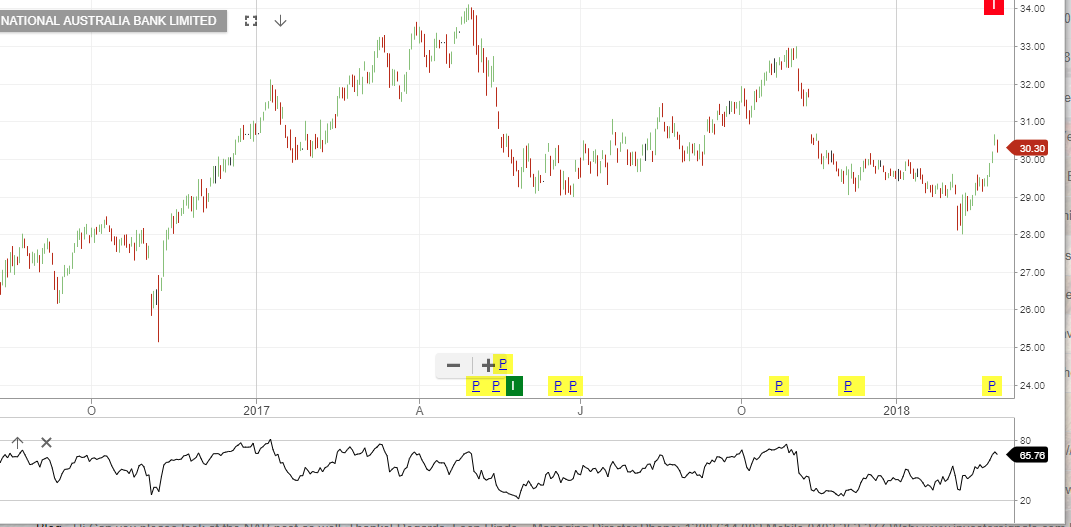

ALGO Sell Signal For NAB

Our ALGO engine triggered a sell signal for NAB into yesterday’s ASX close at $30.40.

This “lower high” pattern is relative to the November 8th high of $31.85.

NAB posted an 18-month low of $28.05 on February 8th. The banking sector, in general, has had a respectable recovery over the last three weeks.

However, the internal momentum indicators now suggest that the local banking names will trade lower over the near-term, taking out the February lows.

NAB

Telstra

Telstra Bank of Queensland

Bank of Queensland

Westfields

Westfields