US Retailers

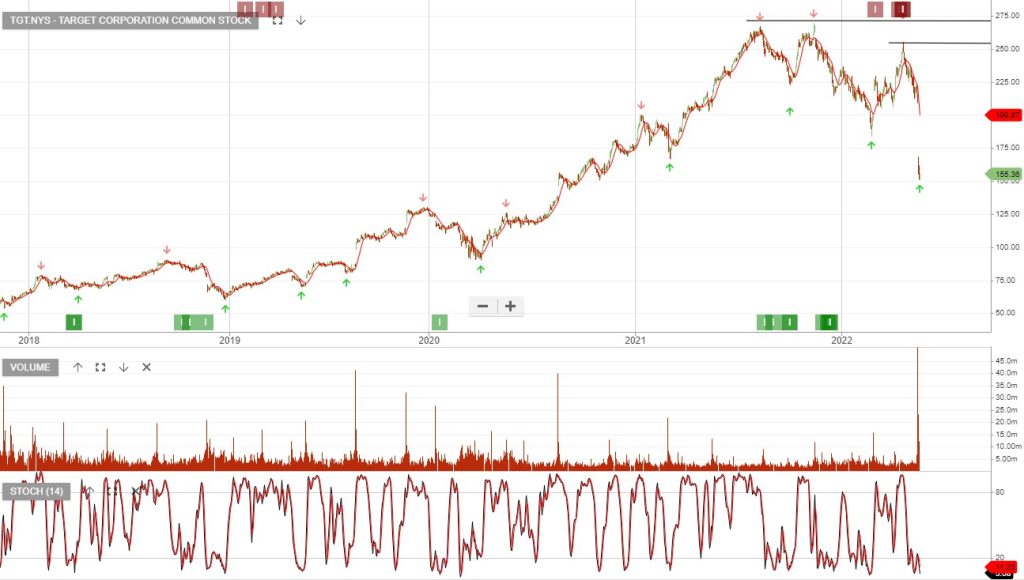

Investors will be watching the retail earnings following the weak results last week from Target and Walmart.

This week sees Costco, Best Buy, Advance Auto Parts, Nordstrom, Dick’s Sporting Goods and Macy’s as consumer-facing companies.

Investors will be watching the retail earnings following the weak results last week from Target and Walmart.

This week sees Costco, Best Buy, Advance Auto Parts, Nordstrom, Dick’s Sporting Goods and Macy’s as consumer-facing companies.

Nvidia’s results are due after market close on May 25. Revenue growth is anticipated to be 40%+ on the same time last year at $8.1bn.

Datacenter revenue should surpass the gaming segment revenue for the first time, driven by strong demand from hyper-scale data centers and AI.

The stock now trades 25x 2023 earnings.

Monday, May 23 – Zoom Video.

Tuesday, May 24 – Intuit

Wednesday, May 25 – Nvidia, Snowflake

Thursday, May 26 – Alibaba, Costco.

Friday, May 27 – Sanderson Farms, Canopy Growth Corporation.

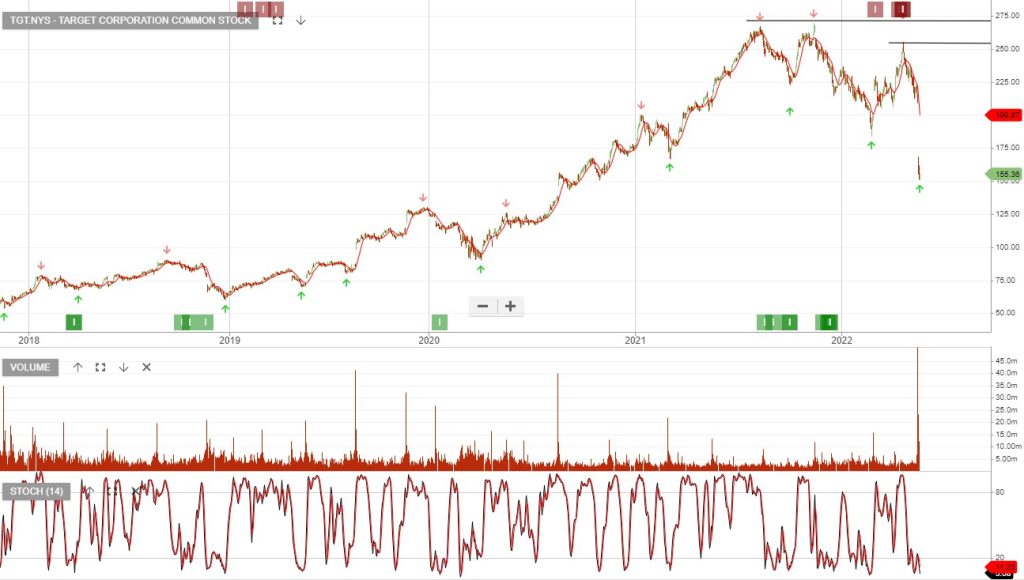

The S&P 500 PE ratio is now within historical norms, at 16.6x. It doesn’t make the S&P 500 cheap but fairly valued when using earnings estimates for 2022.

