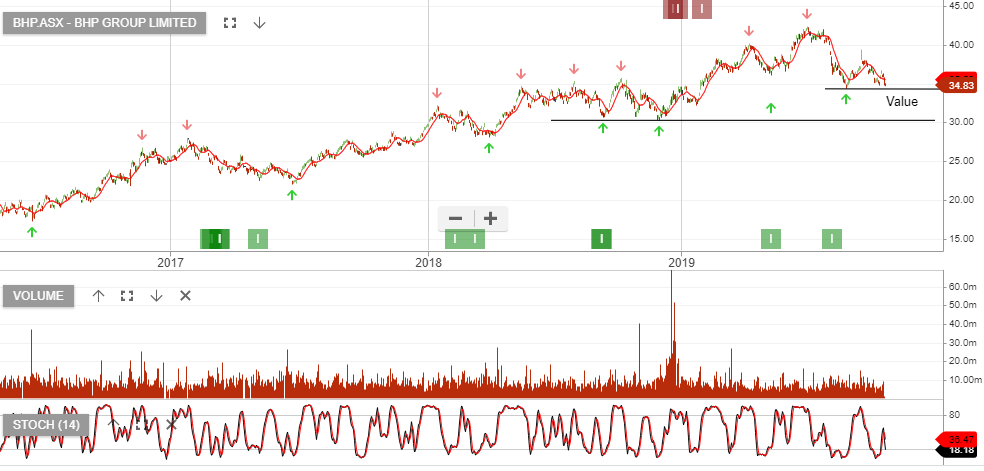

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The company reported Q1 production that was below analyst forecasts. The impact was most significant in copper where production was down 9%. Iron production was down 2% and thermal coal was also lower.

Despite the soft quarter, BHP reiterated its full-year production guidance.

Based on FY20 revenue of $43bn, EBITDA $25bn, net income $11bn, we have BHP trading 15x forward earnings and 4.5% yield.

Accumulate BHP within the $30 – $34.50 price range.