CBA Settles With AUSTRAC For $700 Million

Shares of CBA have opened over 2% higher to reach $70.35 in early trade.

Before the open, CBA announced that the bank had settled on the alleged money laundering charges for $700 million.

This amount is not quite twice the $375 million amount the bank earmarked for the potential penalty, but well below some of the early estimates which were over the $1 billion mark.

And while settling these allegations is a positive result for CBA, we still believe the share price has more downside risk than upside potential.

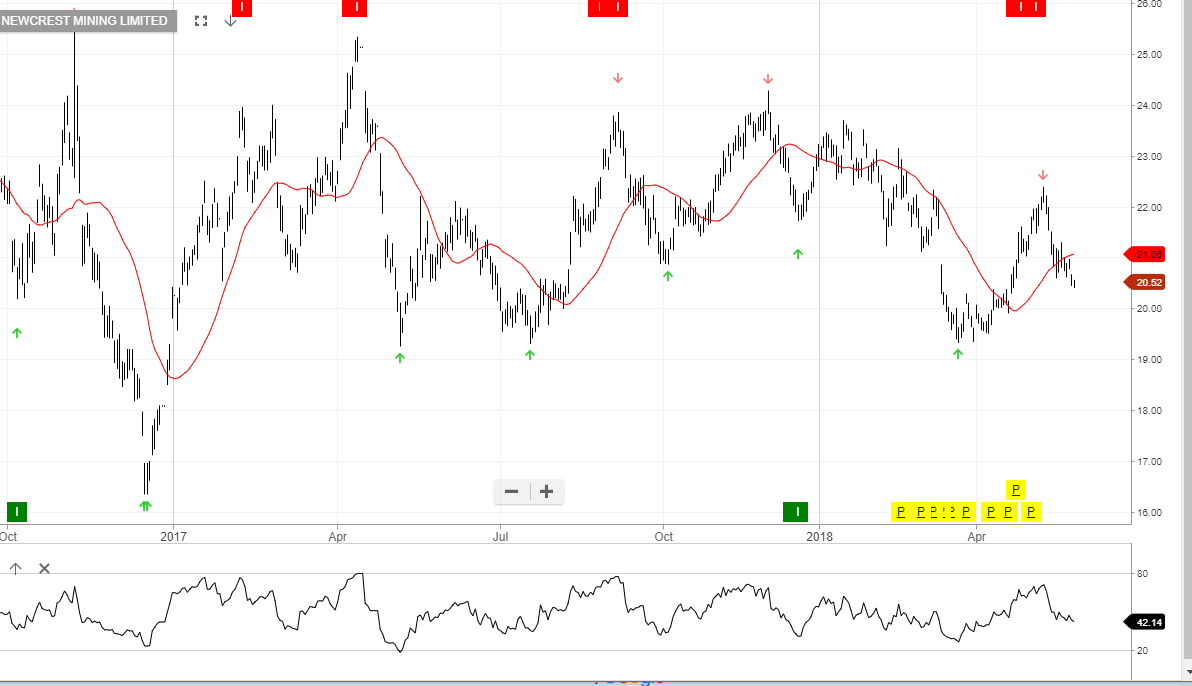

Our ALGO engine triggered a sell signal for CBA at $80.32 in November last year. We see the next significant support level near $68.50.

CBA

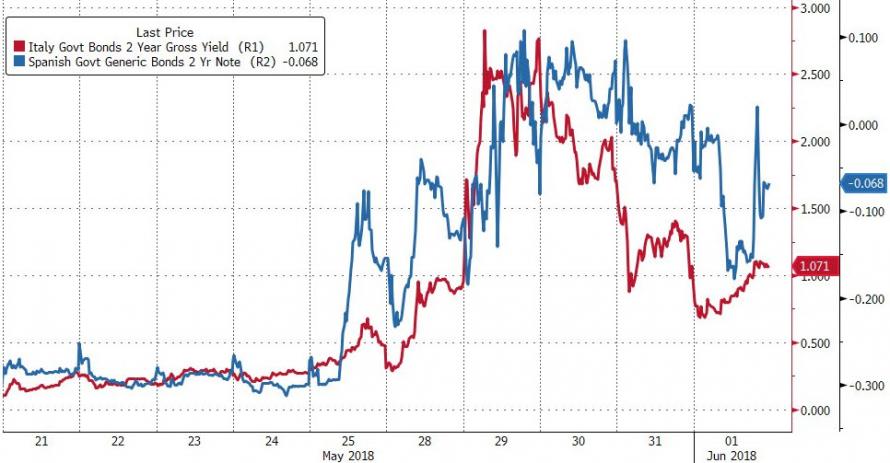

Italian Sovereign Yields

Italian Sovereign Yields BetaShare ETF BBOZ

BetaShare ETF BBOZ