There are new Signals.

For our Members, please find below the latest list of signals.

There are new Signals.

For our Members, please find below the latest list of signals.

Citi Group

{C.NYS}

Citigroup reported net income for the first quarter 2023 of $4.6 billion, or $2.19 per diluted share, on revenues of $21.4 billion. This compares to net income of $4.3 billion, or $2.02 per diluted share, on revenues of $19.2 billion for the first quarter 2022.

Revenues increased 12% from the prior-year period and 6% excluding the divestiture-related impacts, as growth in net interest income was partially offset by lower non-interest revenues. The higher net interest income was driven by the impact of higher interest rates across businesses.

Net income of $4.6 billion increased 7% from the prior-year period, and decreased 19% excluding the divestiture-related impacts.

Alibaba

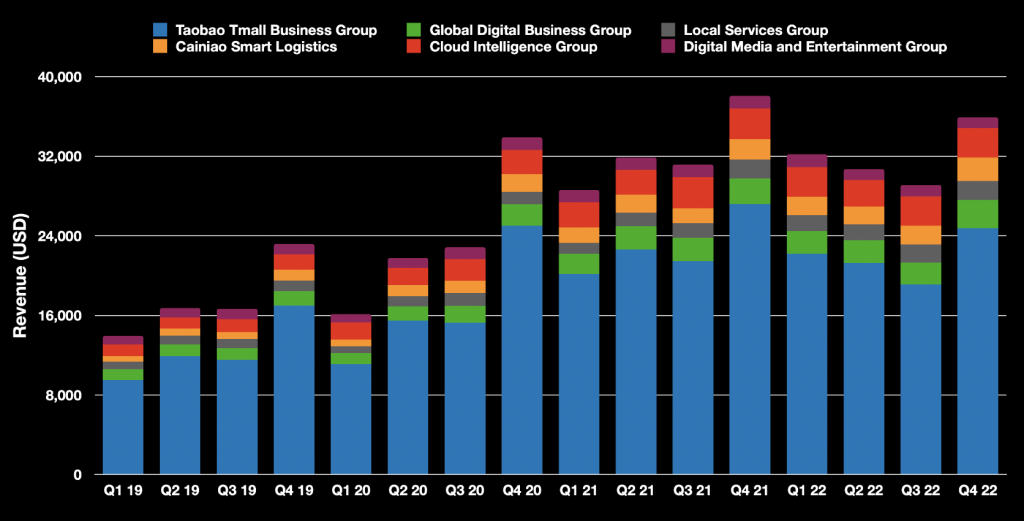

Despite nearly 16x more revenue and 3.6x more operating income, Alibaba is still trading at the same price as in 2014. We’re buyers of the stock based on an inflection point as new value is unlocked as Alibaba splits into 6 different components.

Taobao & Tmall

Cainiao Smart Logistics

Global Digital

Cloud Intelligence

Local Services

Digital Media & Entertainment

Alibaba’s main business, Taobao & Tmall, is currently driving profits. Taobao is a consumer-to-consumer platform, while Tmall is B2C. Both companies target Chinese consumers.

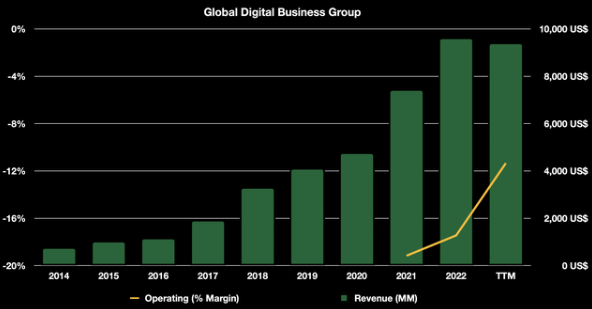

The Global Digital Business includes Alibaba.com, AliExpress, Lazada and others and is mainly focused on international markets.

Cloud Intelligence, this segment alone could be worth more than Alibaba is currently valued at.

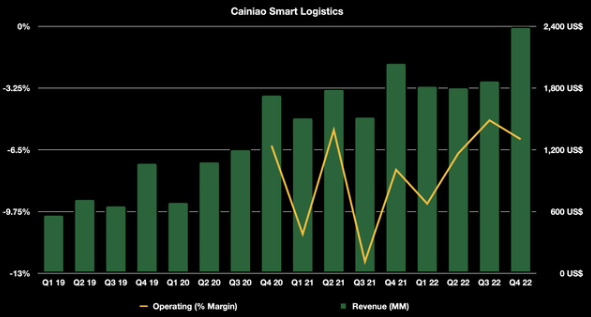

Cainiao Logistics is essential to Alibaba’s operations as it ensures smooth 24-hour delivery across China. The revenue growth of this unit has been quite amazing, with a CAGR of 46.49% since 2018. Widely regarded as one of the largest Unicorns in China.

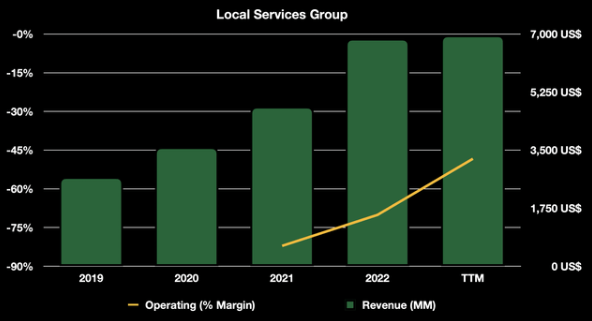

Local Service Group, These are mainly the DoorDash, Takeaway.com, Uber Eats, Yelp, Booking.com etc. in the Chinese economy.

Digital Media & Entertainment, consists of a range of different companies. One of them is Youku, one of the largest video hosting and streaming companies in China.

Buybacks – Almost one year ago, Alibaba Group announced an increase in its stock buyback from $15bn to $25bn. Alibaba bought back $9.66bn worth of shares in 2022 and for 2023 they’ve allocated $12bn+ for buybacks.

Trade Table: US S&P100

We’ve had a number of holdings closed out in the past few days and the remaining positions continue to perform, with Eli Lilly the best at +18.3%.

XJO & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Paypal

PYPL:NAS has been consilidating between $71 & $76 for the past 8 weeks. The stock offers value and may break to the upside of the channel.

Apply a stop loss at $73.21

Okta – Algo Buy

OKTA:NAS is under Algo Engine buy conditions and we’ll look to build a position within the $70 – $75 price range.

Fourth Quarter Fiscal 2023 Financial Highlights:

- Revenue: Total revenue was $510 million, an increase of 33% year-over-year. Subscription revenue was $495 million, an increase of 34% year-over-year.

There are new Signals.

For our Members, please find below the latest list of signals.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.