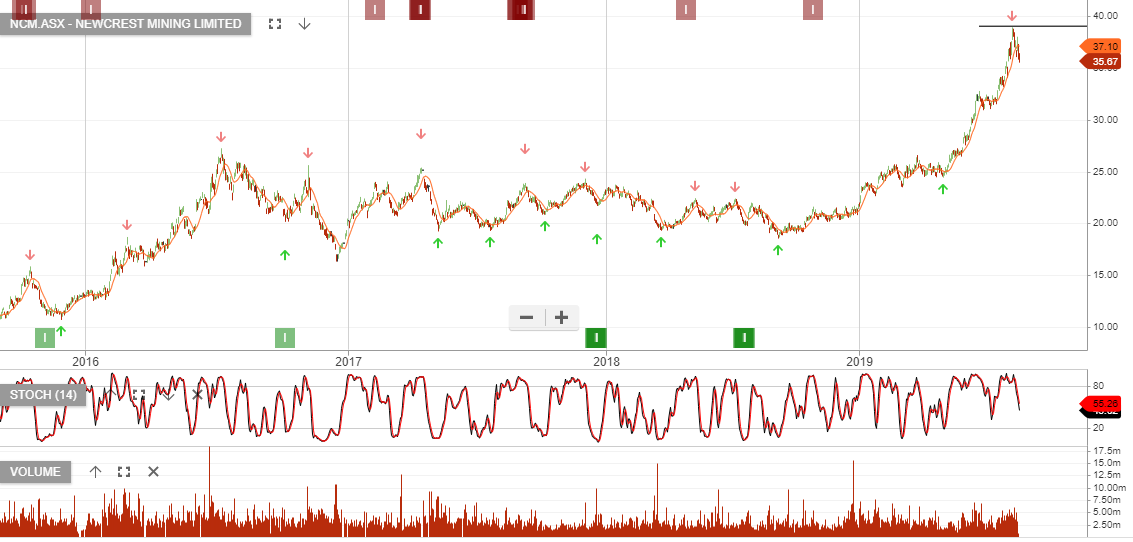

Newcrest Mining is under Algo Engine sell conditions. Our preferred gold names have been EVN and NST, which remain in our ASX 100 model portfolio.

Whilst there’s upside risk to NCM, if the gold price continues

higher, we remain cautious following the latest earnings update.

FY19 EBITDA of US$1,670m was close to market consensus and FY20 production guidance is similar to FY19, with 2.35-2.5 million ounces.

Our base case is FY20 earnings are unlikely to top FY19 and with the stock trading on an FY20 forward dividend yield of 1.6%, we see better opportunities elsewhere.

We’ll continue to monitor NCM and will review further following the next Algo Engine buy signal.