Treasury Wine Estates has been in acquisition talks over the past week with premium winemaker, Robert Mondavi, in the United States

Robert Mondavi Wines, which celebrated its 50th anniversary last year, was bought by beverage giant Constellation Brands for about $US1 billion in 2004.

While it is unclear how progressed the talks with Treasury are, there’s no question that Robert Mondavi would be an excellent fit. The company has plenty of contracted grape supply in the ultra-premium Napa Valley wine region.

Shares of TWE found support just above $13.50 and closed the week 2.5% higher at $14.08.

We see scope for reasonable price appreciation in TWE above $14.50 and will look for an ALGO buy signal at lower levels.

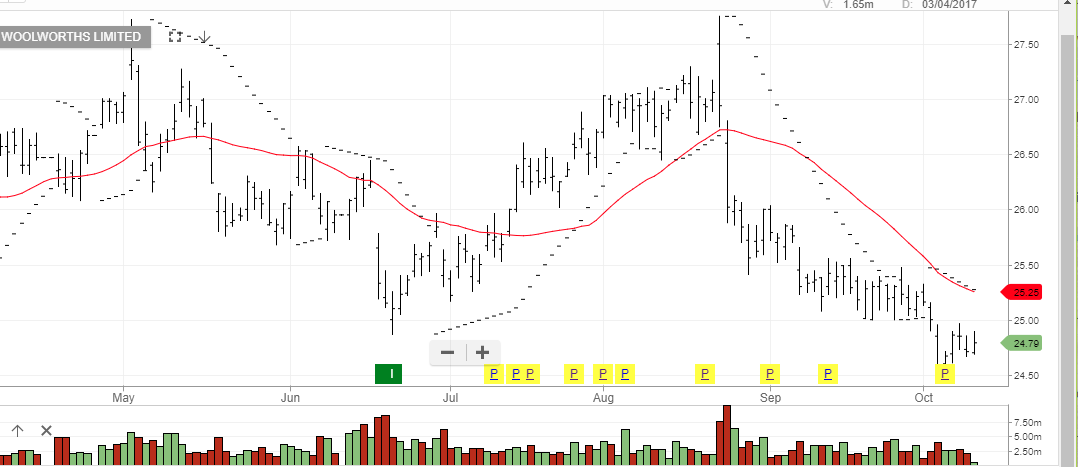

Treasury Wine Estates

Treasury Wine Estates

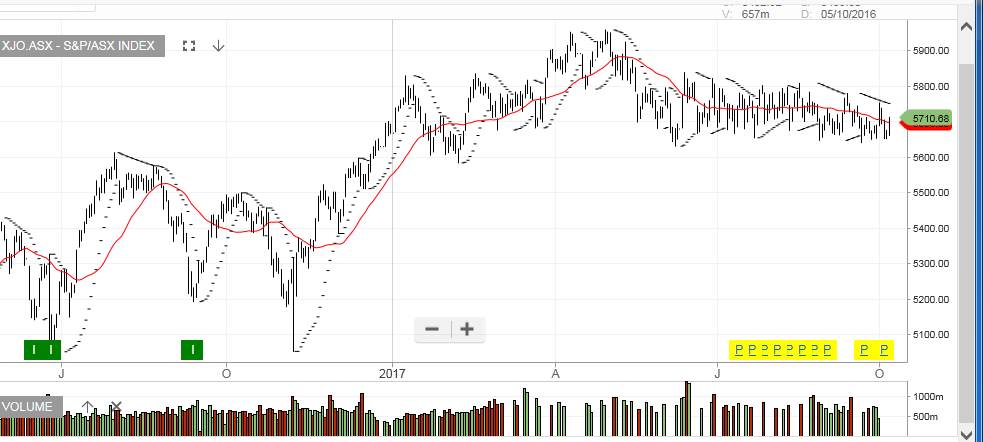

XJO 200 Index

XJO 200 Index Oil Search

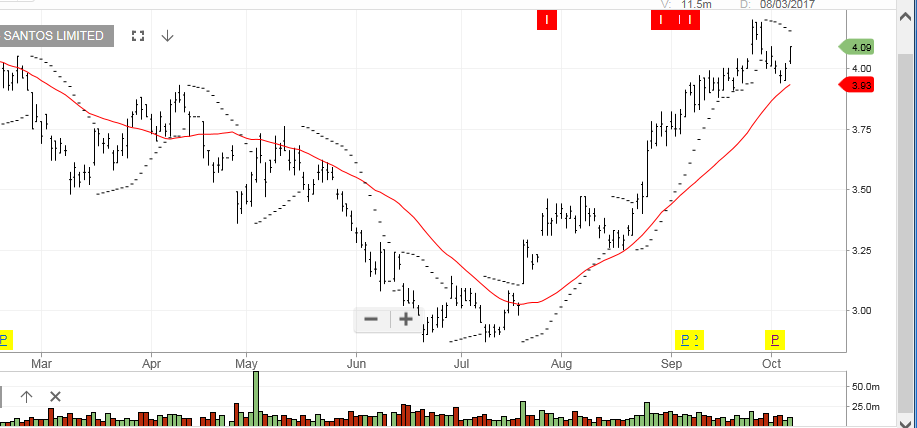

Oil Search Santos

Santos