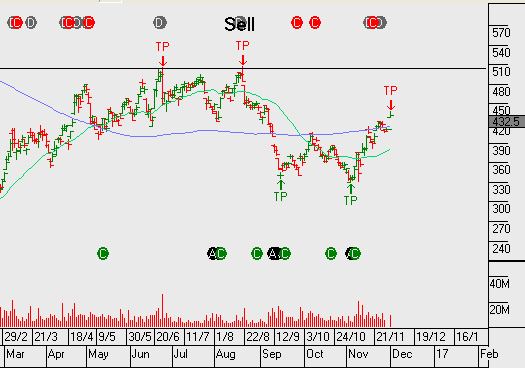

Crude Oil prices surged as much as 10%, almost reaching the $50.00 mark, as the Organization of Petroleum Exporting Countries (OPEC) agreed to curb oil production for the first time since 2008 in an effort to reduce oversupply and support prices.

The 14 nation cartel, led by Saudi Arabia, agreed to cut production to 32.5 million barrels per day, which pencils out to a 1.2 million barrel per day reduction from current levels. Saudi Arabia agreed to take the lion’s share of the cut; lowering their daily production by 486,000 barrels per day to get the deal done.

Russia, the world’s largest Non-OPEC producer, had long resisted cutting output but has tentatively agreed to join the effort by reducing production by 300,000 barrels per day. OPEC will meet with Non-OPEC producers on December 9th.

If history is an accurate gauge, the bullish market response to this deal may be short lived. OPEC members haven’t shown a strong track record of compliance to previous production agreements. As such, the recent price action in Crude Oil could reverse over the near term as more details are released.