IPL up 39%

Incitec Pivot was added to the ASX model portfolio in May this year and is now up 39%. Today, the company announced a 91 percent increase in net profit for FY21.

Incitec Pivot was added to the ASX model portfolio in May this year and is now up 39%. Today, the company announced a 91 percent increase in net profit for FY21.

For our Members, please find below the list of our latest Model Portfolio changes.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

Lendlease has warned of a challenging year to come as COVID-19 puts a dampener on development and construction globally.

FY21 net profit after tax of $377 million was in line with the company’s guidance, largely due to divesting its loss-making engineering and services.

We expect to see an improvement in earnings towards the end of FY22.

Note: Buying LLC is a high-risk turnaround story, an alternative to buying the stock is the purchase of $11 March call options. Call 1300 614 002 to learn more about this strategy.

Treasury Wine Estates is under Algo Engine buy conditions.

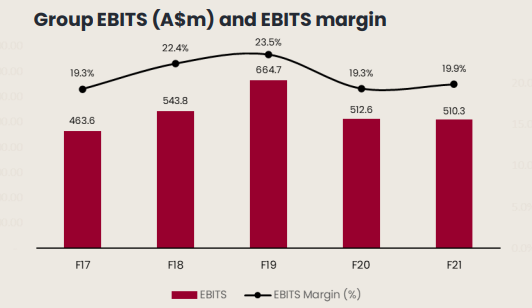

TWE continues to adjust to a post pandemic/post Chinese tariff environment. FY21 EBIT of $510 exceeded market expectations. After a number of years of disappointment for TWE in this region, we see America’s division accelerating growth into FY22.

FY22 EBIT growth is forecast to be in the mid to high single-digit range.

8/11 update: Buy above the $11.50 support range and place the stop loss below the recent pivot low of $11.48.

BlueScope Steel is under Algo Engine buy conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.