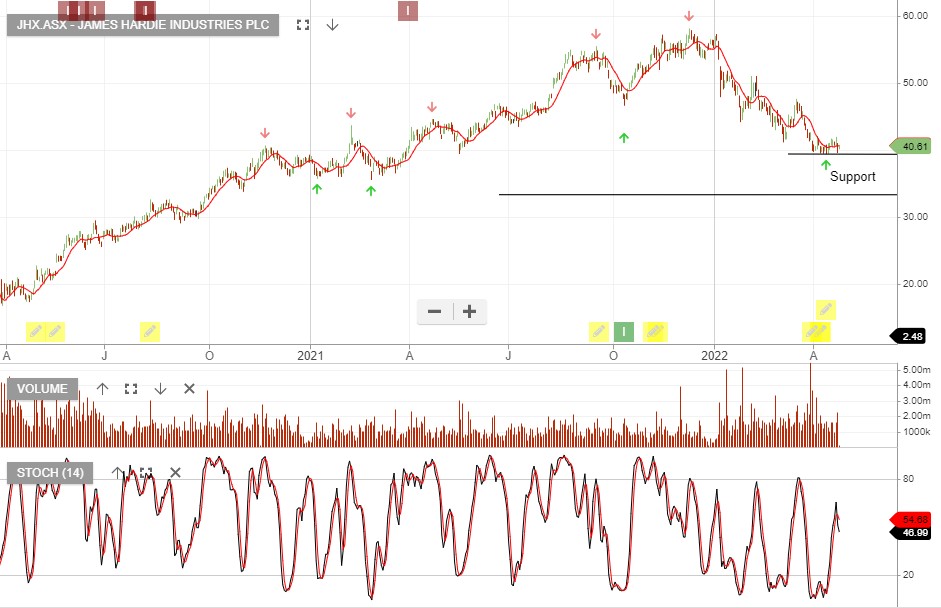

James Hardie – Add to Watchlist

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

ARB Corporation is under Algo Engin buy conditions.

ARB is Australia’s largest manufacturer and distributor of 4×4 accessories. They have a vast international presence, with offices in the USA, Europe and the Middle East, and an export network that extends through more than 100 countries around the globe.

28/4 update:

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

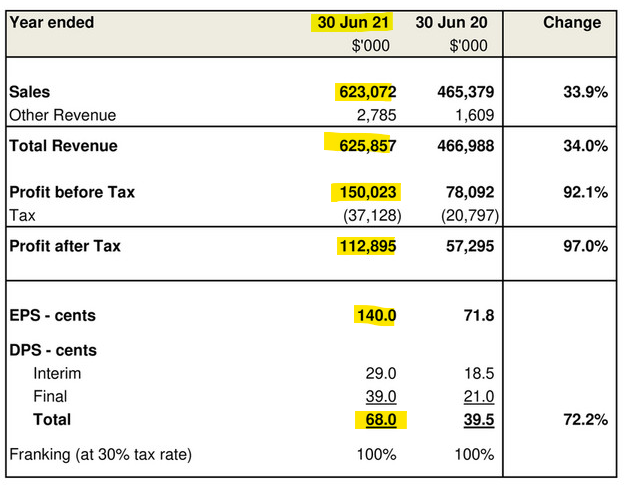

We’ve been waiting for an increase in positive pivot points to support our interest in short-term trade setups. The shift to a green arrow, (positive pivot point), combined with the primary Algo Engine buy signal is the pattern we tend to focus on when establishing short duration trades. i.e 7 to 21 days.

Referencing the initial display of the green arrow is the first indication that buying interest is beginning to rebuild. To put this into context, last week we had 2 out of 14 coins displaying the short-term setup, today we have 10 of the 14 coins.

To further filter the best trades from the 10 qualifiers, we tun to the stochastic oscillator to provide some discipline around the entry timing. Cosmos, Kadena and Oasis now meet our filtering process.

