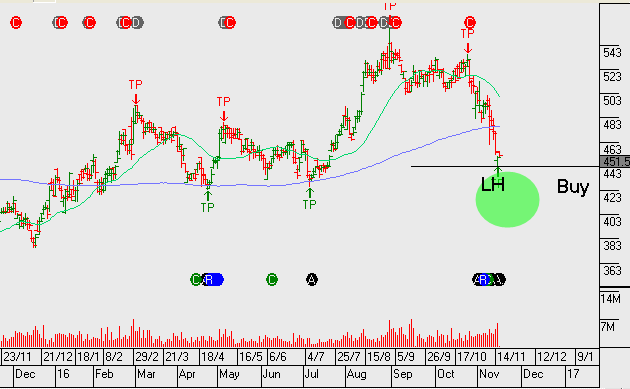

Harvey Norman and JB Hi-Fi have sold off recently and now reflect at a “higher low” price formation within a broader uptrend. Our algo engine has triggered buy signals on both of these names, so we will take this opportunity to look a little closer.

Harvey Norman reported a solid Q1FY17 trading update, yet the share price has sold off over 15% following questions being raised over the group’s accrual accounting practises. The strong history of free cash flow generation should begin to dampen investor concerns and lift share prices.

FY17 revenue is likely to be up 7% year-on-year to $1.9b, EBITDA $650m and NPAT $375 which will be up 10% on FY16, placing HVN on a forward yield of 7%.

Momentum studies suggest HVN is worthy of consideration: FY15 to FY16 EPS growing by 25% or from $0.24 to $0.30 per share.