Crypto Weekly Review

Crypto Weekly Review 31/5

Crypto Weekly Review 23/5

Crypto Weekly Review 10/5

Crypto Weekly Review 29/4

Crypto Weekly Review 20/4

Crypto weekly review 10/4

Crypto weekly review video 27/3

Crypto weekly review: 17/3

Watch Last Night’s Webinar

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

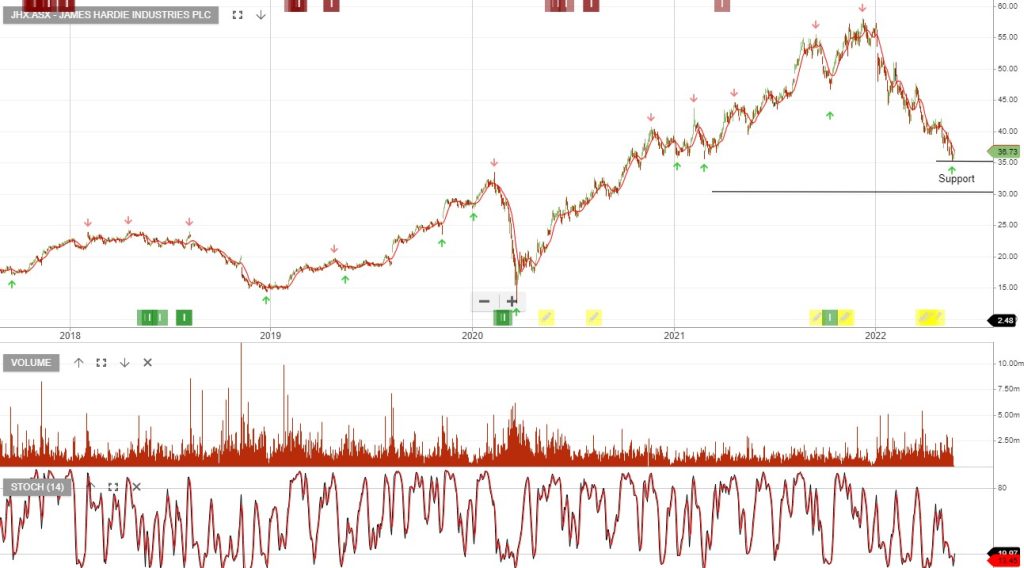

James Hardie FY23 Outlook

JHX reported FY22, with NPAT increasing by 36% to US$620m. While volumes generally slowed in recent months, FY23 NPAT guidance is maintained at US$750-800m.

Based FY23 earnings we have JHX trading on a forward yield of 3.8%.

