There are new Signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

In case you missed it, you can watch last night’s webinar here.

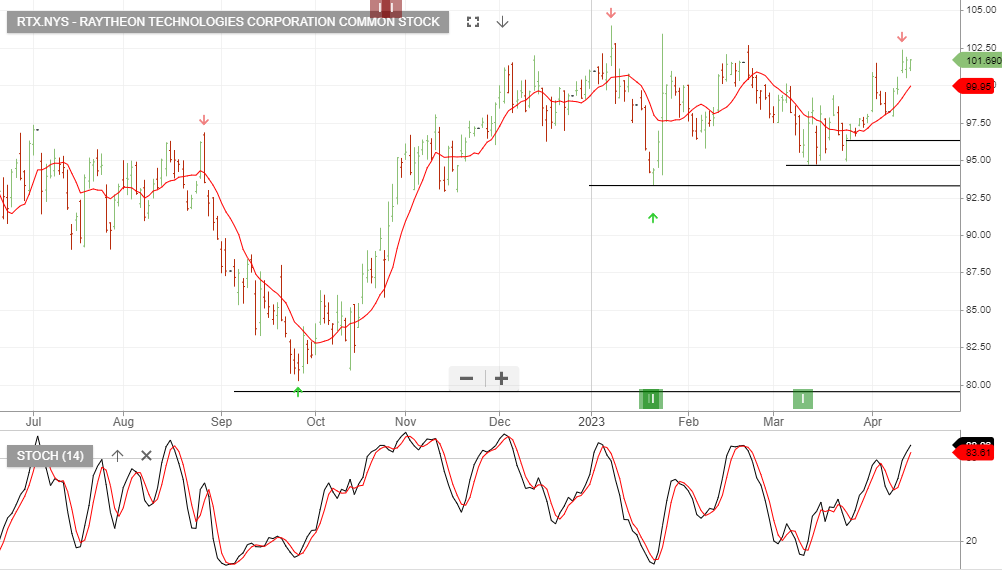

Raytheon Technologies Corporation Common remains our preferred overweight exposure heading into first-quarter results. RTX reports on April 25, 2023.

January 24, 2023: Raytheon Technologies reported fourth-quarter sales of $18.1 billion, up 6 percent over the prior year. GAAP EPS from continuing operations of $0.96 was up 109 percent versus the prior year and included $0.31 of acquisition accounting adjustments and net significant and/or non-recurring charges. Adjusted EPS of $1.27 was up 18 percent versus the prior year. Both GAAP and Adjusted EPS included about 6 cents of a tax benefit associated with legal entity and operational reorganizations.

The company recorded net income from continuing operations attributable to common shareowners in the fourth quarter of $1.4 billion, up 108 percent versus the prior year which included $446 million of acquisition accounting adjustments and net significant and/or non-recurring charges. Adjusted net income was $1.9 billion, up 16 percent versus prior year. Operating cash flow from continuing operations in the fourth quarter was $4.6 billion. Capital expenditures were $855 million, resulting in free cash flow of $3.8 billion

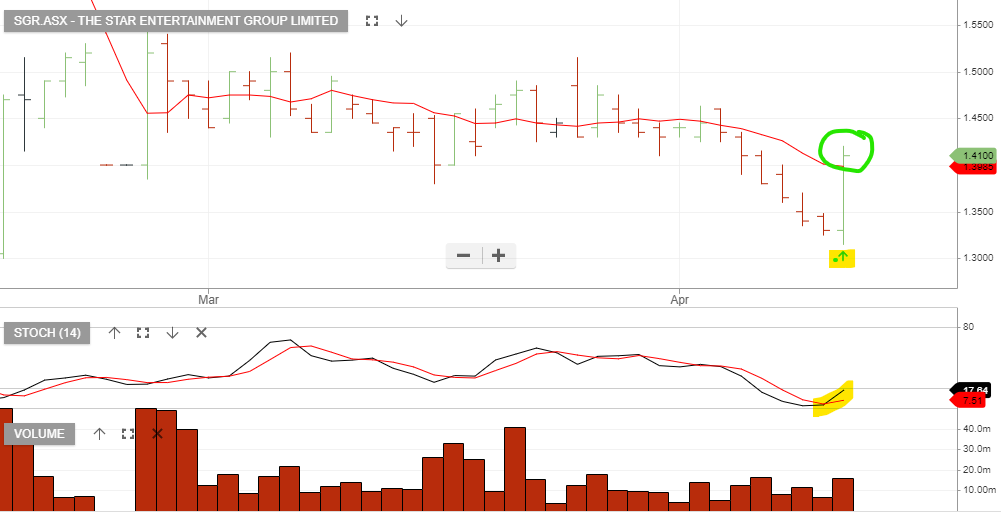

The Star Entertainment Group experienced above-average volume and a strong close in yesterday’s session.

NAS:INTL has traded through the $30 resistance and is likely in the early stages of a multi-year recovery.

Combined with Gaudi 3 and Sierra Forest Xeon to be launched by 2024, INTC may just claim a decent market share in the generative AI market moving forward.

INTC has further streamlined its AI GPU offerings for the accelerated computing market through the next-gen Habana Gaudi 3, slated to be launched together with the Sierra Forest Xeon processor by H1’24.

For our Members, please find below the latest list of signals.

For our Members, please find below the latest list of signals.

Or start a free thirty day trial for our full service, which includes our ASX Research.