Gold Tops $1300.00 To End The Year

What looked like a price meltdown two weeks ago has turned into a powerful 6% rally that is now attempting to take out key resistance at $1312.

Gold has rallied 11 of the last 13 sessions and has closed above $1300 for the first time in three months.

Our technical view is that the $70.00 rally from $1236 looks more like a short squeeze and much of the buying is from those who got too aggressive going down, with shorts being forced to cover.

Although we are longer-term bullish, at $1307 with the speed and parabolic angle of this rally, we believe a pullback into the $1285 level is a reasonable area to buy.

We added NCM to our Top 50 model Portfolio on December 13th at $22.10.

And while the internal momentum indicators for NCM are not as stretched as they are for Spot Gold, a range trade between $23.50 and $22.60 is possible for this week.

A close above the December 5th high of $23.60 would confirm NCM shares are breaking back into a new, higher trading range.

Newcrest Mining

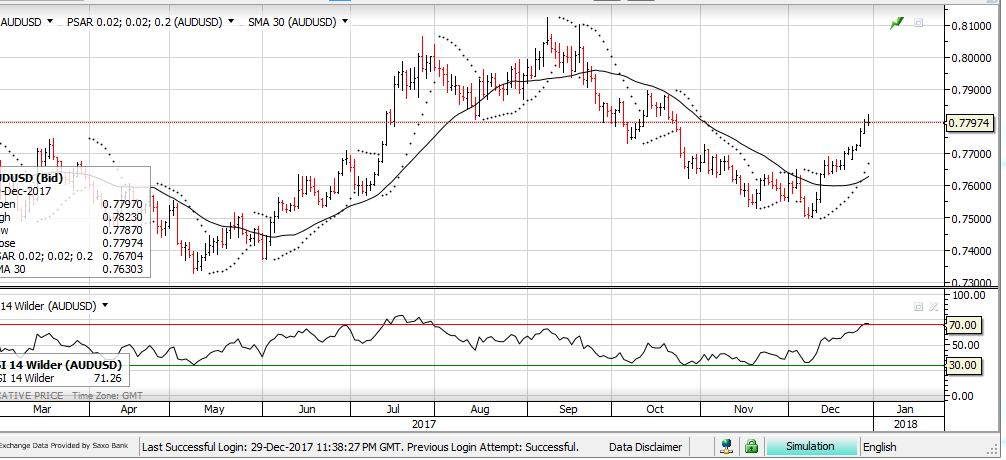

Aussie Dollar

Aussie Dollar

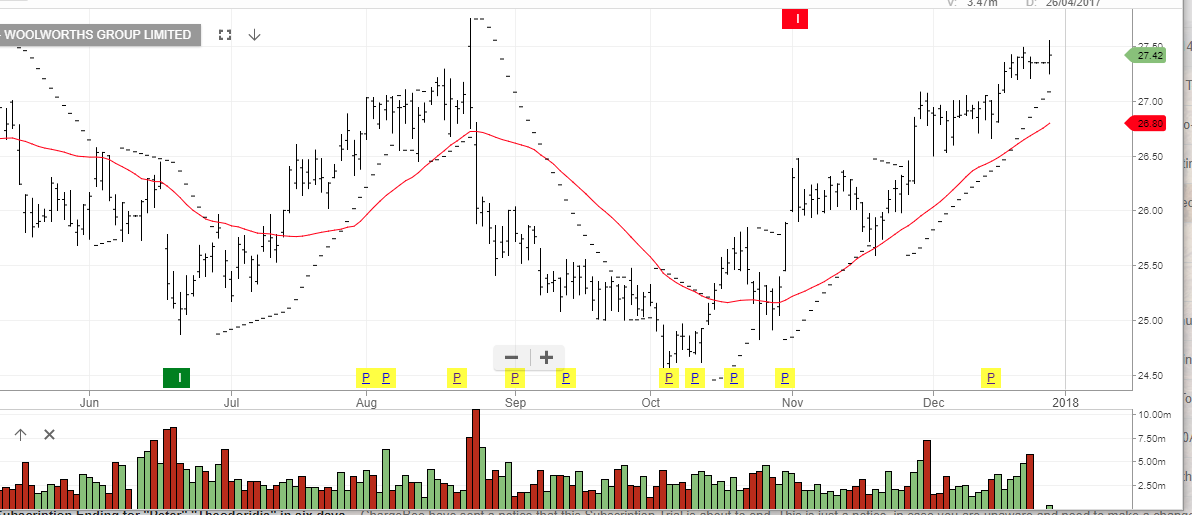

James Hardie

James Hardie