There are new Signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

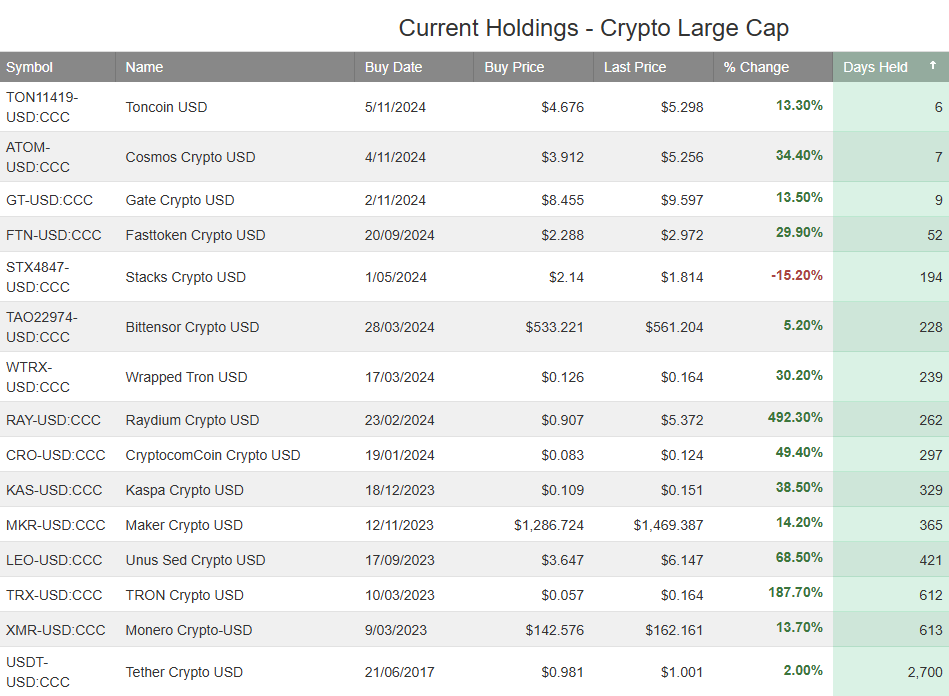

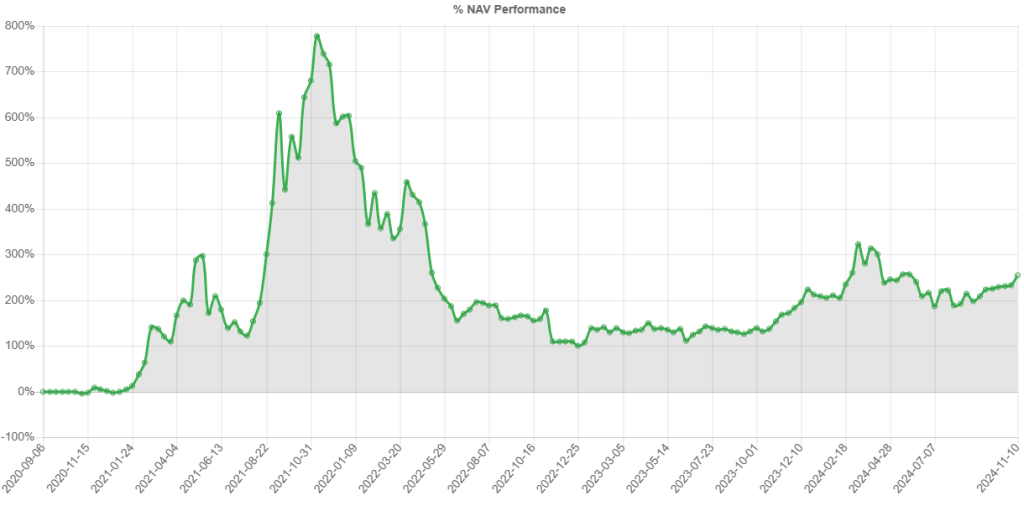

Our Crypto Large Cap model portfolio is up over 80% in the last 12 months.

For our Members, please find below the latest list of signals.

Pinterest’s Q3 FY24 earnings showed 18% YoY revenue growth.

Okta, Inc. – Class A Common is under Algo Engine buy conditions.

Okta is a leading company providing cloud-based solutions for secure user authentication and identity management.

ASX:NXP is under Algo Engine buy conditions. NXP Semiconductors is navigating a cyclical downturn, particularly in the Industrial, IoT and automotive markets. Despite this, we see value within the $200 – $220 price range.

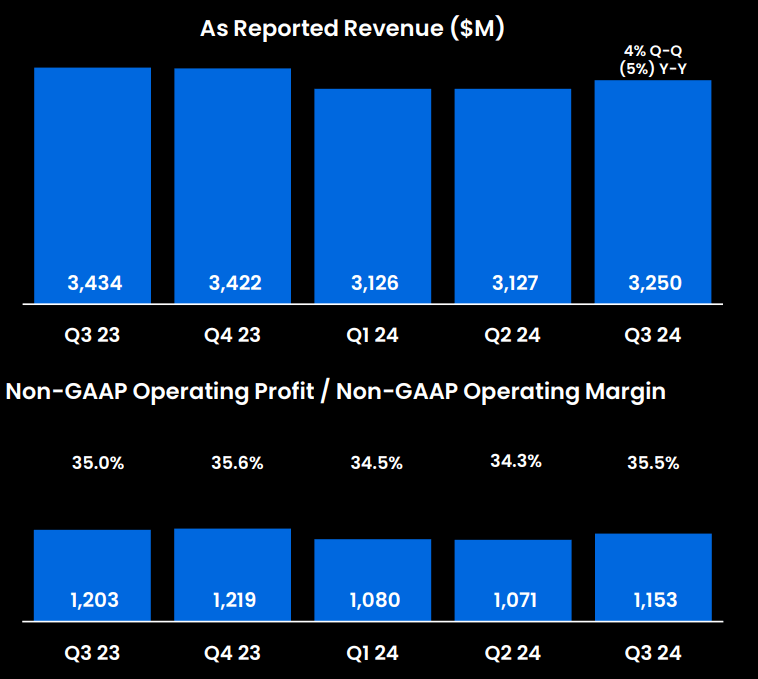

NXP Semiconductors released its Q3 FY24 on November 4th after the market close, reporting a 5% year-over-year revenue decline.

NXP Semiconductors is guiding for $3 billion-$3.2 billion in revenue for Q4, which a 9% year-over-year decline.

Or start a free thirty day trial for our full service, which includes our ASX Research.