Both the Dow Jones 30 and SP 500 finished the first week of 2017 in positive territory gaining 1% and 1.5%, respectively.

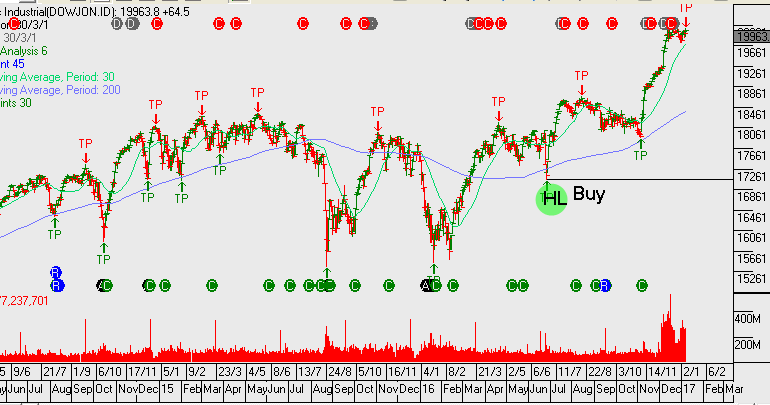

Many market commentators are suggesting the potential for overbought conditions as the major US stock indexes have added about $2 trillion in share value over the last 8 weeks.

There’s no question that the Bulls are currently in charge. However, with earnings season just a few weeks away, investors need to be cognizant of the index earnings required to maintain these lofty price valuations.

Earnings over the last three years have been in a tight range between $116.50 and $118.00. Based on our calculations, if US companies don’t post EPS growth of 10% and only deliver a flat $120.00 of average annualised EPS, the Dow Jones 30 is worth 16,500 points with 10-year bond yields at 2%.

Although energy and commodity companies should help to lift the average from the prior 12 months, bank earnings should also be up in the fourth quarter. With this in mind, the middle ground may result in 5% average EPS growth ($125 per share), which then supports the Dow Jones Index trading at or near 18,000 points.