SCG reported 1H16 NPAT of $1.15b on $0.116 cps up 2%+ on the same time last year. FY17 forecast growth of 3% or $0.23 cps places the stock on a forward yield into FY17 of 4.4% on a 90% payout ratio.

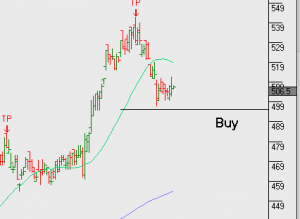

Potential for added growth from the development pipeline into FY17 and FY18 along with low interest rates underpin SCG. The stock is close to full value and a sideways consolidation is the most likely price action. Buy at $5.00 and sell at $5.45