We have contracted a third-party firm to conduct a study on the ALGO Engine signals and trading model performance.

The preliminary results have supported my assumptions made by following 18 years of practical experience in the markets. The methodologies developed are now being integrated into a model using the following technical principles.

Our Algo Engine is capturing higher low buy points in individual stocks which make up the ASX top 50 index. When the XJO itself is making “higher highs” and “higher lows”, this produces a very high success rate.

Buying into these patterns can keep investors exposed to major bullish momentum without the human emotion of prematurely taking profits on the trade, and importantly, automating the stop-loss when the upward price momentum begins to reverse.

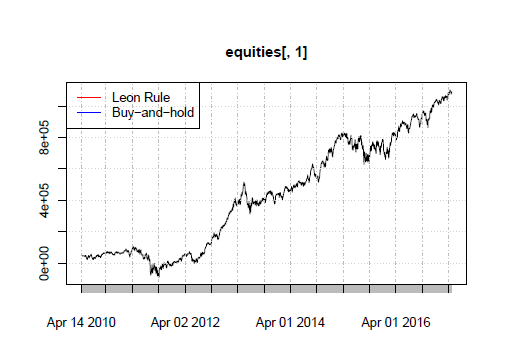

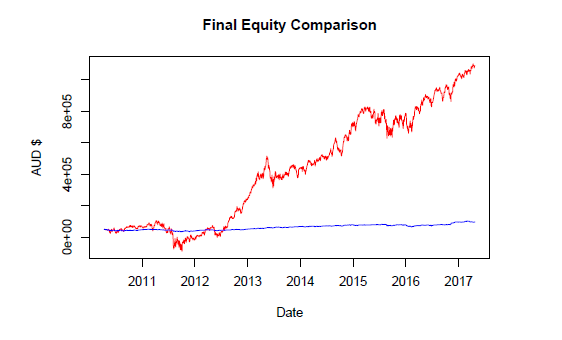

The chart below shows the performance of the “long only” ALGO Engine signals. The model is based on buying $50k in all long signals and holding the long position until a subsequent short or sell signal is triggered.

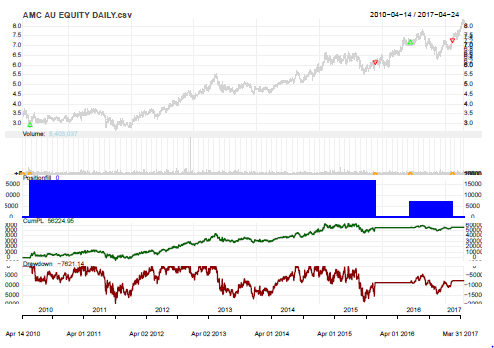

An example of this logic is also displayed on the individual stock sample below using Amcor.

For a comprehensive copy of our preliminary research paper, please contact me on leon@investorsignals.com