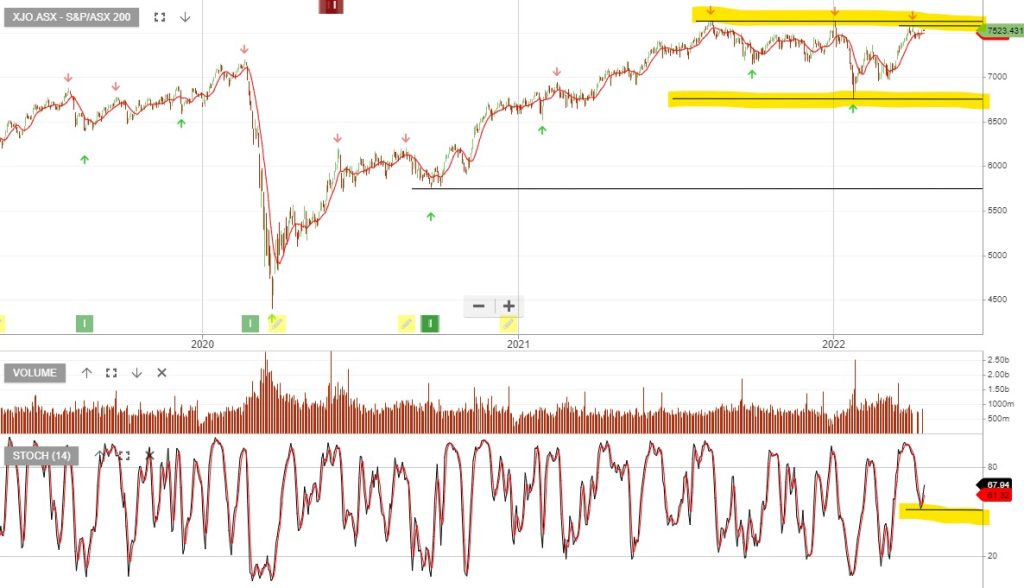

XJO – Chart Review

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

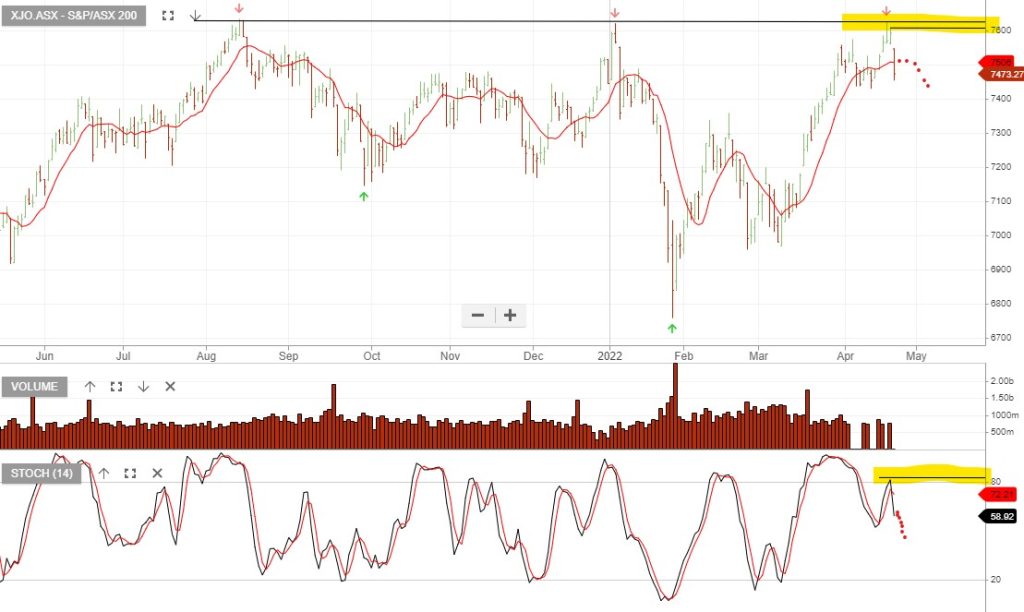

23/4/2022 Update:

