Keep Transurban On Your Radar

Shares of TCL have dropped about 10% over the last month since announcing a $4.8 billion capital raising related to the WestConnex project.

The share price suggested has been $10.80, which is just 10 cents below last Thursday’s intra-day low.

From a broader perspective, we believe the 25.5% ownership of the WestConnex project will underscore TCL’s status as Australia’s dominate toll road operator, support future cash flow and secure their dividend growth.

We don’t currently have an ALGO buy signal for TCL, but would not be surprised to see one soon.

Our medium-term target for TCL is in the $13.00 area.

Transurban

Lend Lease

Lend Lease

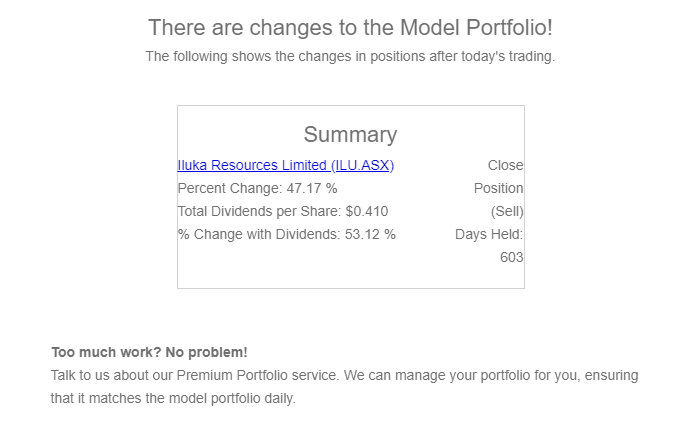

Iluka Resources

Iluka Resources

Aristocrat Leisure

Aristocrat Leisure