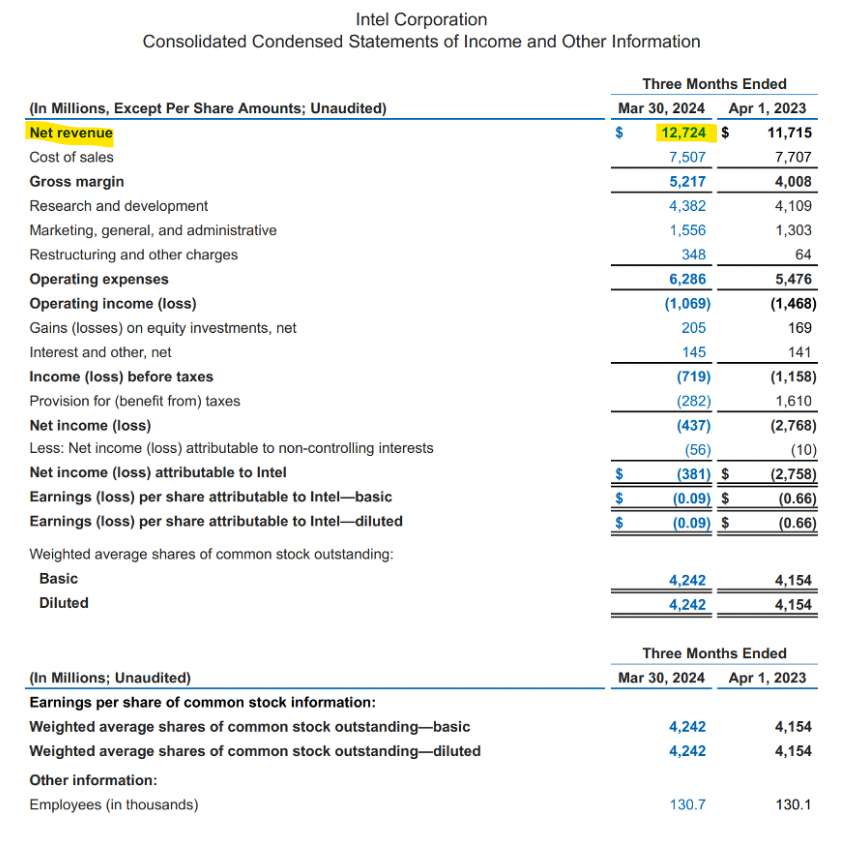

Revenue increased from $11.7b in Q1/23 to $12.7b in Q1/24, resulting in 8.6% year-over-year growth.

Intel is now reporting in two major segments – Intel Foundry and Intel Products.

The chart pattern shows support at $30.00

The long-term chart suggests investors should accumulate the stock within the $25 – $35 range and look for a multi-year recovery starting in 2025.