ASX:ALL} is under Algo Engine buy conditions.

ALL reported normalised 1H22 sales +23% to $2.74bn and EBITDA up +31% $970mn. The share price will remain well supported by the announced on market A$500 mn share buyback program.

FY23 revenue growth of 7% and EBITDA 10%+, places the stock on 17x forward earnings and a 2.2% yield

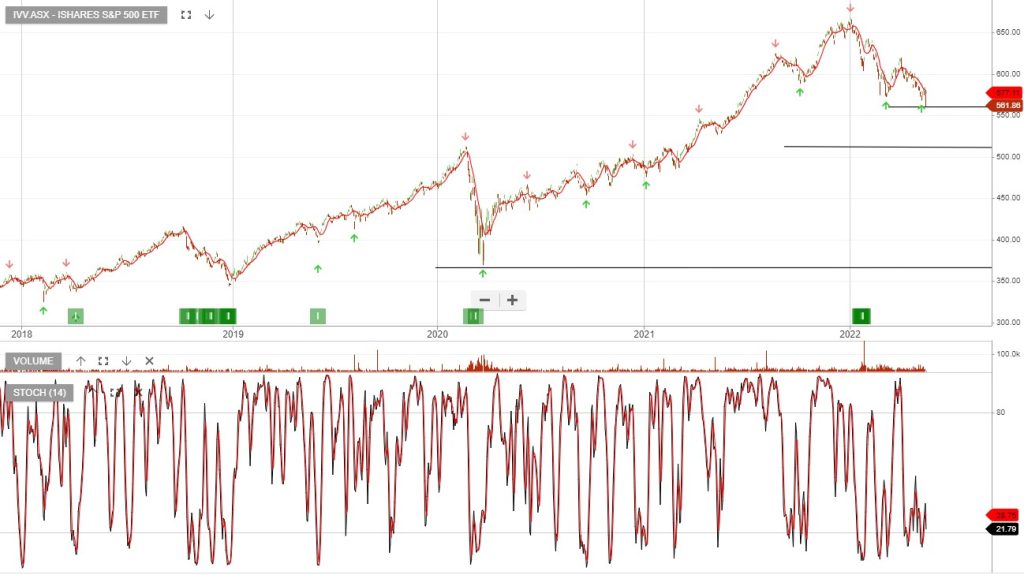

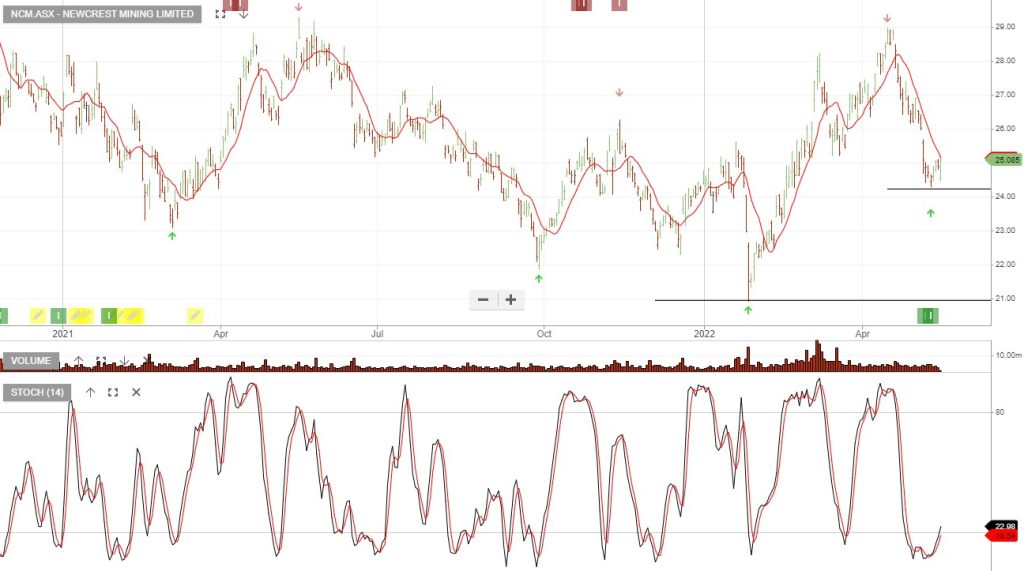

Newcrest Mining is under Algo Engine buy conditions.