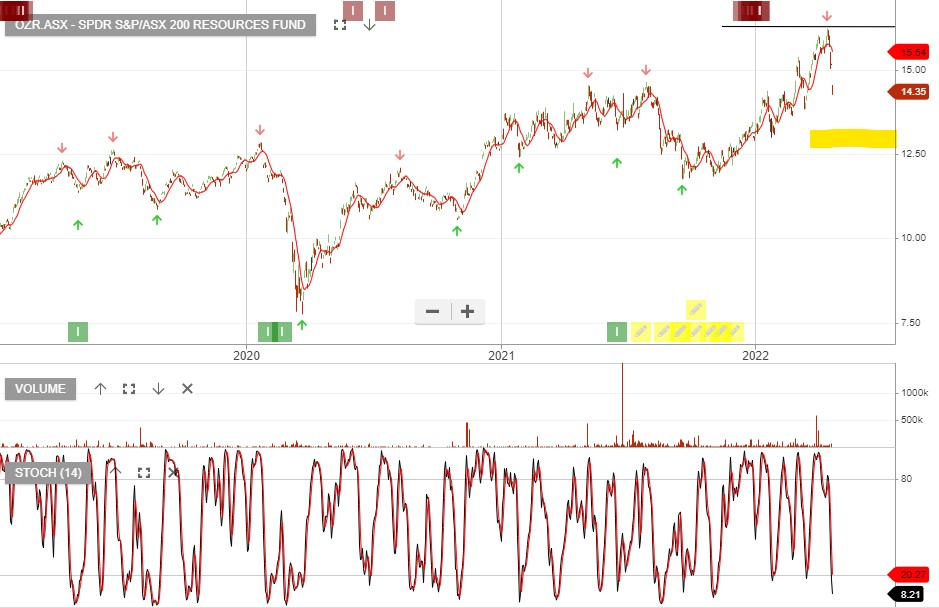

It’s important to begin building your list of potential buying opportunities and staying on the lookout for upcoming Algo Engine buy conditions. An example that we’ll look at in tonight’s webinar is the OZR Resources ETF.

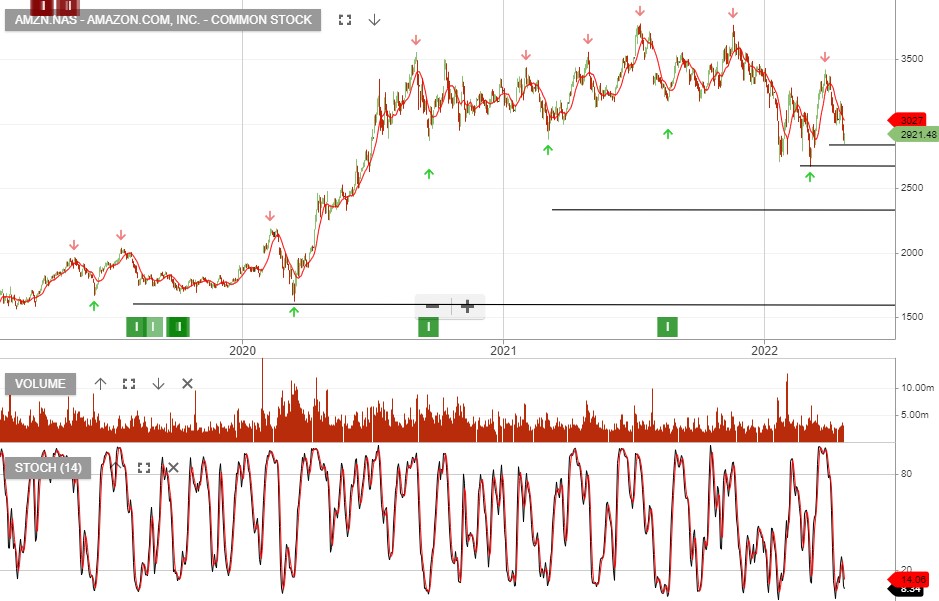

Tech giants will be pushed into the spotlight with Apple, Amazon, Microsoft, Alphabet, Meta Platforms, and Intel reporting this week.

