ALGO Sell Signal For BOQ

Our ALGO engine triggered a sell signal for BOQ into yesterday’s ASX close at $10.50.

The “lower high” chart pattern is referenced to the $10.80 high posted on April 17th.

Recent chart rotation points to a medium-term low at or near $9.40. Investors looking to short BOQ can use our SAXO Go trading platform.

For more information on trading CFD products, call our office at 1-300-614-002

Bank of Queensland

Tabcorp

Tabcorp

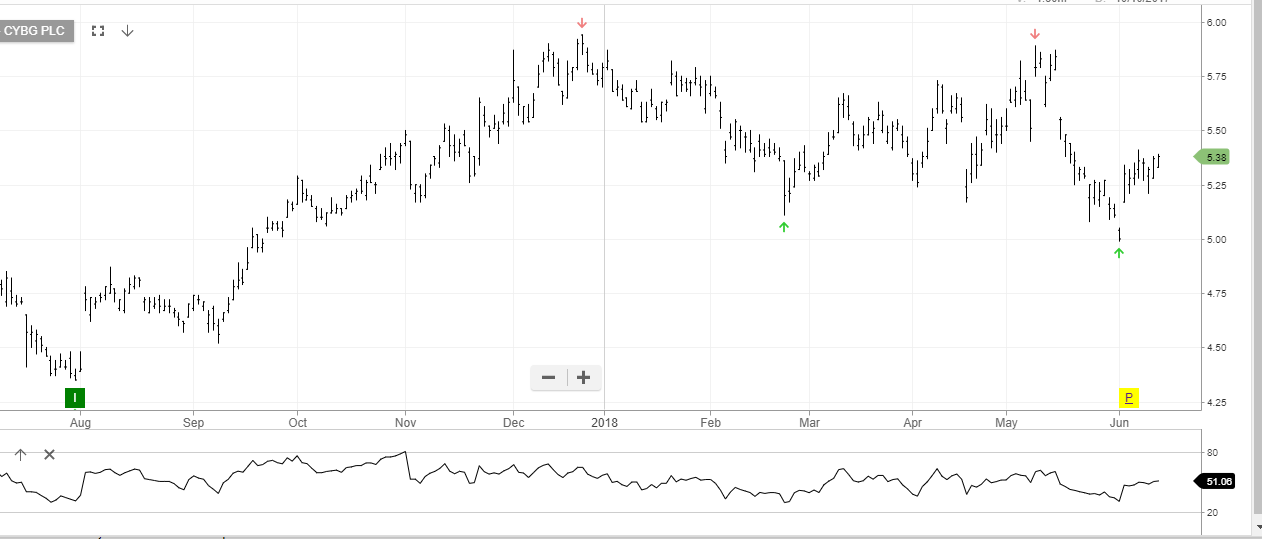

CYB

CYB