Update 14/5

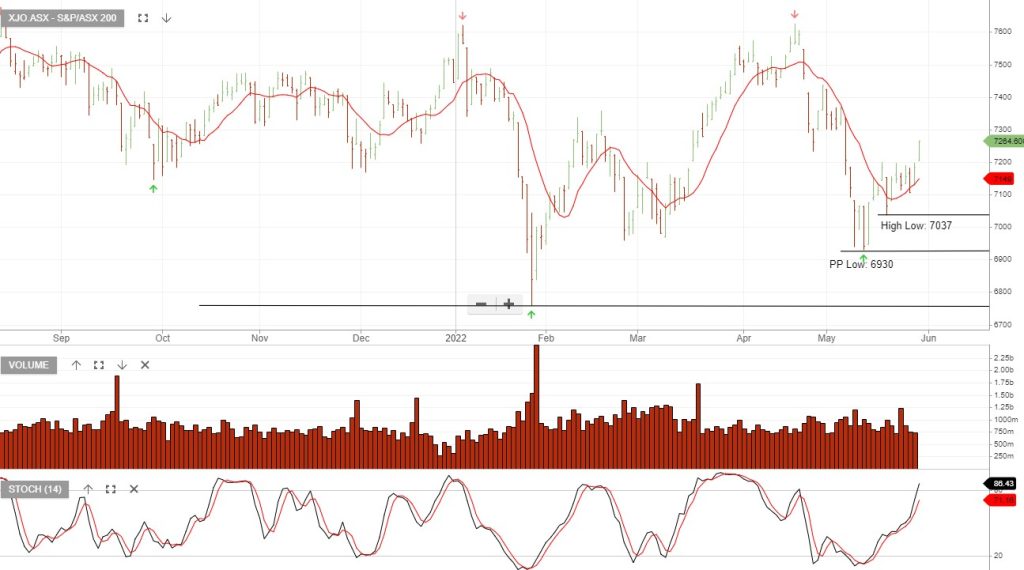

30/5 update:

Bluescope Steel – Algo Buy

ASX:BL is under Algo Engine buy conditions. BSL provided a trading update and now expects EBIT for 2H FY22 to be $1.375-1.475bn.

The more robust outlook is driven by improved earnings expectations for North America with better-than-expected realised steel prices and spreads in the United States.

Based on FY23 earnings we have Bluescope on a 2.3% forward dividend yield.

