Gold Price Rally

Spot gold is up 1.2% to US$1,816.80 per ounce, as yields on the U.S. 10-year Treasury notes slipped to their lowest level in about a month.

Spot gold is up 1.2% to US$1,816.80 per ounce, as yields on the U.S. 10-year Treasury notes slipped to their lowest level in about a month.

Treasury Wine Estates is under Algo Engine buy conditions.

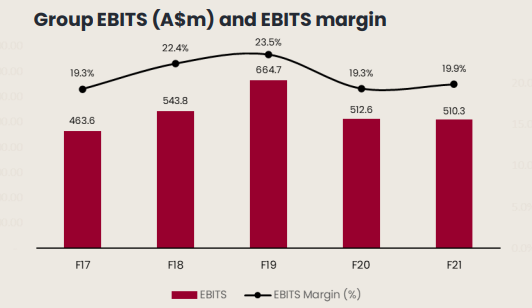

TWE continues to adjust to a post pandemic/post Chinese tariff environment. FY21 EBIT of $510 exceeded market expectations. After a number of years of disappointment for TWE in this region, we see America’s division accelerating growth into FY22.

FY22 EBIT growth is forecast to be in the mid to high single-digit range.

8/11 update: Buy above the $11.50 support range and place the stop loss below the recent pivot low of $11.48.

For our Members, please find below the list of our latest Model Portfolio changes.

Evolution Mining is under Algo Engine buy conditions.

Trader instructions

Buy: @market above $3.50 support

Sell: stop loss $3.45

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

Trader Instructions

Buy: @market above $9.00 support

Sell: stop loss $8.90

Lendlease has warned of a challenging year to come as COVID-19 puts a dampener on development and construction globally.

FY21 net profit after tax of $377 million was in line with the company’s guidance, largely due to divesting its loss-making engineering and services.

We expect to see an improvement in earnings towards the end of FY22.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Reliance Worldwide Corporation was added to our model portfolio on 29 September and it’s now up 25.3%

James Hardie Industries was added to our model portfolio on 12 October and is now up 14.6%.

REA Group is among the best-performing stocks in our ASX 100 model portfolio, with the share price up 67% since being added in September last year.

REA Group has acquired 100 percent of the shares in Mortgage Choice for $1.95 a share, valuing the company at $244 million. REA is now focused on accelerating its financial services strategy to become a leading player in the home loan market.

REA is a high quality business with terrific growth potential, however, the 65x PE multiple is a little rich and we recommend waiting for the next Algo Engine buy signal.

5/11 update: REA Group delivered 22% revenue growth for Q1 FY22.

Or start a free thirty day trial for our full service, which includes our ASX Research.