Over the last 4 years, the ability of G-10 Central bankers to drive financial markets has risen to historic levels.

A perfect illustration of this dynamic was yestrday’s sharp sell-off in the USD after comments from US Treasury Secretary Steven Mnuchin at the World Economic Forum in Davos.

The USD Index fell over 1% and posted a 3-year low after Mr Mnuchin said:

“A weaker dollar is good for us as it relates to trade and opportunities. Longer term, the strength of the dollar is a reflection of the strength of the US economy and that it is, and will continue to be, the primary reserve currency.”

It’s important to note that while the Yen, Sterling and EURO were all stronger against the USD, their domestic stock markets were all down over 1% on the day.

A policy meeting for the ECB is scheduled for later today. The EUR/USD has risen over 5% since the last ECB meeting in December.

It’s reasonable to expect ECB chief Mario Draghi to talk the EURO lower, which could mark a significant inflection point for the USD versus the other G-10 currencies, including the AUD.

The AUD/USD has gained more than 7% since mid-December. And while the RBA has not openly commented about the value of the AUD recently, they have been clear in their policy statements that a rising AUD is a “headwind” to domestic growth.

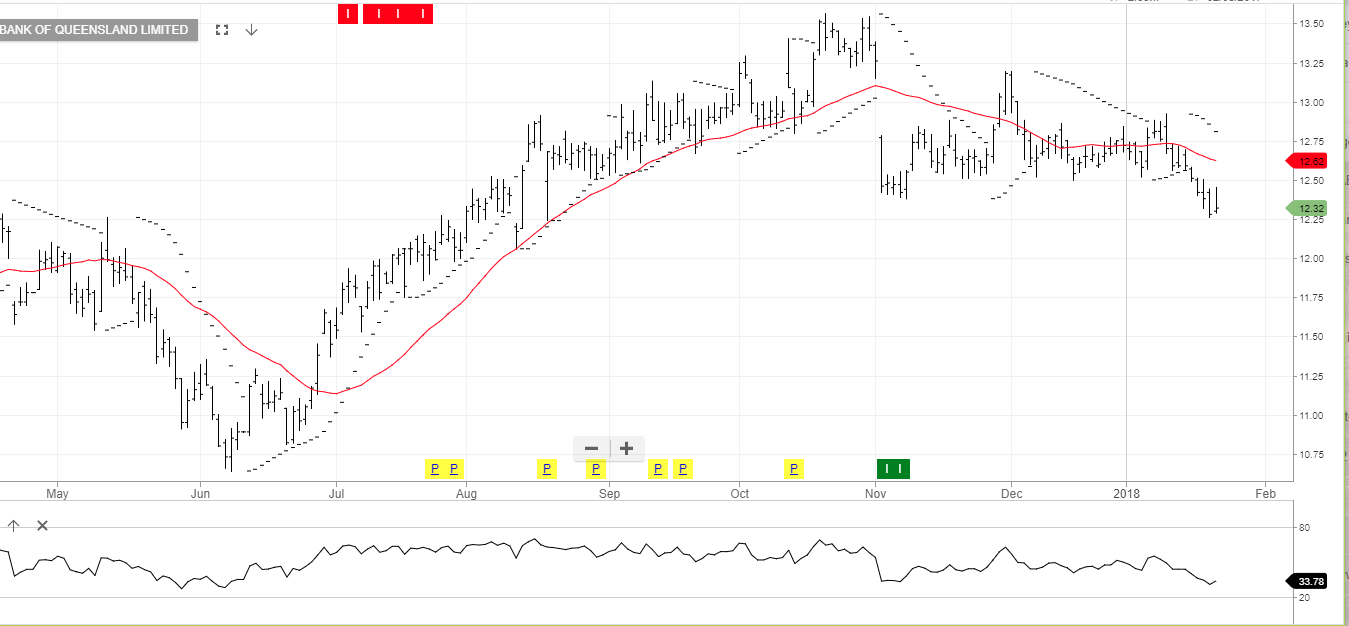

Investors who want to profit from a lower AUD/USD can look to buy the BetaShare YANK ETF. YANK is an inverse ETF with a 2.5% weighting. This means that the share price of YANK will increase by 2.5% for every 1% fall in the AUD/USD.

With the YANK currently priced around $12.20, we estimate the share price to rise to $16.40 when the AUD/USD reaches .7150.

Call in for more information about YANK and the other ASX listed ETFs.

BetaShare ETF: Yank

BetaShare ETF: Yank

QANTAS

QANTAS Oil Search

Oil Search

BetaShare ETF: Yank

BetaShare ETF: Yank

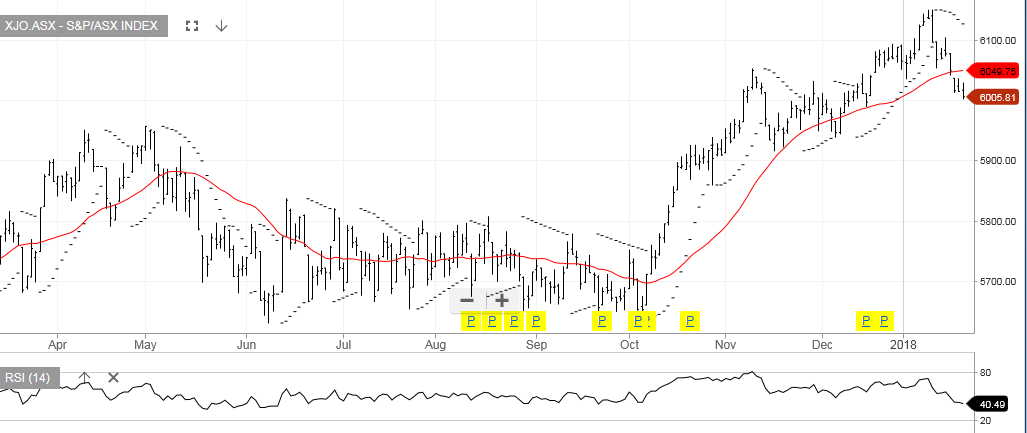

XJO Index

XJO Index