ETF UPDATE: Aussie Dollar Hits 4-Month Low

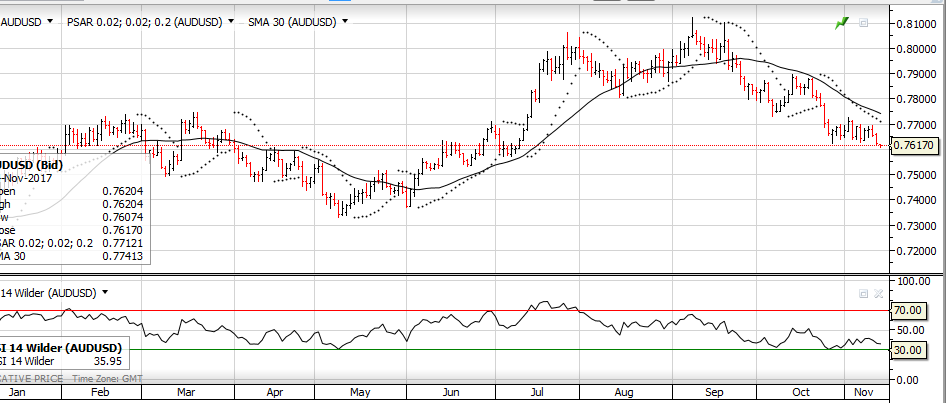

The AUD/USD has broken down to a 4-month low as local political turmoil combined with general US Dollar strength has the Aussie close to breaking the .7600 support area.

Softer import data from China and dovish comments from the RBA have also triggered investors to exit long AUD positions.

Internal momentum indicators are pointing lower with the next key support level in the .7540 area.

Investors looking to profit from a lower AUD/USD can buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the price of YANK increases as the AUD/USD trades lower. It also has a weighting of 2.5%, which means the unit price will fluctuate by 2.5% for every 1% change in the AUD/USD exchange rate.

With a current price of $13.85, we calculate that the price of YANK will be near $16.50 as the AUD/USD returns to the January low of .7160.

Aussie Dollar

Aussie Dollar

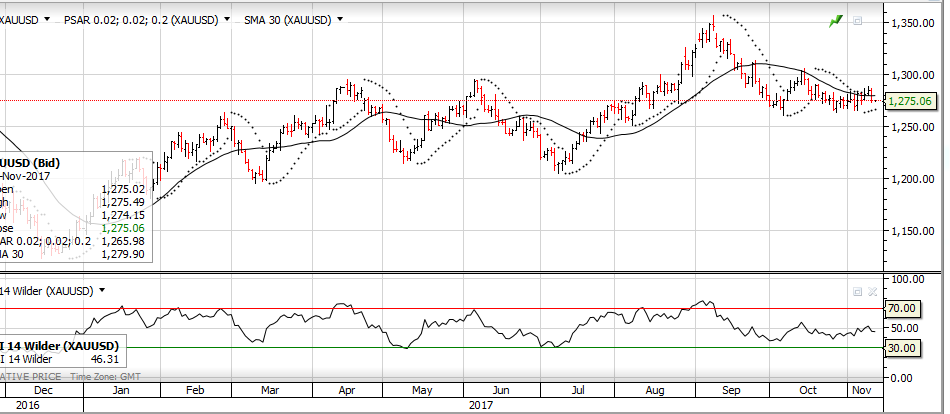

Spot Gold

Spot Gold

Newcrest Mining

Newcrest Mining AUD/ USD

AUD/ USD WTI Crude Oil

WTI Crude Oil Ramsay Health Care

Ramsay Health Care Amazon

Amazon