There are new Signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

VanEck Junior Gold Miners is a suggested way of gaining exposure to a rally in the gold price.

Hewlett Packard Enterprise Company Common is a suggested short tarde, with a stop loss on a reversal above $17.15

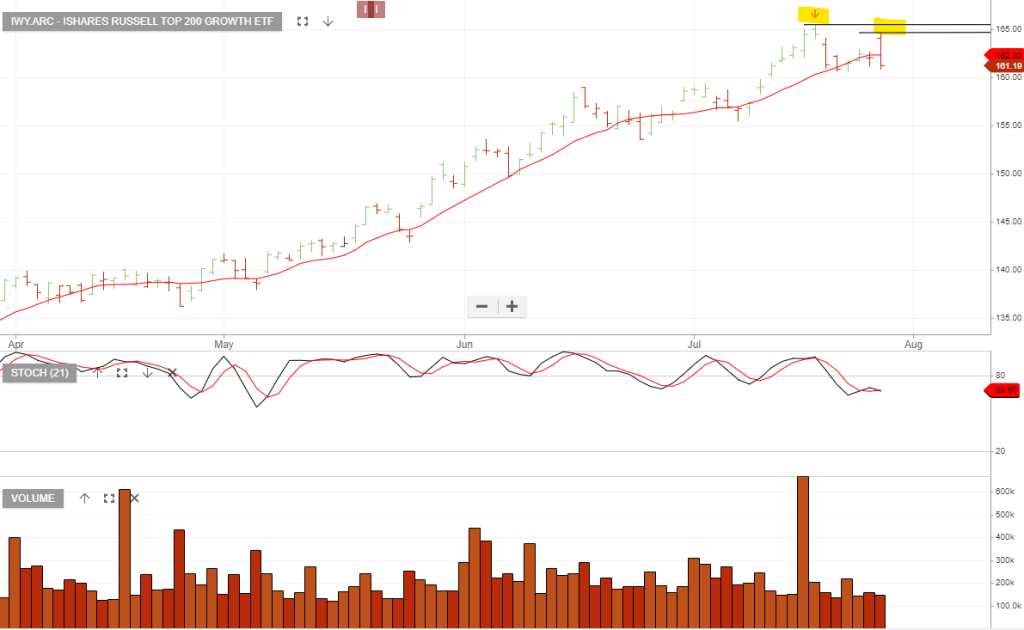

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

23/8 update: Stay on the short side of the US growth trade.

18/8: Remain on the short side of the trade and prepare to close the position when the price action trades above the 10-day average.

16/8 update: Maintain short exposure and lower the stop loss to $159.52

10/8 update: The sell-off in growth-related companies is taking place and we remain on the short side of the trade.

5/8 update: The price action remains below the 10-day average.

3/8/ update: The price action has rolled over and short exposure should be maintained whilst the close value is below the 10-day average.

Consider the short side with a stop loss on a break above $165.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

In case you missed it, you can watch last night’s webinar here.

For our Members, please find below the latest list of signals.

Or start a free thirty day trial for our full service, which includes our ASX Research.