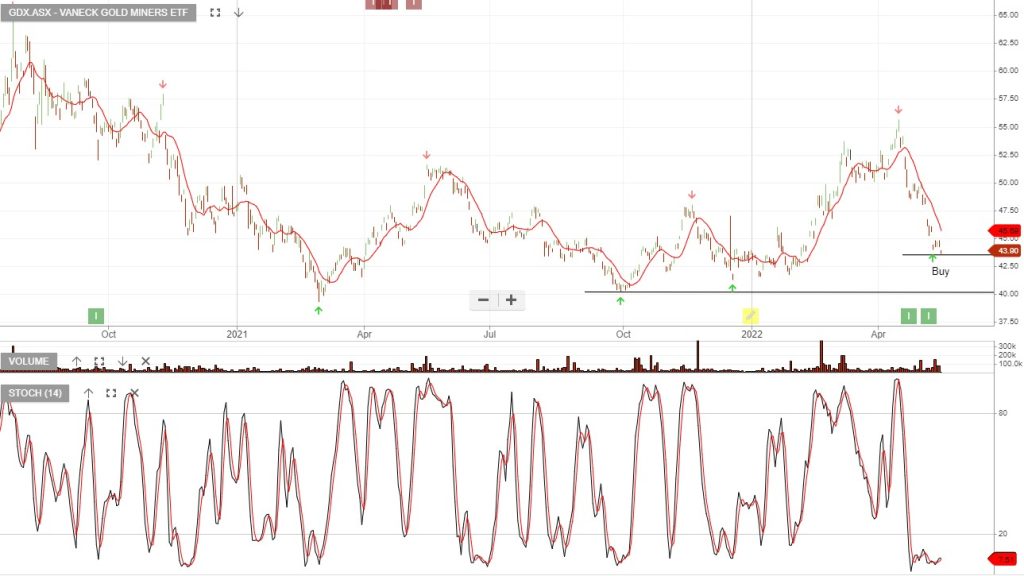

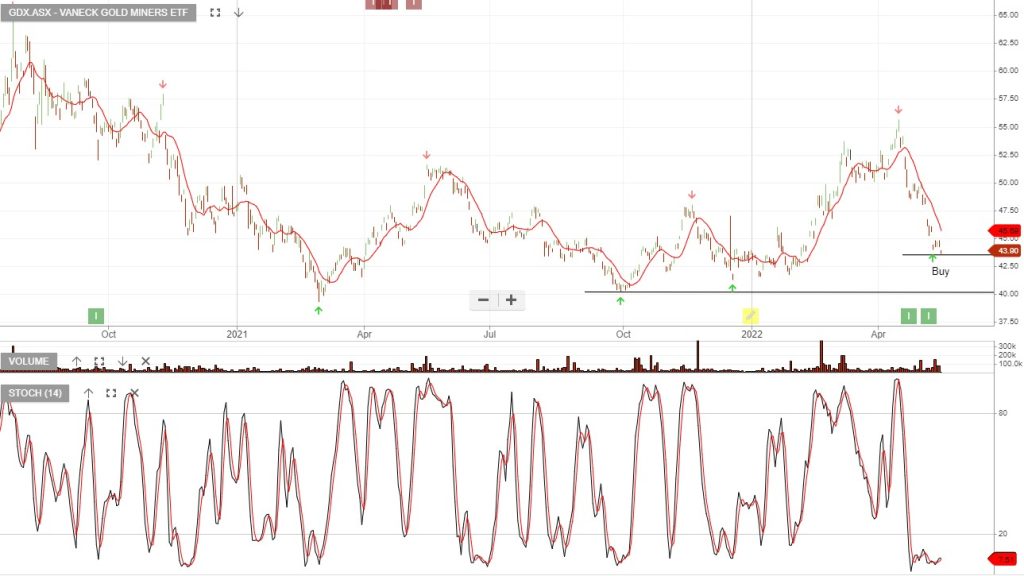

Vaneck Vectors Gold Miners is under Algo Engine buy conditions. GDX provides broad exposure to the leading global gold producers.

