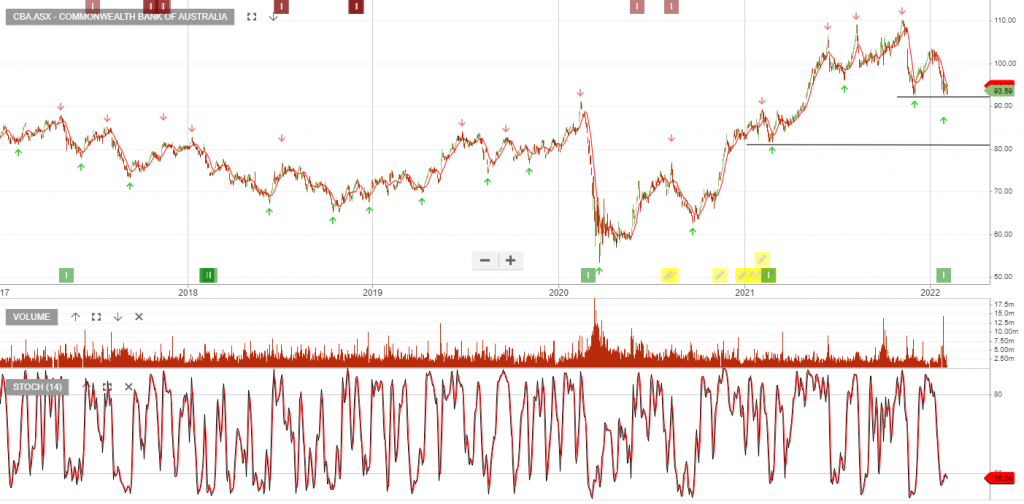

CBA: Scheduled to Report 1H22 Earnings

Commonwealth Bank of is scheduled to report its 1H22 result on 9 February 2022. Forecasting 1H22 cash earnings of $4.3bn with the FY22 interim dividend of $1.74 per share.

We remain underweight Australian banks.