Tuesday: Alphebet & Microsoft

Wednesday: Meta Platforms

Thursday: Amazon & Intel

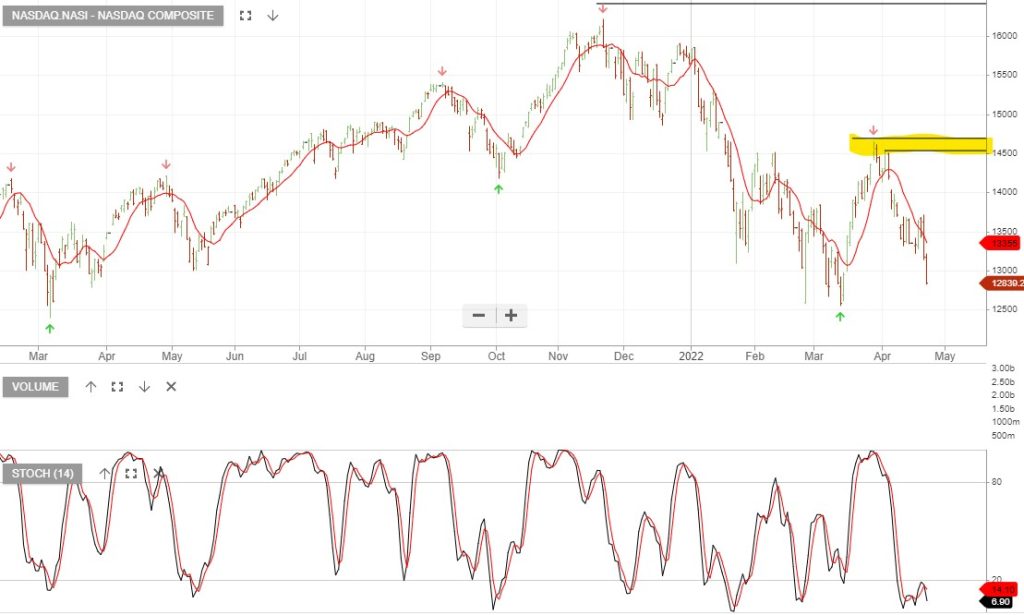

NASDAQ

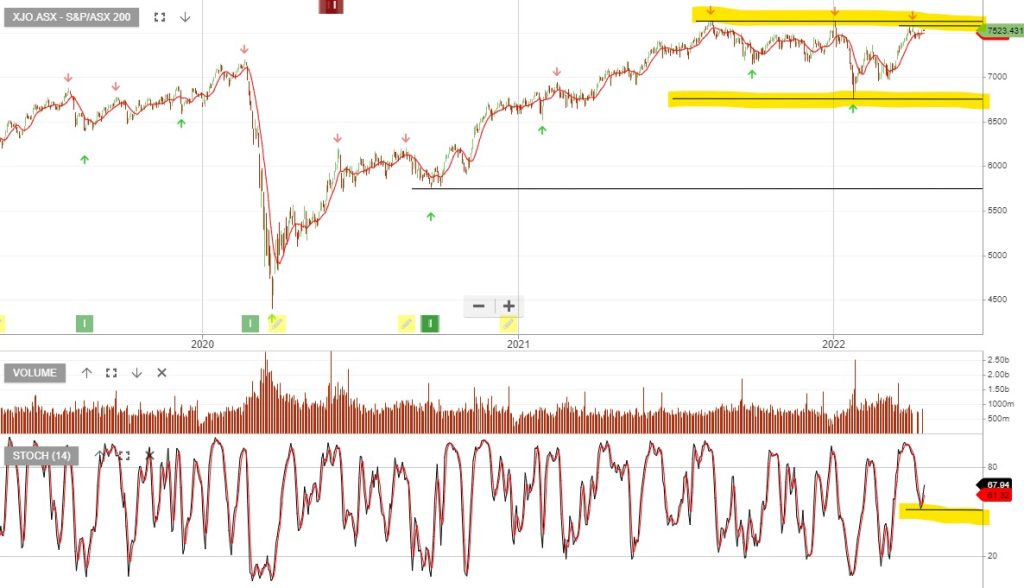

