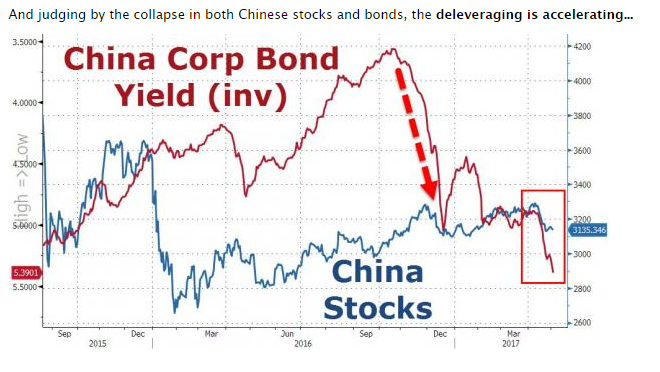

China’s credit system has expanded quickly and there are some concerning signs beginning to emerge. In particular, ballooning assets in Chinese wealth management products could create another credit crisis.

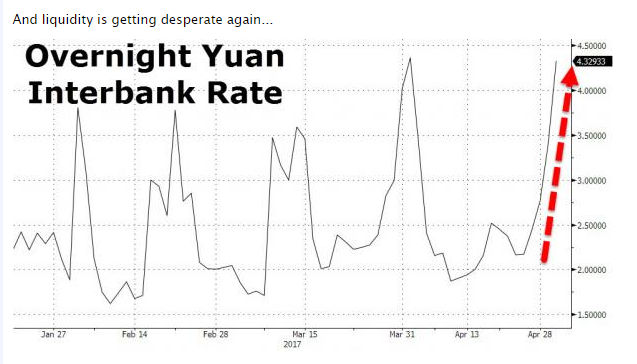

As soon as we see investors opting to not rollover existing investments due to rising risks and defaults, the lack of liquidity will expose under performing investments.

Wealth management products, or WMPs, have swelled to $4 trillion in assets in the last few years against a $34 trillion banking system. This well exceeds the mismatch at the peak of the US subprime collapse.