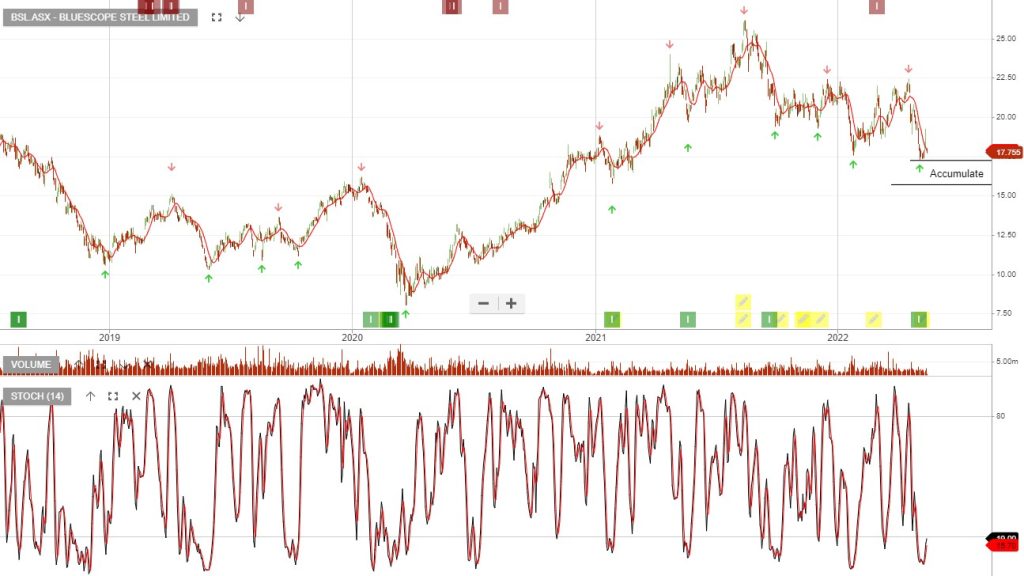

ASX:BL is under Algo Engine buy conditions. BSL provided a trading update and now expects EBIT for 2H FY22 to be $1.375-1.475bn.

The more robust outlook is driven by improved earnings expectations for North America with better-than-expected realised steel prices and spreads in the United States.

Based on FY23 earnings we have Bluescope on a 2.3% forward dividend yield.

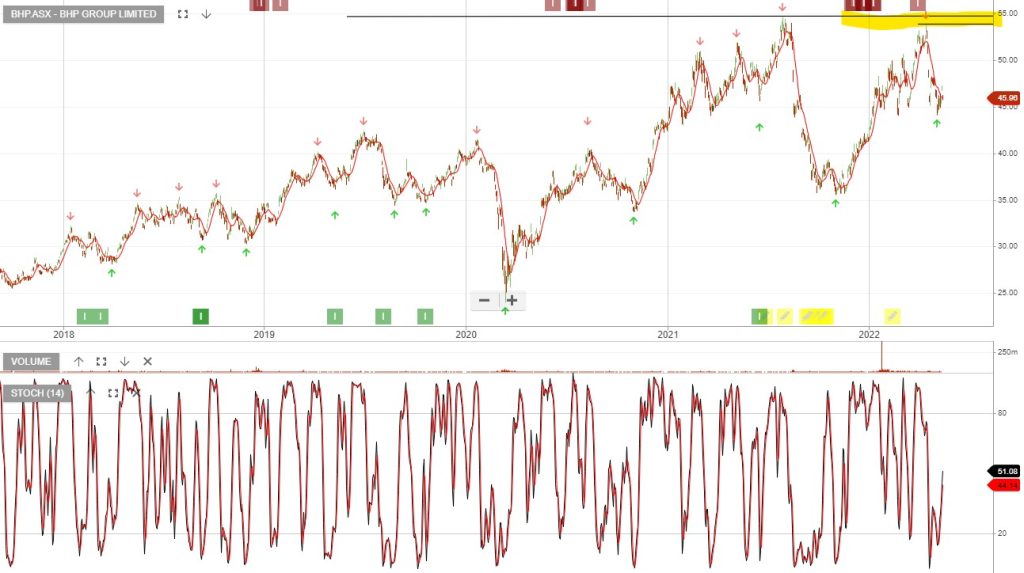

Future facing commodities, such as copper and nickel are well supported in BHP’s portfolio. BHP has the world’s largest copper resource and the second-largest nickel sulphide resource base globally.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions. GDX provides broad exposure to the leading global gold producers.

Or start a free thirty day trial for our full service, which includes our ASX Research.