There are new Signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

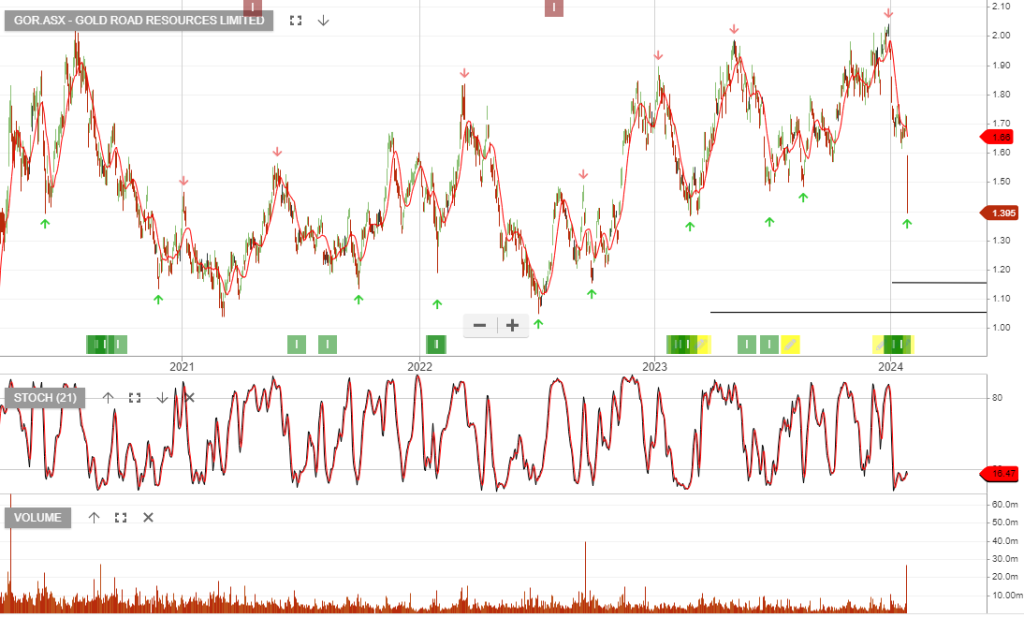

The miner reported a slip in gold production and downgraded its full-year guidance in its latest quarterly report.

STO shares remain heavily discounted, given superior free cash flow. Barossa project progression, completion of PNG selldown, and the potential merger proposal from WDS are all positive catalysts.

We expect STO to report a solid 4Q on 25th January and we look to buy STO on the current dip in price.

For our Members, please find below the latest list of signals.

BWP offers a 5%+ yield and modest capital growth.

Beach Energy is likely to benefit from the stronger oil price.

IGO has formed a higher low formation and the buying momentum has pushed the price action above the 10-day average.

Monday, January 29 – Whirlpool and Nucor.

Tuesday, January 30 – General Motors, United Parcel Service, Sysco, Pfizer, Alphabet, Microsoft, Starbucks, Mondelez International, and Advanced Micro Devices.

Wednesday, January 31 – Phillips 66, Boeing, Mastercard, MetLife, Qualcomm, and Boeing.

Thursday, February 1 – Merck, Honeywell, Altria, Amazon, Apple, Meta Platforms, Royal Caribbean Cruises and Post Holdings.

Friday, February 2 – Exxon Mobil, Chevron, AbbVie, and Charter Communications.

For our Members, please find below the latest list of signals.

Or start a free thirty day trial for our full service, which includes our ASX Research.