OSH Nears Resistance at $7.90

The price of West Texas Intermediate Crude Oil (WTI) posted its largest weekly advance in over four years.

The 9% gain for the week in WTI also lifted the local oil names, including OSH, STO and WPL

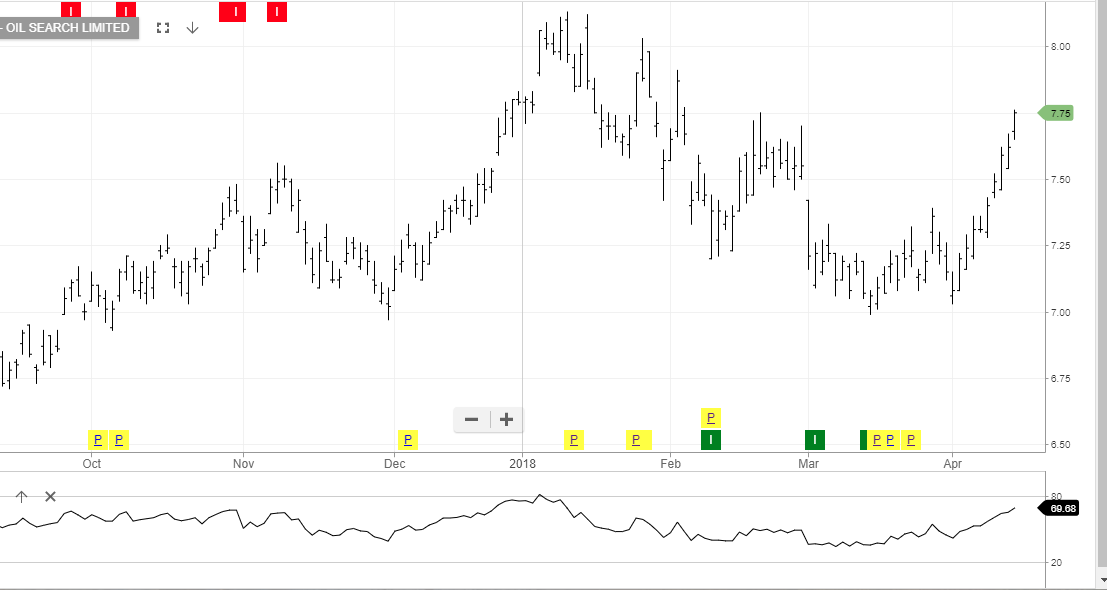

Our ALGO engine triggered a buy signal in OSH on February 13th at $7.10.

At the time, our initial upside target was at $7.70.

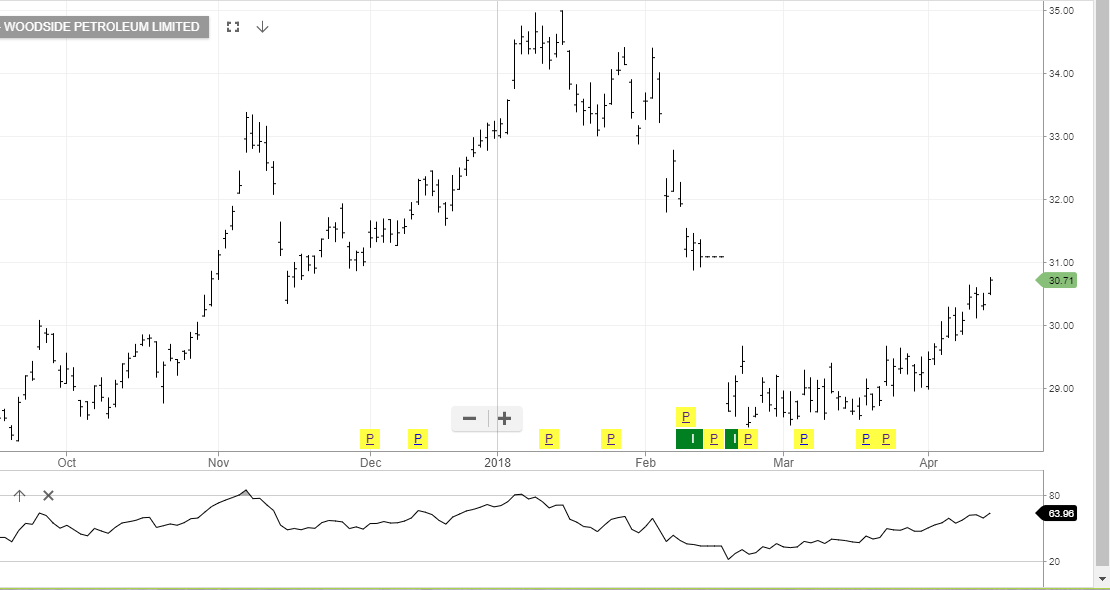

With today’s high posting of $7.75, We can see the logic in taking profits in OSH and rotating into WPL.

Taking into account the sharp selloff after announcing a capital raising on February 2nd, we consider WPL a better long-term value in the oil sector.

Oil Search

Woodside Petroleum