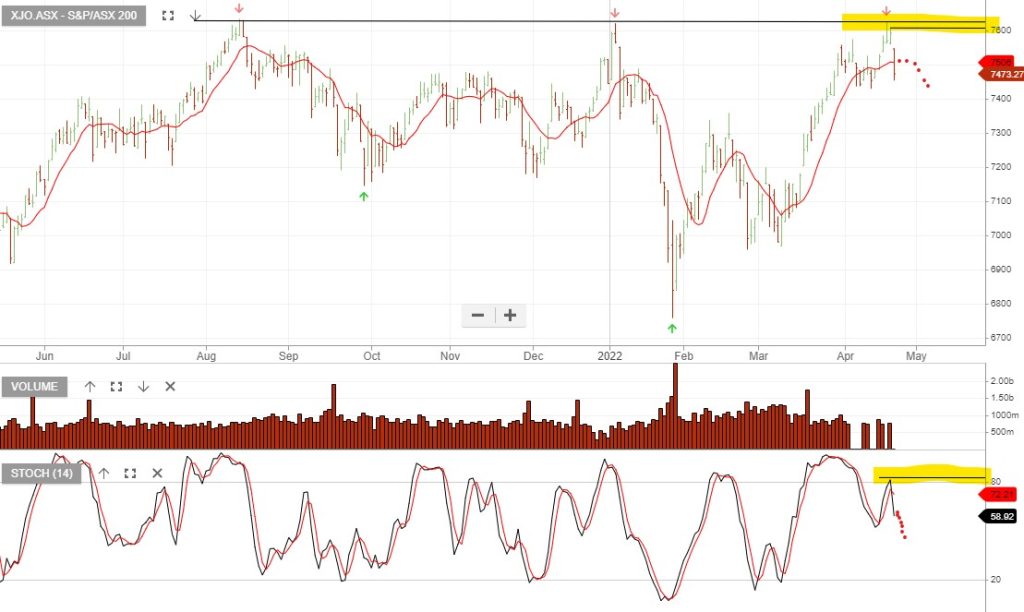

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

23/4/2022 Update:

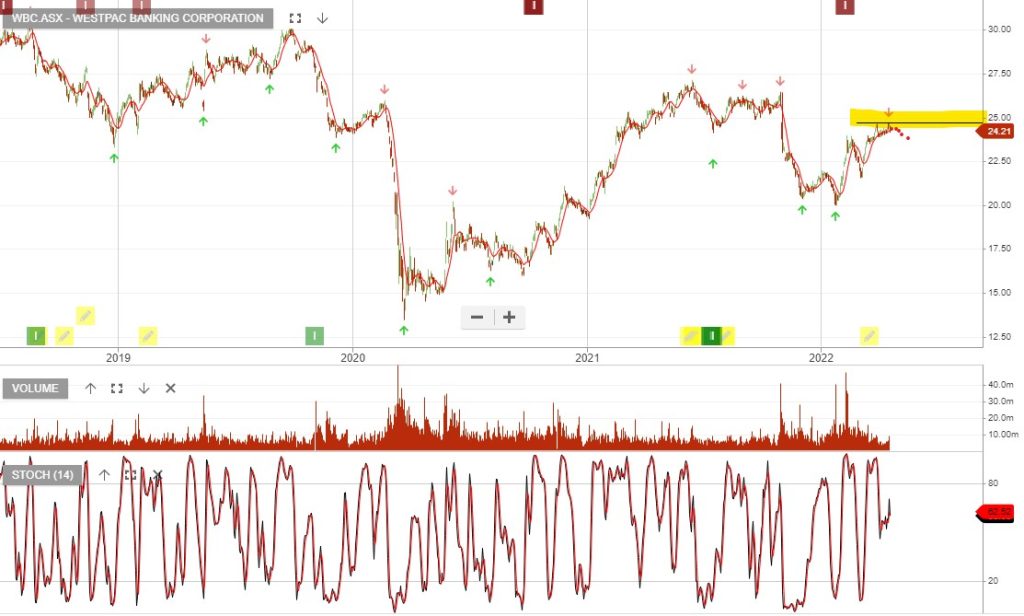

Westpac Banking is under Algo Engine sell conditions.

