CBA, Australia’s largest bank, posted an un-audited Q3 profit of $2.4 billion for the three months ending march 31st.

This is up 4.3% from last year’s number of $2.3 billion. The level of bad debts rose to $6.7 billion compared to $6.3 billion a year ago. CBA shares opened over 2% lower at $83.30.

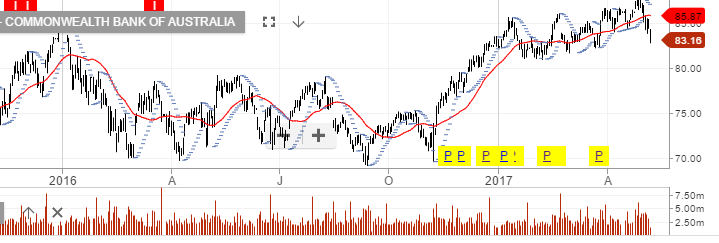

The ALGO engine gave buy signals on the 5 major banks during the last several months. Over the last several weeks, we have been suggesting that based on future growth prospects, the banking names were fully valued.

We will watch for ALGO buy signals over the near-term as the banking sector sell of extends lower.