iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

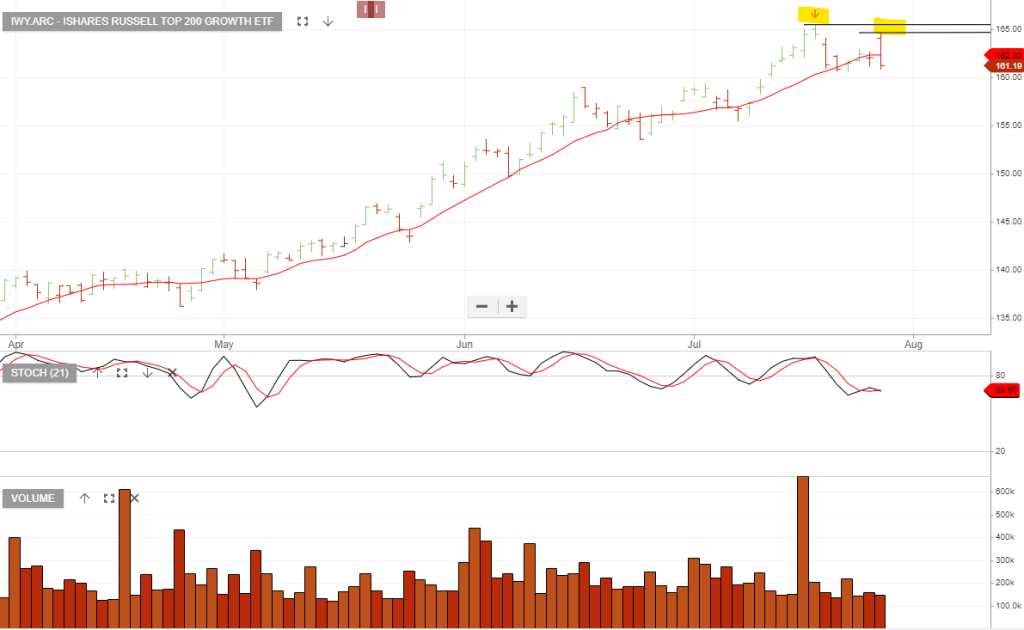

18/8: Remain on the short side of the trade and prepare to close the position when the price action trades above the 10-day average.

16/8 update: Maintain short exposure and lower the stop loss to $159.52

10/8 update: The sell-off in growth-related companies is taking place and we remain on the short side of the trade.

5/8 update: The price action remains below the 10-day average.

3/8/ update: The price action has rolled over and short exposure should be maintained whilst the close value is below the 10-day average.

Consider the short side with a stop loss on a break above $165.