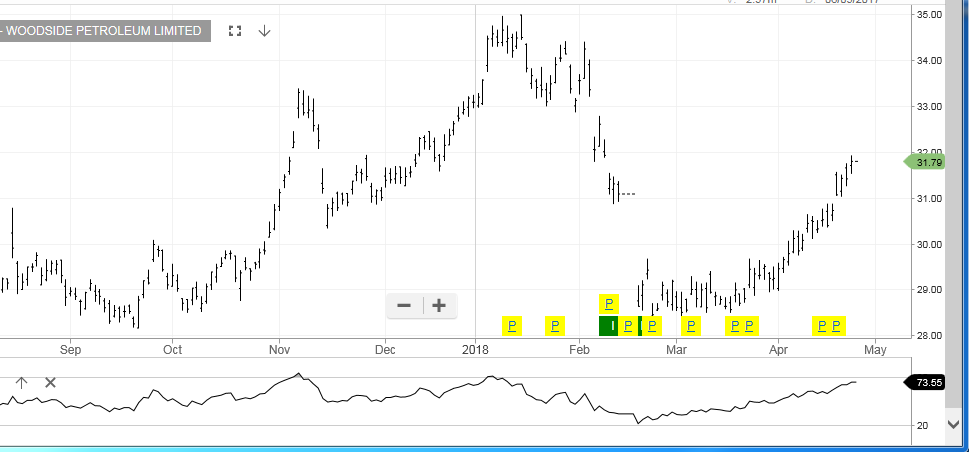

ALGO Sell Signal For Woodside Petroleum

Our ALGO engine triggered a sell signal in WPL into the ASX close yesterday at $32.20.

This corresponds to the ALGO buy signal triggered on February 20th at $29.10. Investors who followed this trade would have gained over 10% on the trade.

As noted in previous postings, the WPL share price is closely correlated to the price of WTI crude oil, which has been trading near 4-year highs over $68.00 per barrel.

Recent increases in crude oil supplies have been offset by political tensions in the Middle East, which have kept oil prices buoyant.

We believe that WPL shares are overbought and susceptible to trading lower along with spot crude oil prices. As such, we suggest exiting long WPL positions near the $32.35 level.

Woodside Petroleum

Woodside Petroleum

WTI Crude Oil

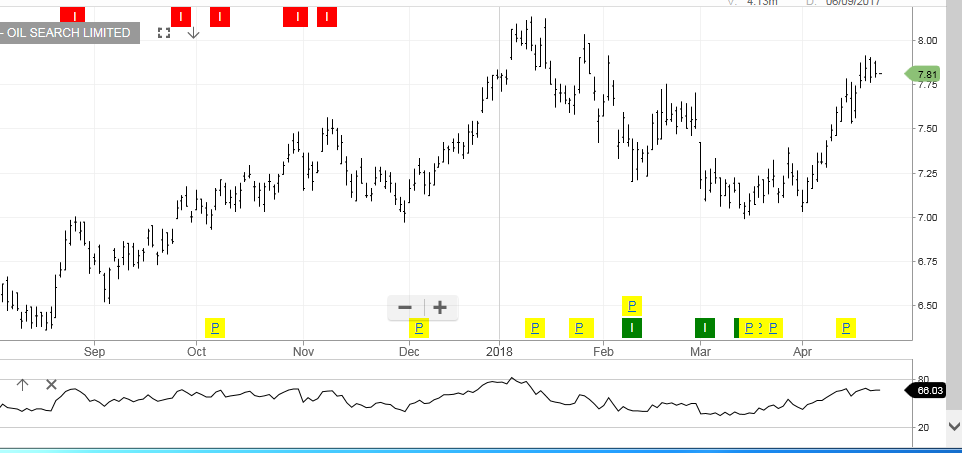

WTI Crude Oil Oil Search

Oil Search Woodside Petroleum

Woodside Petroleum Santos

Santos

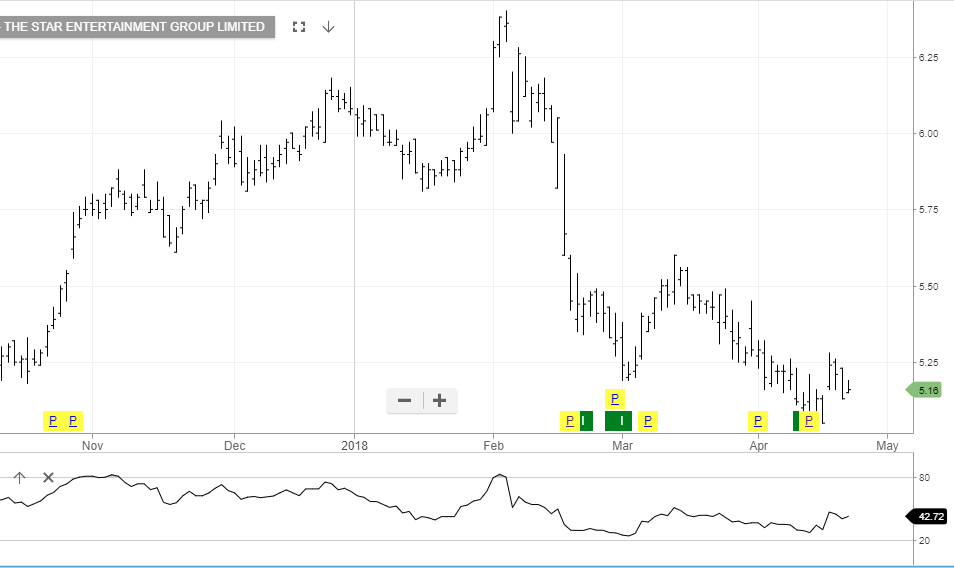

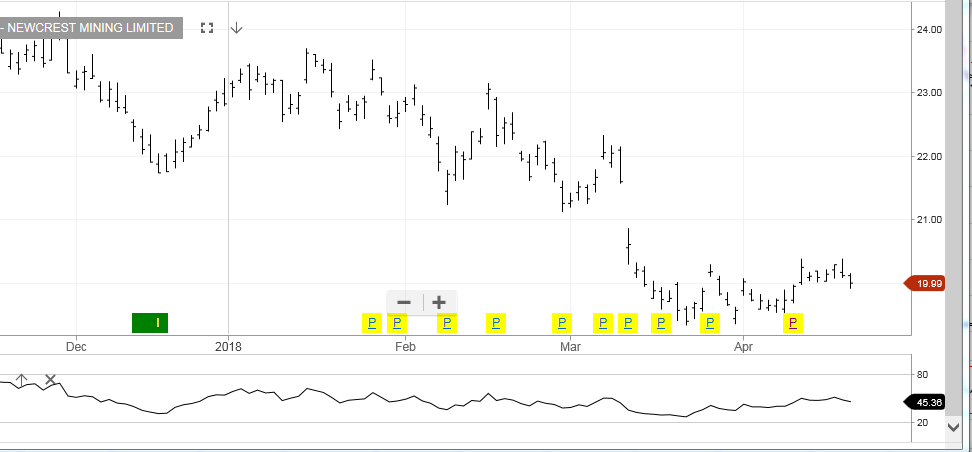

Newcrest Mining

Newcrest Mining Fortescue Metals Group

Fortescue Metals Group Oz Minerals

Oz Minerals