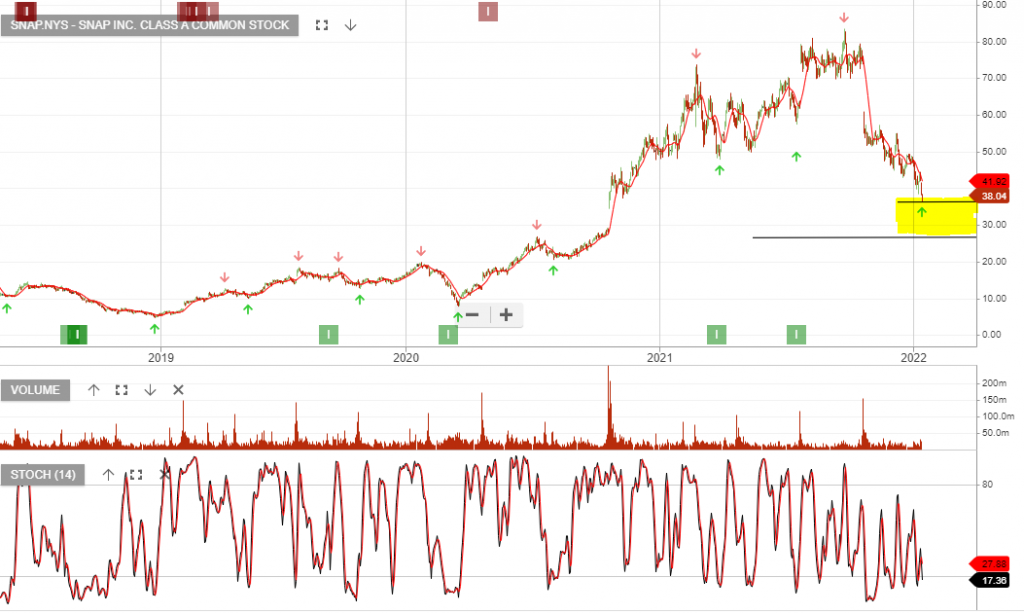

{SNAP.NYS} is under Algo Engine buy conditions. The correction in high PE technology and the negative impact to earnings from the change in Apple’s advertising privacy regulations have seen Snap correct from $80 down to $38. Even after the 50% correction, Snap remains on 80x PE.

Despite the still high PE ratio, Snap offers tremendous growth and we’re accumulating the stock within our defined range.

5/2 update:

Snap shares rocket as much as 62% on first-ever quarterly net profit.

Here are the key numbers:

- Earnings per share: 22 cents, adjusted vs 10 cents expected, according to a Refinitiv survey of analysts

- Revenue: $1.3 billion vs $1.2 billion, according to Refinitv

- Global Daily Active Daily Users (DAUs): 319 million vs 316.9 million, according to StreetAccount

- Average Revenue per User (ARPU): $4.06 vs $3.79, according to StreetAccount