Has Spot Gold Found A Near-Term Low?

After reaching an intra-day high just under $1370.00 in mid-April, the price of Spot Gold has dropped over 12% and matched a 1-year low of $1210.00 last week.

The recent strength in the USD, weakness in the Yuan and uncertainty over global trade tariffs are some the reasons used to explain the slide in the yellow metal over the last 2 months.

What is clear is that the technical picture in Gold is deeply oversold and due for a material correction higher.

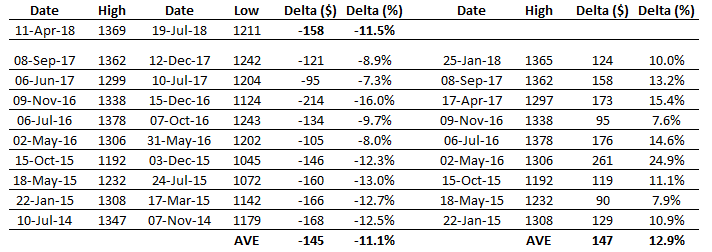

As illustrated in the chart below, the last 8 times that Gold fell more than $90.00 over a 3-month period, the rally that followed averaged close to $150.00, or just under 13%.

Despite the recent weakness in Spot Gold, local Gold miners have performed reasonable well and have expanded production both domestically and abroad.

Our ALGO engine is now showing buy signals for NCM, SBM, NST, OGC, SAR and EVN.

In addition, NST, EVN and NCM are included in our ASX Top 100 model portfolio.

We currently see the $1235.00 area in Spot Gold as an inflexion point which could drive the price higher and would be a net positive for these local Gold names.

Oz Minerals

Oz Minerals