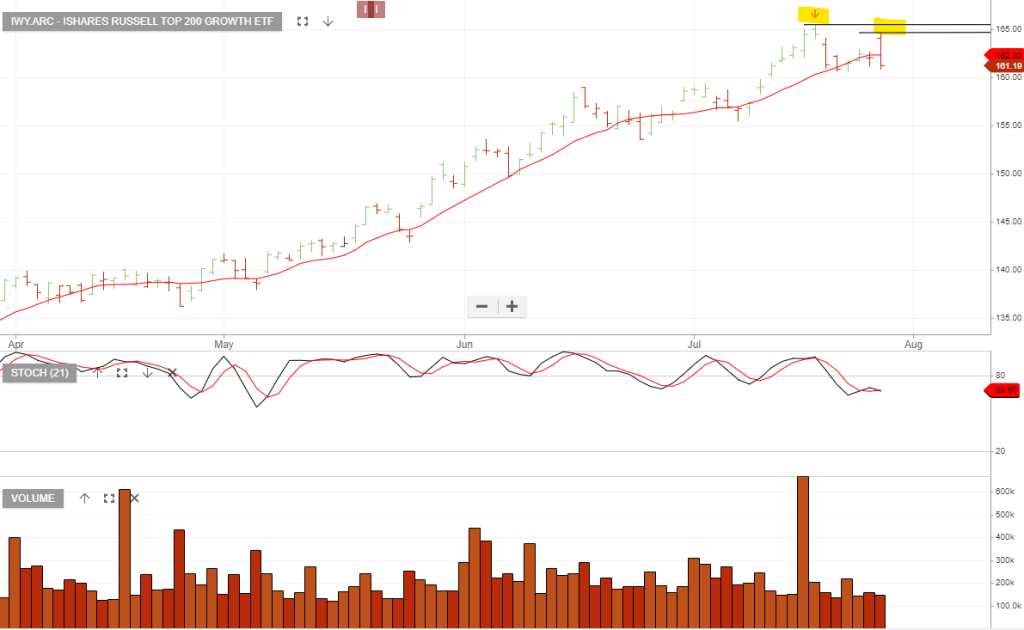

Russell Top 200 Growth ETF: Short Position

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

16/8 update: Maintain short exposure and lower the stop loss to $159.52

10/8 update: The sell-off in growth-related companies is taking place and we remain on the short side of the trade.

5/8 update: The price action remains below the 10-day average.

3/8/ update: The price action has rolled over and short exposure should be maintained whilst the close value is below the 10-day average.

Consider the short side with a stop loss on a break above $165.

There are new Signals.

For our Members, please find below the latest list of signals.

There are new Signals.

For our Members, please find below the latest list of signals.

There are new Signals.

For our Members, please find below the latest list of signals.

US interest rates

Goldman Sachs expects the first Fed rate cut to occur in mid-2024 and expects no more hikes this year.

Watch Last Night’s Webinar

In case you missed it, you can watch last night’s webinar here.

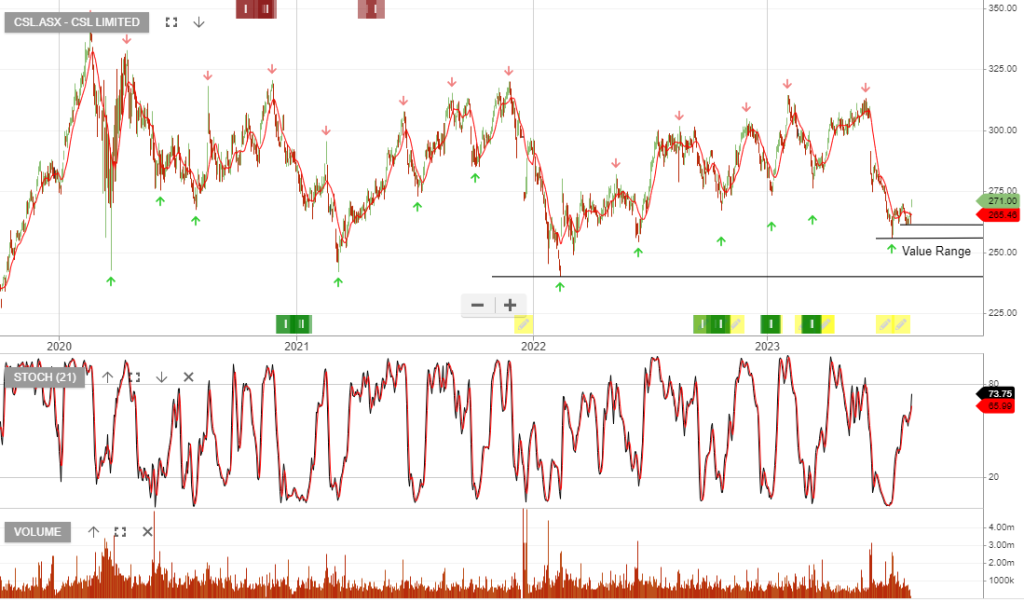

CSL

CSL FY23 revenue $13.31bn, up 31% on FY22 and NPAT of $2.19bn, down 3%. FY24, revenue growth is anticipated to be 10% with NPAT of approximately $3.0bn, representing 12% growth.

There are new Signals.

For our Members, please find below the latest list of signals.

There are new Signals.

For our Members, please find below the latest list of signals.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.