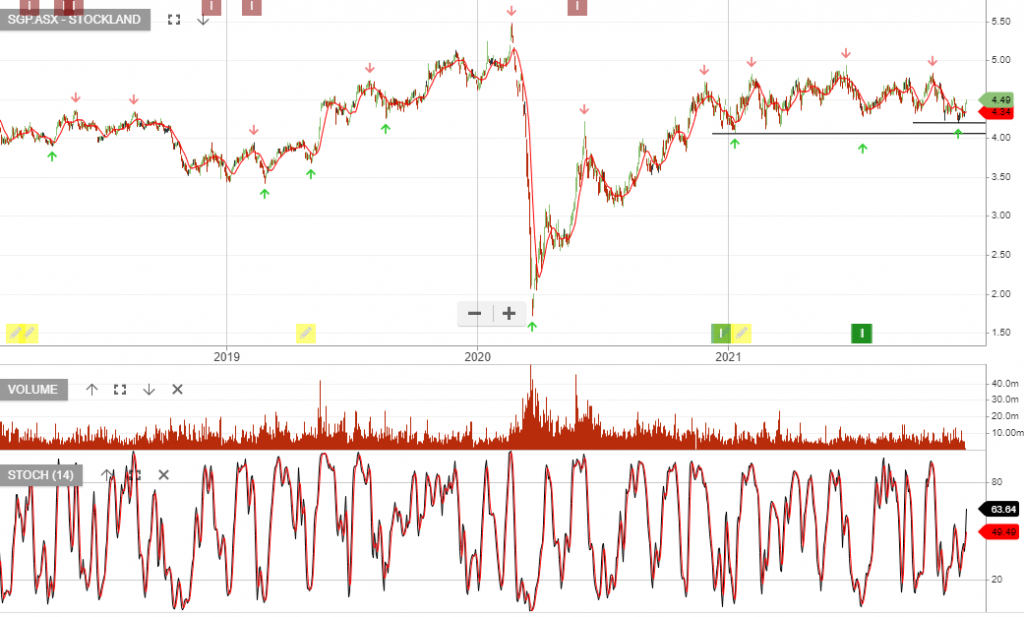

is under Algo Engine buy conditions and we see buying interest building above the $4.20 support level.

1Q22 Update and Reconfirming Guidance:

FY22 estimated FFO per security forecast in the range of 34.6 to 35.6 cents. Distribution per security is forecast to be within our target payout ratio of 75% to 85% of FFO.

Current market conditions remain uncertain and challenging with ongoing lockdowns and community transmission of COVID-19. All forward looking statements including FY22 earnings guidance are provided on the basis that the vaccination roll out continues and COVID-19 restrictions ease towards the end of CY21 and are underpinned by the following business assumptions:

• Residential settlement around 6,400 lots

• Residential operating profit margin ~18%

• Land Lease communities delivering ~300 sites in FY22

• Retail rent collection returning to levels experienced prior to recent lockdowns towards the end of CY21