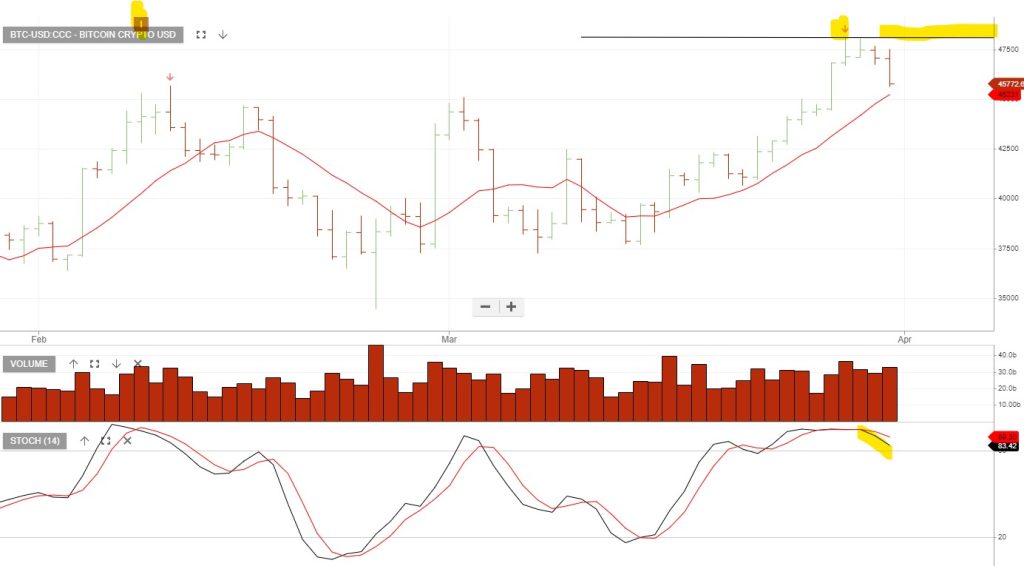

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

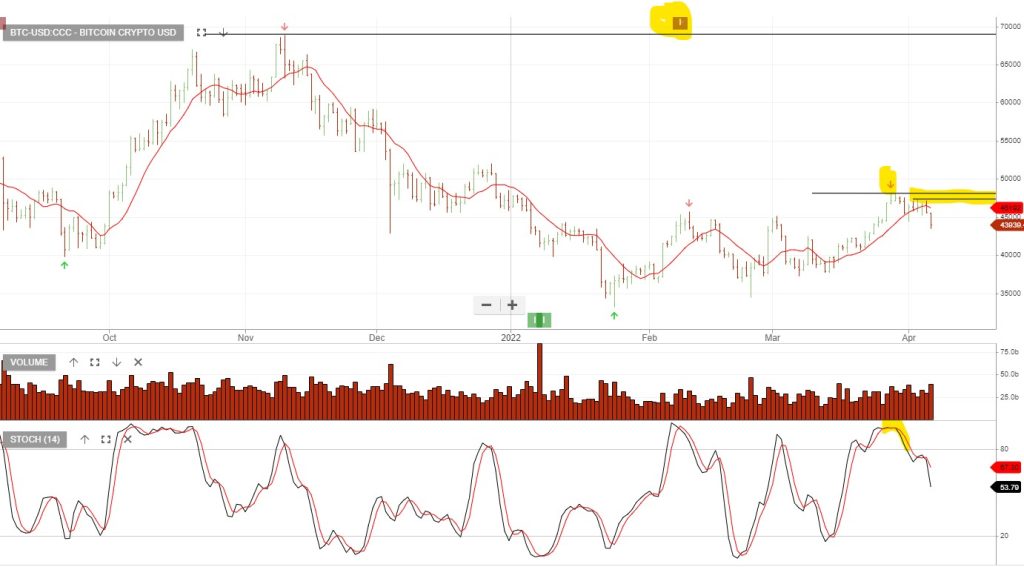

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

23/4/22 update: The NASDAQ continues to move lower reflecting a risk-off sentiment, which is also impacting Bitcoin. BTC is under Algo Engine sell conditions and we remain short Bitcoin futures as an open trade.

Or start a free thirty day trial for our full service, which includes our ASX Research.