Gold Road – Buy

Gold Road Resources remains our preferred gold exposure.

Gold Road Resources remains our preferred gold exposure.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Pro Medicus is up 100% since the buy signal back in July 2020.

While the stock trades on a very high multiple 100x FY22 earnings, the 40%+ revenue and profit growth is supported by long-term contract wins. Watch for buying interest to build within the range indicated.

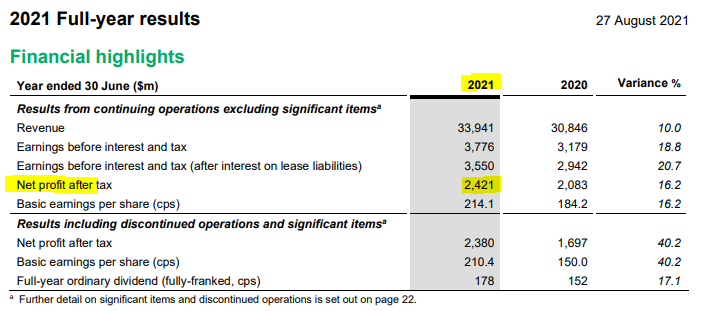

Wesfarmers preliminary half-year profit result.

Wesfarmers expects to report net profit after tax (NPAT) of between $1,180 and $1,240 million, in line with

current consensus expectations, for the half-year ended 31 December 2021.

The Group’s performance for the half was supported by pleasing results in Bunnings and Wesfarmers

Chemicals, Energy & Fertilisers, while results in Kmart Group and Officeworks were impacted by

COVID-related disruptions and costs

The first half FY22 number indicates that net profit is tracking in line with 2021.

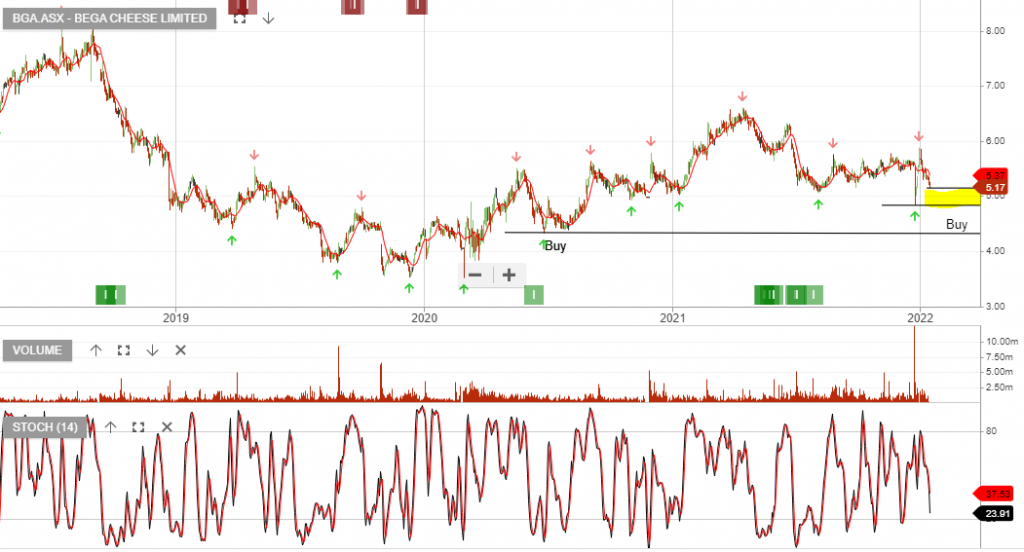

Bega recently provided a trading update, with FY22 underlying EBITDA expected to be in the range of

A$195-215mn.

Earnings have been impacted by supply chain-related disruptions, with some offset by the full-year contribution of the Lion Dairy & Drinks acquisition and related cost synergies. FY23 earnings should reaccelerate and recent shareholder support from Andrew Forrest suggests the current price range is a good opportunity to build a position.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

In case you missed it, you can watch last night’s webinar here.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Collins Foods is under Algo Engine buy conditions. Buying support is likely to increase near the $11.80 price level.

The market has sold companies with exposure to inventory disruption, such as WOW, COL, CKF and DMP. We consider all four names as buying opportunities and i’ll highlight the entry setups in tonight’s webinar.

If you’re not on the registration list, please add your details to the following form.

https://kd169.infusionsoft.com/app/form/92e0b51c19ccfb52145719f7c932533a

Or start a free thirty day trial for our full service, which includes our ASX Research.