Telstra Chairman Connects With Shareholders At AGM

During the recent AGM, Telstra chairman John Mullen covered many topics including market penetration to the NBN.

However, what shareholders were most interested in hearing was that the 22 cent dividend would be a low as it would go and, if anything, will be increased.

Shares of TLS have been beaten down pretty hard since trading over $5.00 earlier this year. In our view there is plenty of pessimism priced into the stock.

TLS is the dominant player in the domestic telecom industry, with strong brand recognition and a network quality advantage which underpins a 49% subscriber advantage.

The stock currently trades on a P/E of 10X and hasn’t been this fundamentally cheap since 2010, when base interest rates were 5.5%.

It’s our view that TLS offers good value at current levels and we have a medium-term price target of $4.15.

Telstra

Telstra

Coca-Cola Amatil

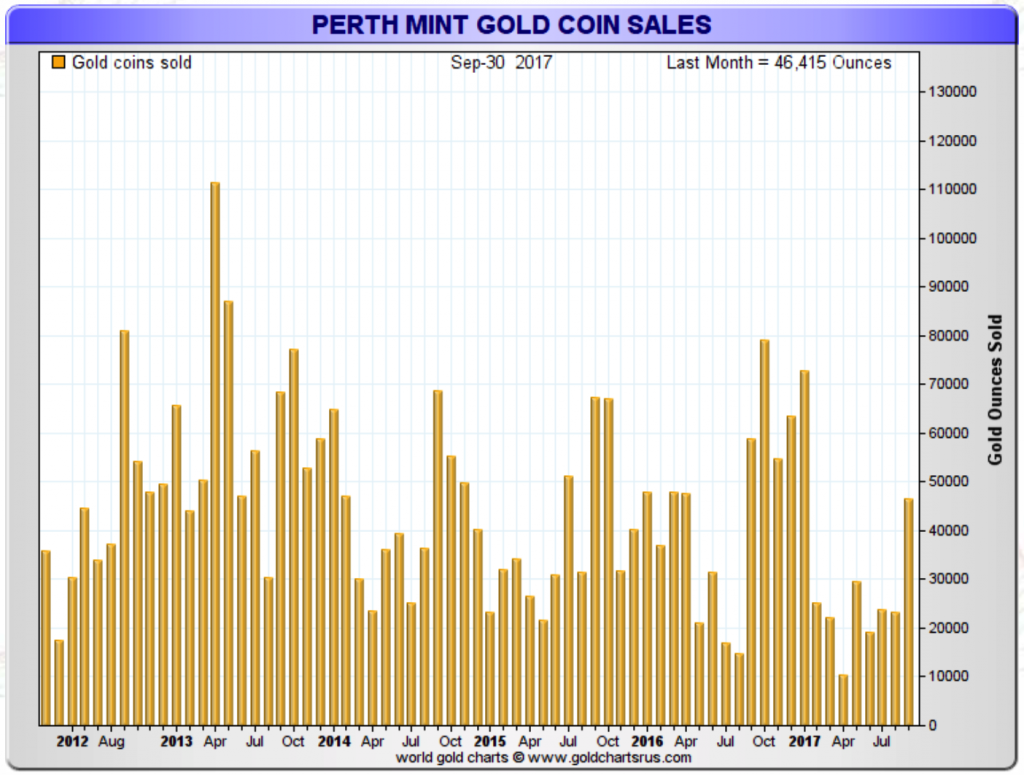

Coca-Cola Amatil Perth Mint Gold Coin Sales

Perth Mint Gold Coin Sales