Bega recently provided a trading update, with FY22 underlying EBITDA expected to be in the range of

A$195-215mn.

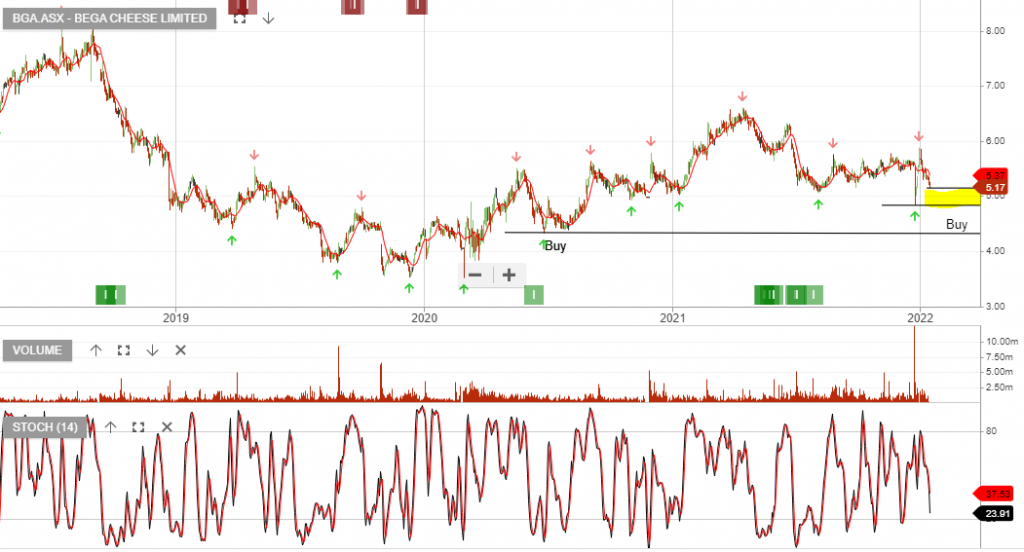

Earnings have been impacted by supply chain-related disruptions, with some offset by the full-year contribution of the Lion Dairy & Drinks acquisition and related cost synergies. FY23 earnings should reaccelerate and recent shareholder support from Andrew Forrest suggests the current price range is a good opportunity to build a position.