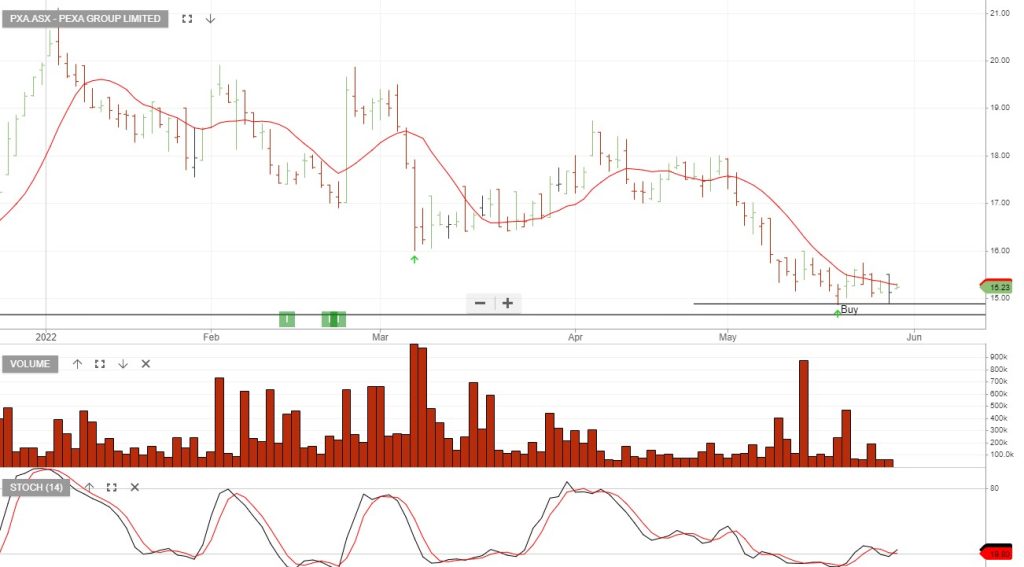

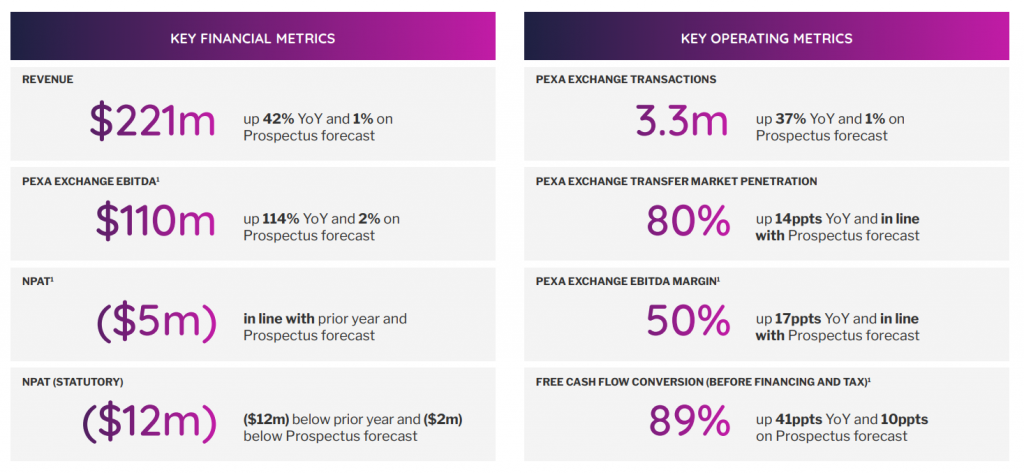

Pexa – Accumulate

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one.

FY21 underlying earnings doubled to $110 million and analysts are forecasting a further 20% increase in FY22.

CBA & Link are major shareholders.

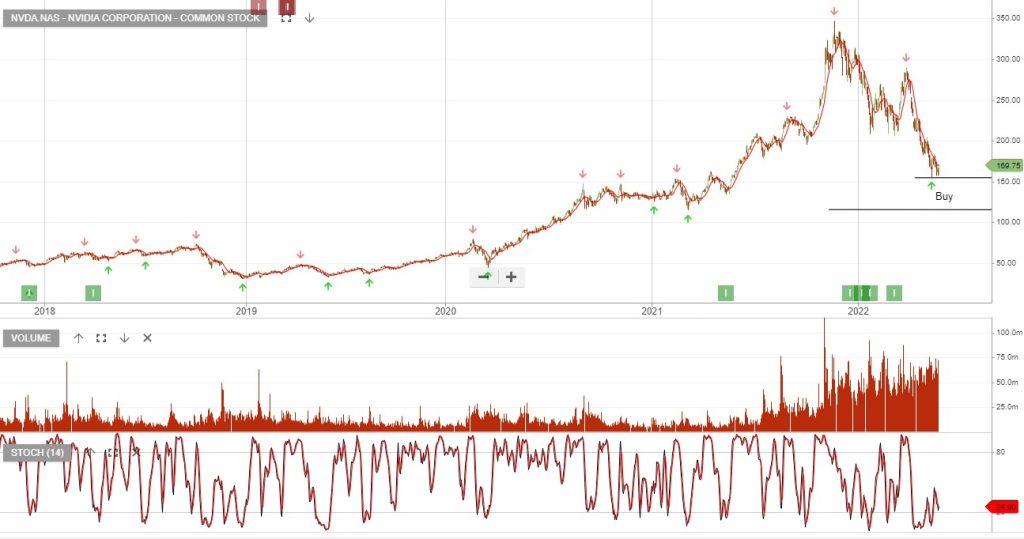

Nvidia – Q1 Earnings

Nvidia will slow down its hiring pace and control expenses as the company deals with a challenging macroeconomic environment. Revenue for the March quarter came in at $8.29bn on EPS of $1.36.

Forecast revenue for the June quarter is expected to be $8.1 billion.

The company’s operating expenses increased 35% year-over-year. On the positive side, demand for its graphics processors used for gaming and artificial intelligence helped support sales growth of 46% year-over-year. Nvidia’s data center business, which sells chips for cloud computing companies and enterprises, grew 83% annually to $3.75 billion.

Nvidia said its board has authorized an additional $15 billion in share buybacks through the end of next year.

BHP

Rebasing investor expectations for BHP without the contribution from its petroleum business places the stock on a forward yield of 6% with flat to lower adjusted EPS into FY23.

Iron ore now represents around 50%, Copper 25%, with Coal and Nickel remaining other key exposures. We expect the eventual divestment of its remaining thermal coal assets.

Fisher & Paykel

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and we expect FY22 to be the low point in earnings, with FY23 and FY24 returning to double-digit EPS growth.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.